GST in SAP Hana – Complete GST Tax Configuration in SAP S4 HANA

In Country India, Every business organization should register their business for GST and the registration number obtained upon registration is called GSTIN. Once an organization receives the GST Identification Number, it must be maintained in the SAP system.

The implementation of GST in SAP S4 Hana includes the following configuration steps:

| 1. Activate Business Place | SPRO |

| 2. Define Business Places | SPRO |

| 3. Define Tax Access Sequence | OBQ2 |

| 4. Define Condition Types | OBQ1 |

| 5. Define Accounts Keys for GST | OBCN |

| 6. Define G/L Accounts for Account Determination | FS00 |

| 7. Assign GL Accounts to Account Keys (Account Determination) | OB40 |

| 8. Define Tax Calculation Procedure | OBQ3 |

| 9. Assign Tax Procedure to Country | GGBO |

| 10. Create GST Tax Codes | FTXP |

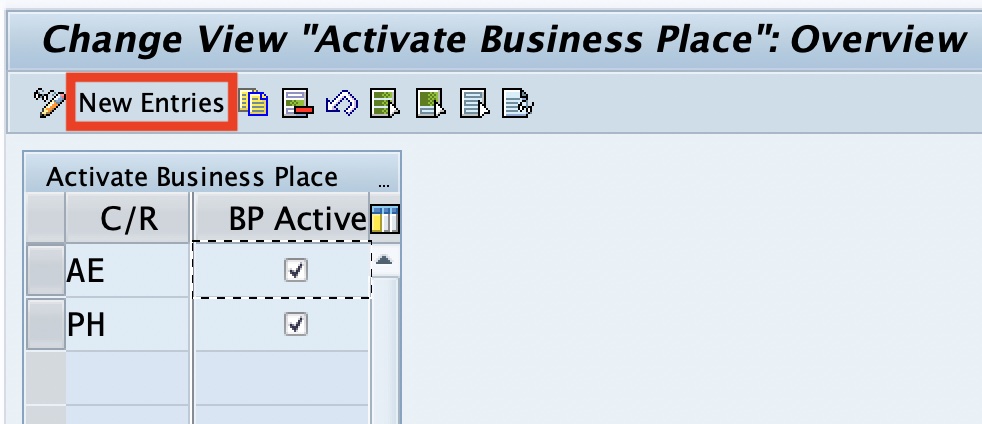

1. Activate Business Place

You can Activate the business place by using the following IMG menu Path:

- SPRO > SAP Reference IMG > Cross Application Components > General Application Functions > Business Place > Activate Business Place.

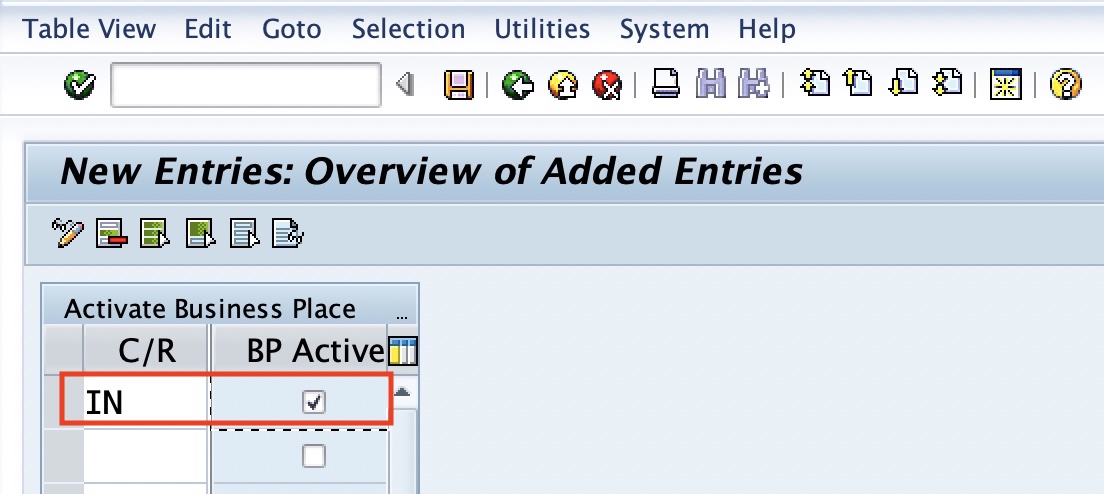

Click on the “New Entries” button

Now enter your C/R key and enable the option for BP Active. Click on the save button to save the details.

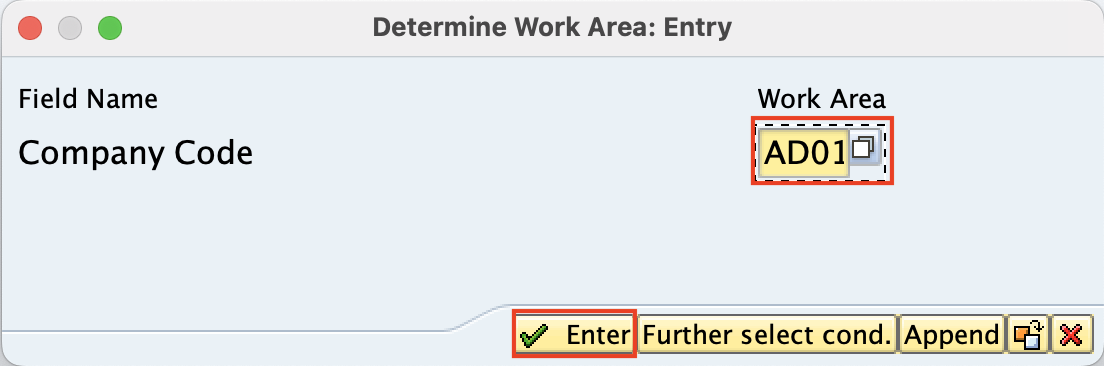

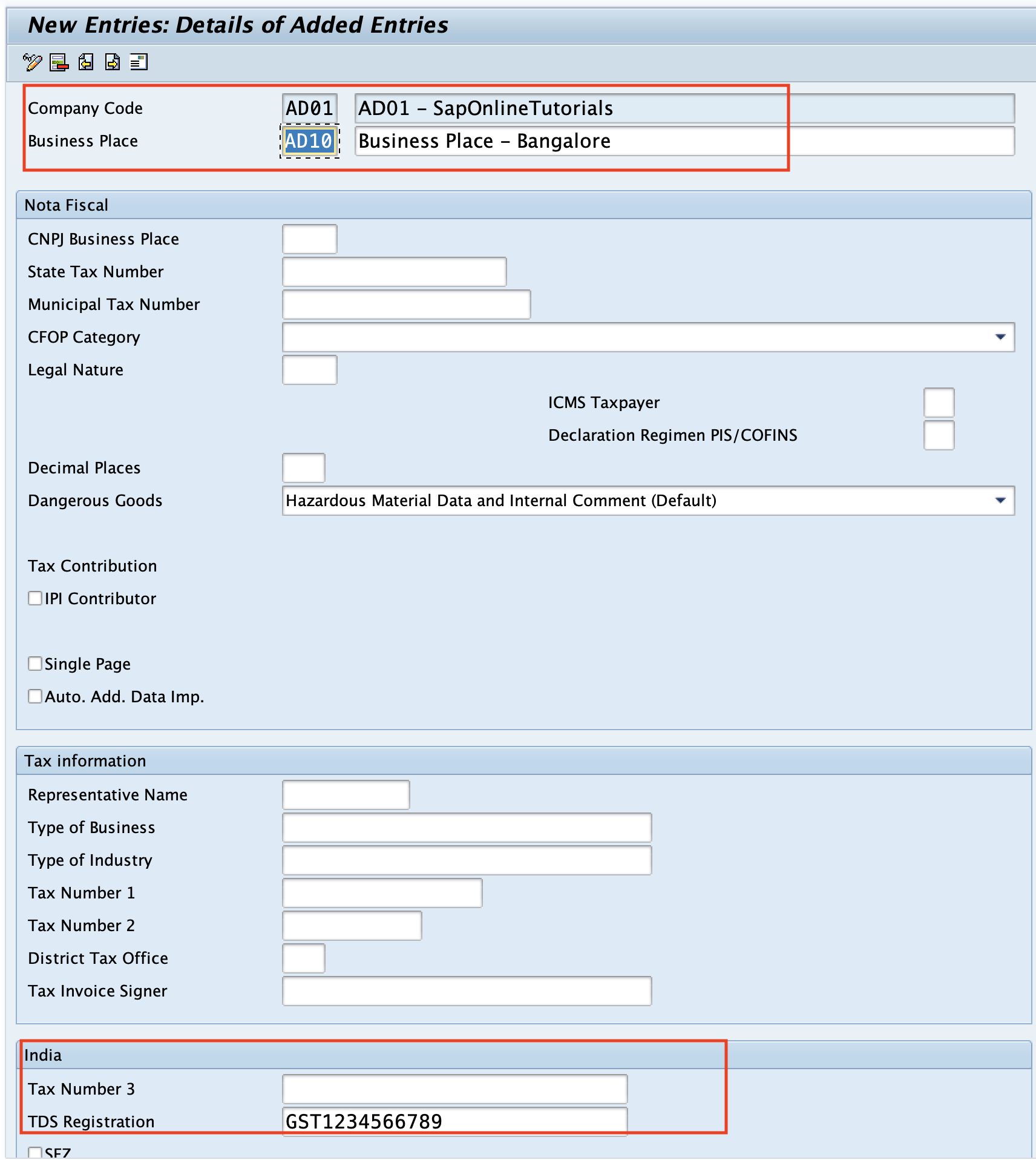

2. Define Business Place

You can create business places in SAP Hana, by using the following menu path

- SAP IMG Path: SPRO > SAP Reference IMG > Cross Application Components > General Application Functions > Business Place > Define Business Places.

On determine work area: entry screen – Update your company code and press enter to continue

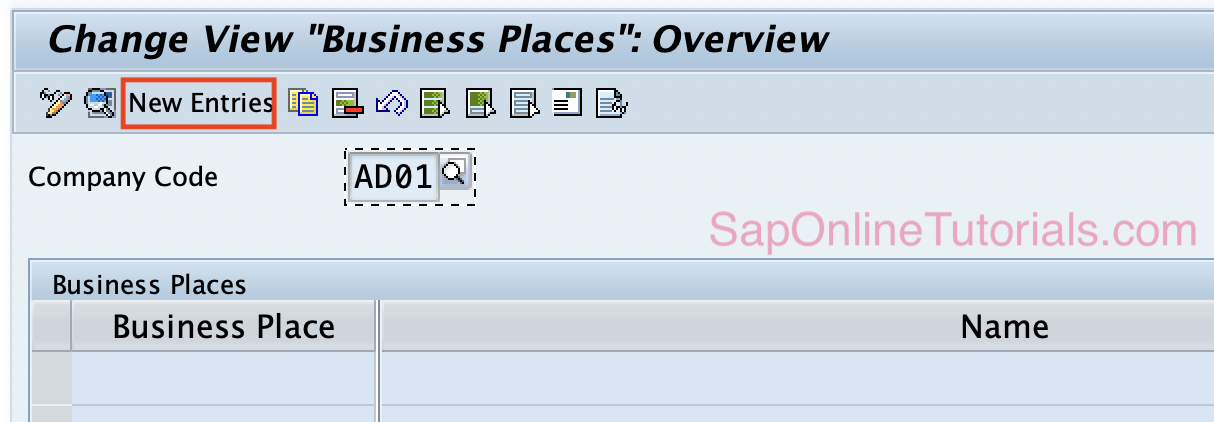

Click on “New Entries” to create new business places in SAP

Now update the required details like

- Business Place

- Tax Information

- GST Identification number, etc

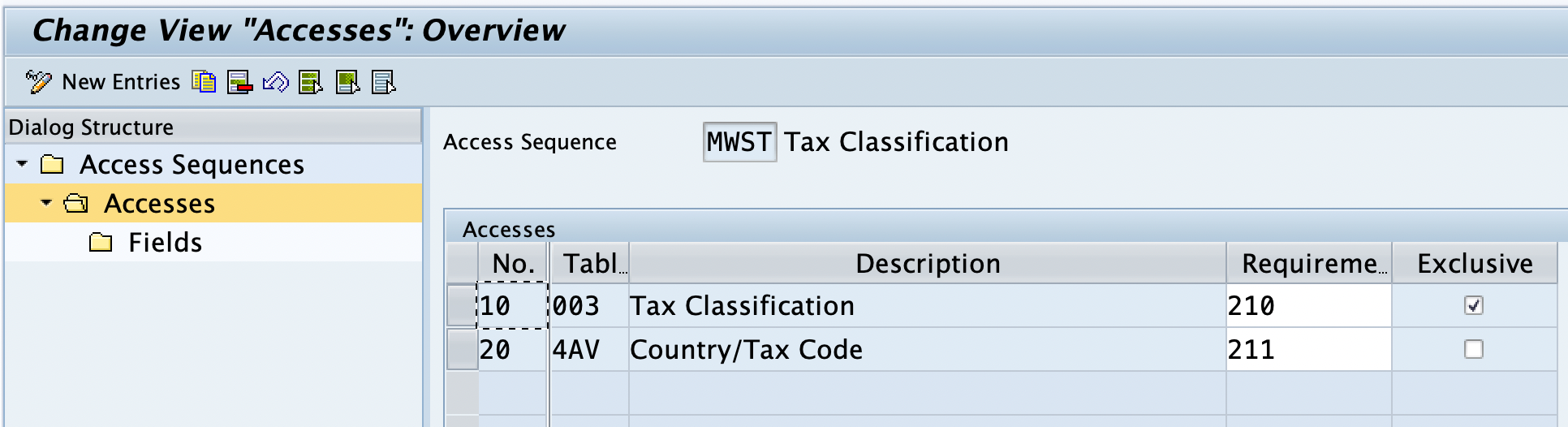

3. Define Access Sequence

Access Sequence in the SAP system allows finding the valid condition record for a condition type.

In this scenario, we are going to use the following access sequence for Input GST and Output GST

| Access Sequence | Description |

| MWST | Tax Classification |

However, you are recommended to create access sequences as per the business requirements.

You can also define a new access sequence by using the following IMG Path:

- IMG > Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Check Calculation Procedure > Access Sequence.

- Transaction code: OBQ2

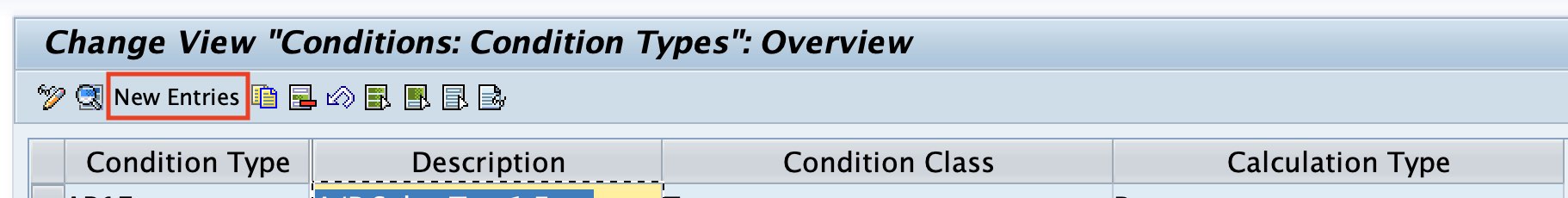

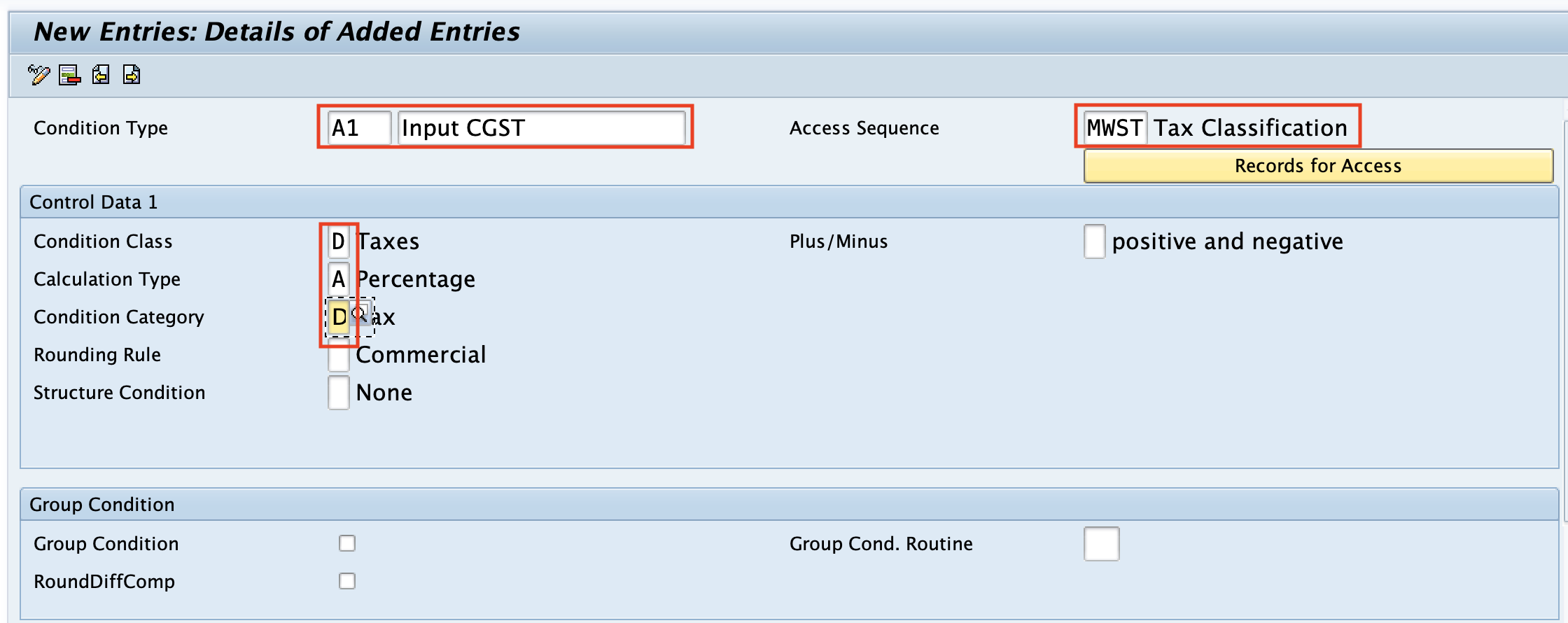

4. Define Condition Types

Condition types are important steps we need to define for GST in SAP S4 HABA. As per the requirements, we need to define the following condition types for each Input GST and Output GST.

| Condition Types for Input GST | |

| Condition Type | Description |

| A1 | Input CGST |

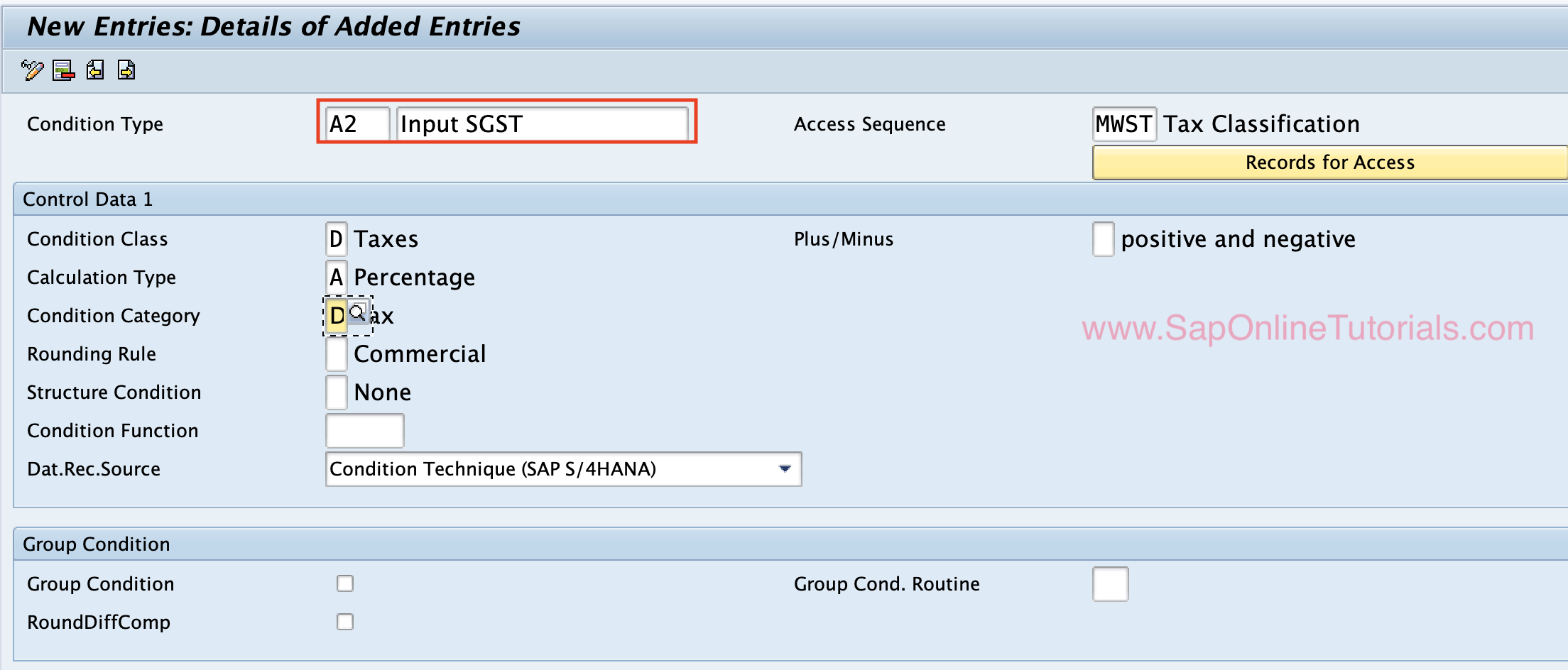

| A2 | Input SGST |

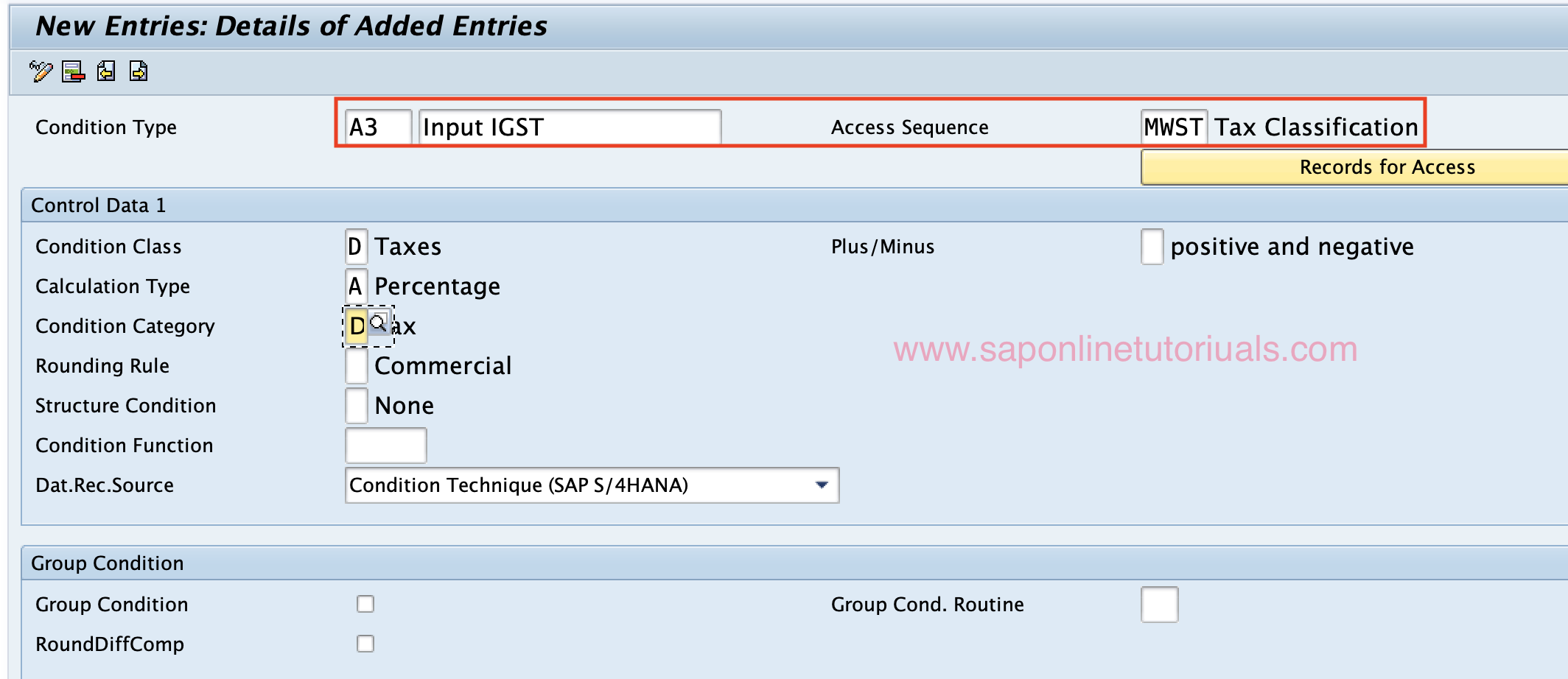

| A3 | Input IGST |

| Condition Types for Output GST | |

| Condition Type | Description |

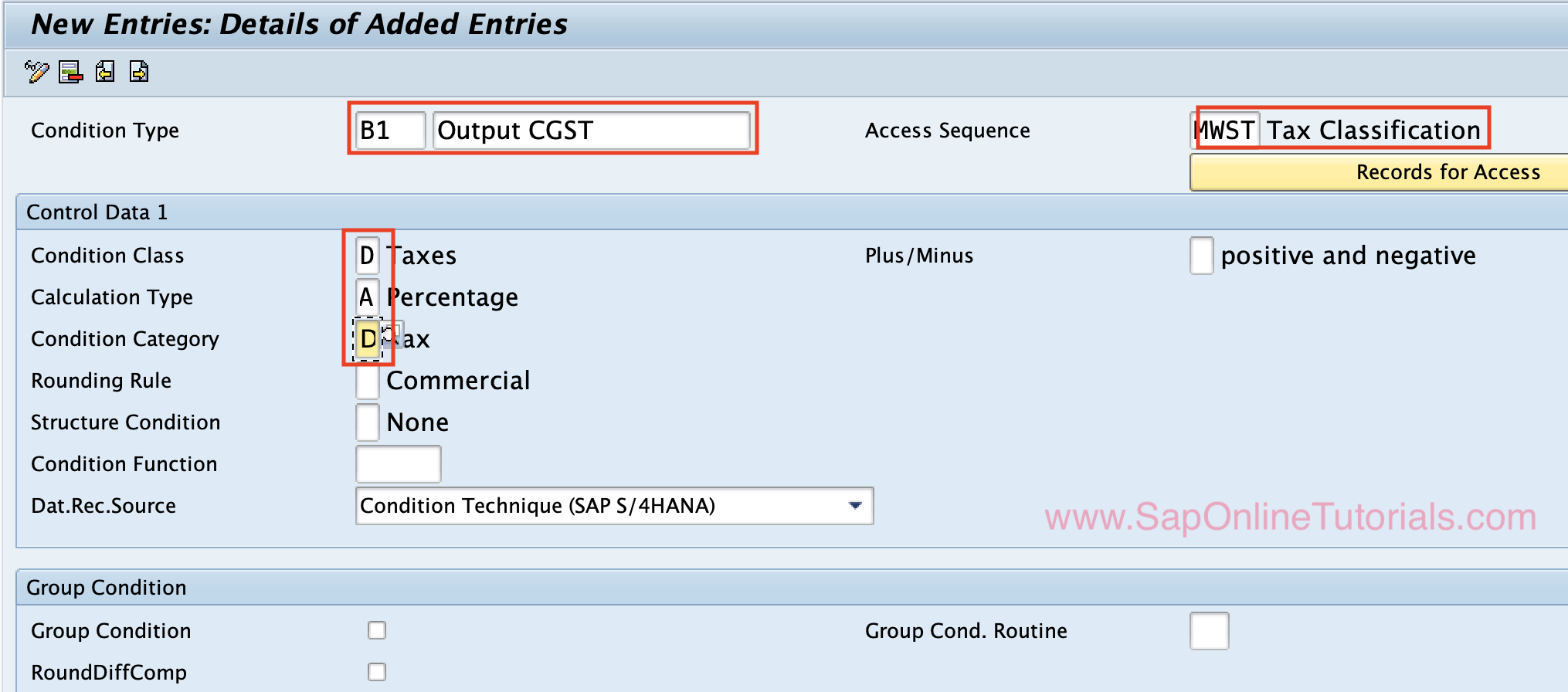

| B1 | Output CGST |

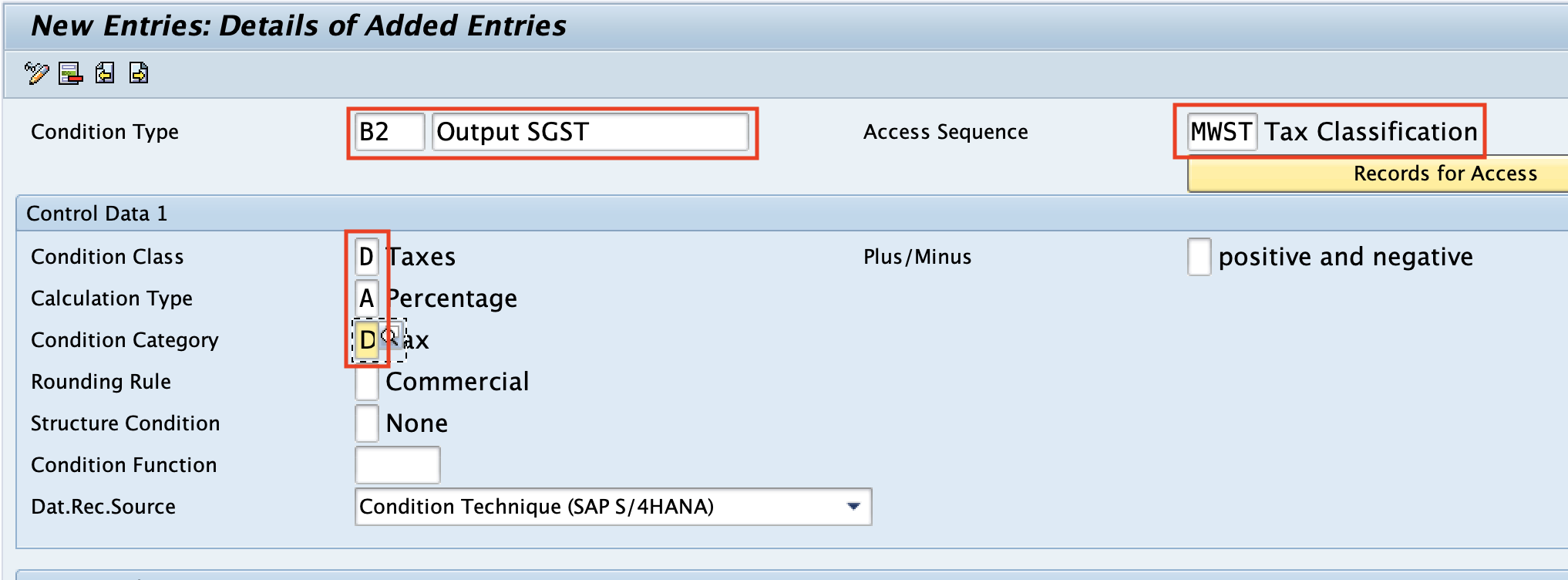

| B2 | Output SGST |

| B3 | Output IGST |

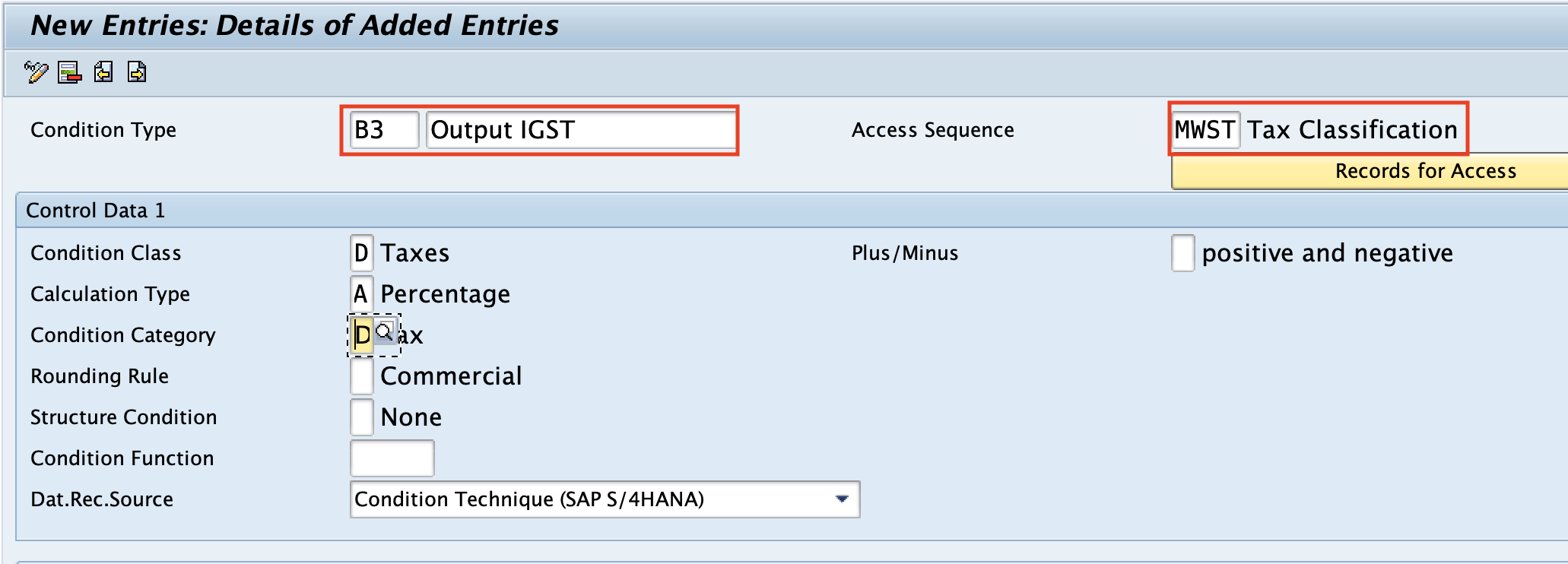

You can define the condition types in SAP S/4Hana by using the following path:

- IMG > Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Check Calculation Procedure > Define Condition Types

- Transaction Code: OBQ1

Click on the “New Entries” option to create the condition types for Input GST & Output GST.

On the Condition Types configuration screen, update the following details:

- Condition Type

- Condition Type Description

- Access Key

- Condition Class

- Condition Condition type

- Condition Category

Similarly, create other condition types A2, A3, B1, B2 & B3.

Condition Type A2: Input-SGST

Condition Type A3: Input-IGST

Condition Type B1: Output-CGST

Condition Type B2: Output-SGST

Condition Type B3: Output-IGST

5. Define Transaction Account Keys

The transaction accounts keys are used to determine the G/L accounts, posting keys to post the GST tax amount automatically by the SAP Hana system. To full fill this requirement, we need to define the following tax account keys.

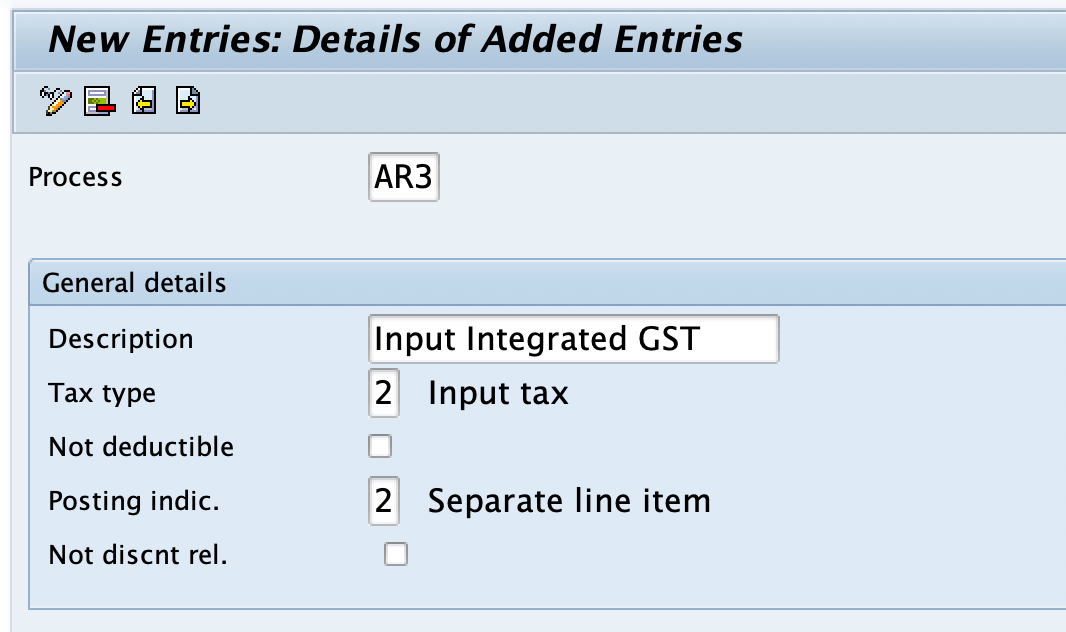

A/R Input Transaction Keys

| Account key | Description |

| AR1 | Input Central GST |

| AR2 | Input State GST |

| AR3 | Input Integrated GST |

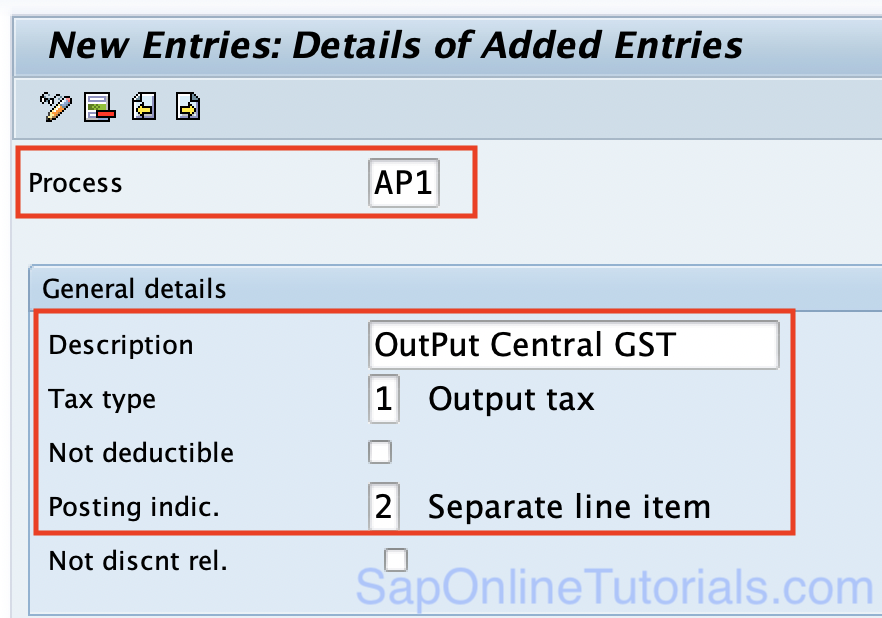

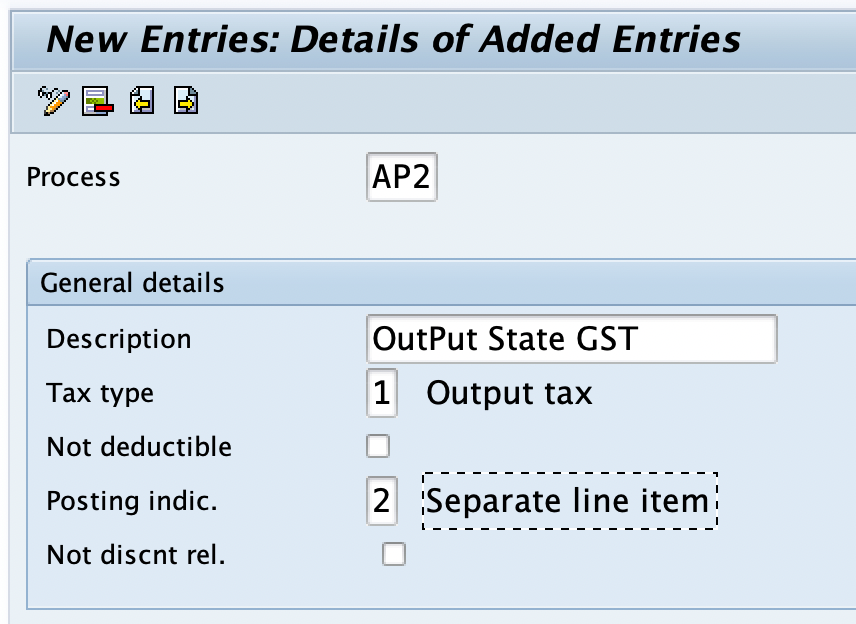

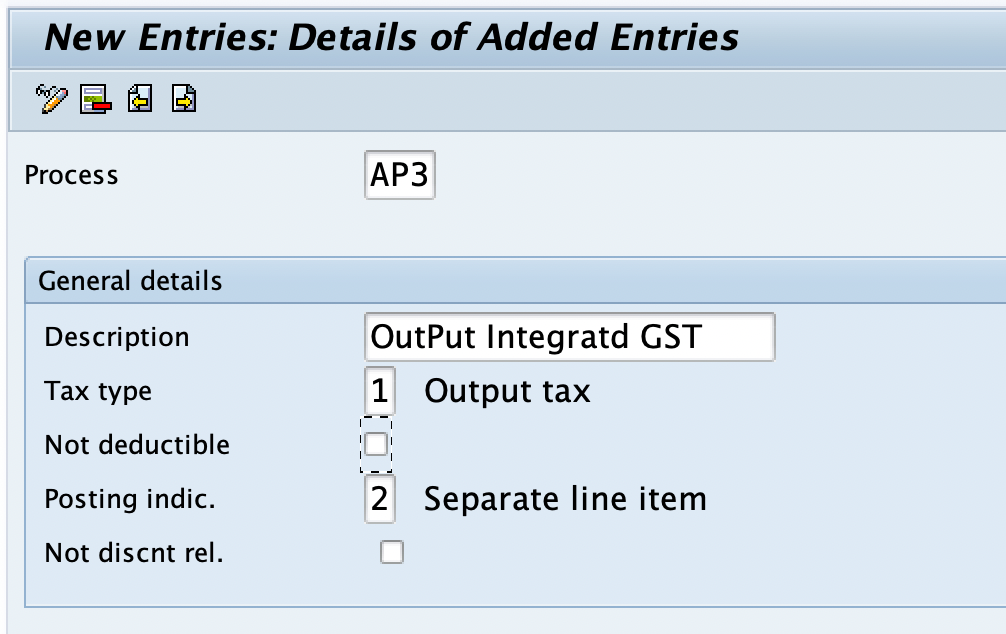

A/P Output Transaction Keys

| Account Key | Description |

| AP1 | Output Central GST |

| AP2 | Output State GST |

| AP3 | Output Integrated GST |

Configuration Steps:

You can create the Transaction tax account keys in SAP S4 Hana by using the following configuration steps

- SPRO > IMG > Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Check and change settings for tax processing.

- Transaction Code: OBCN.

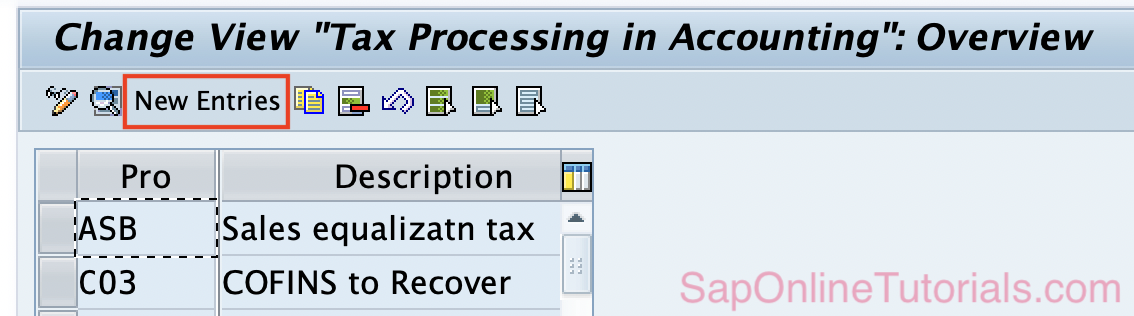

Execute the transaction code “OBCN” in the command field and enter to continue.

On the change view “Tax Processing in Accounting” screen, click on “New Entries”

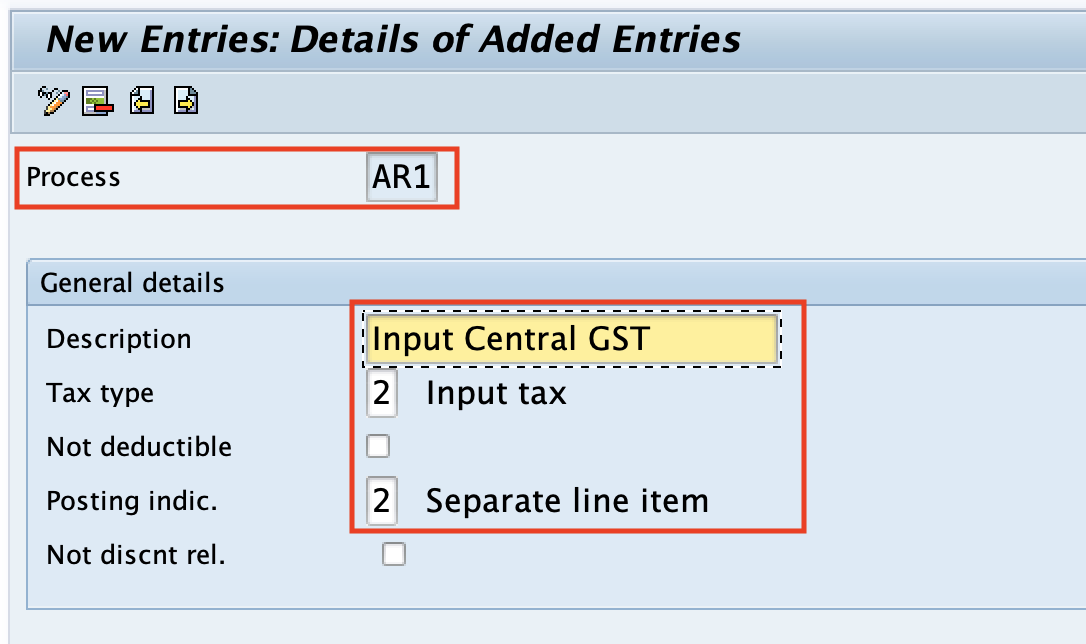

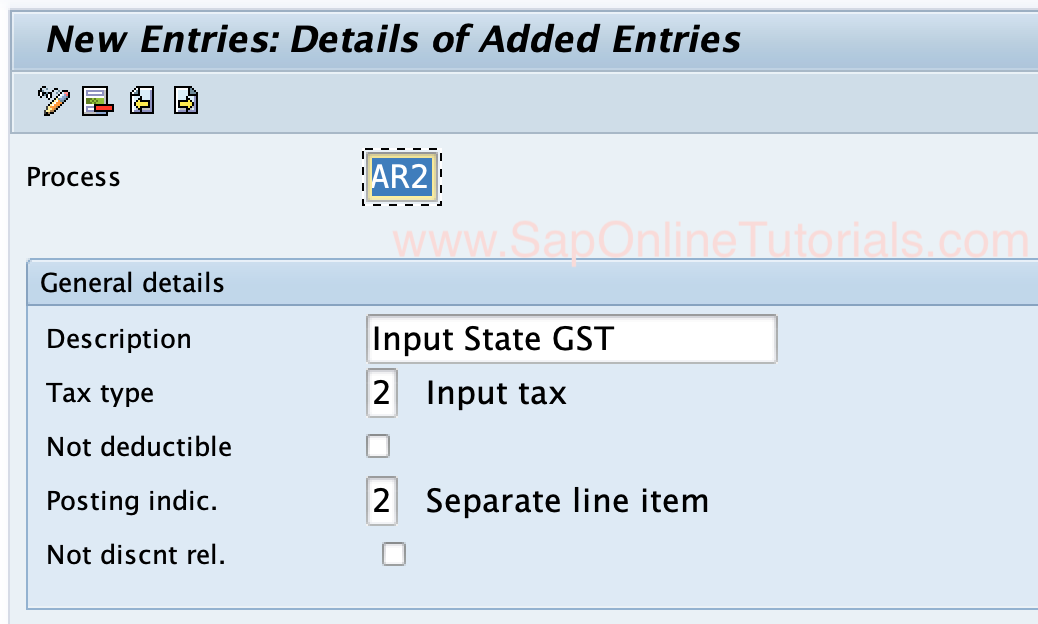

On the new entries screen, update the following details

- Process: Enter the new tax account key

- Description: Update the description of the account key

- Tax Type: Update the tax type whether it is input Tax or Output tax

- Posting Indicator: Update the 2 to post the tax amount separate per line item.

Similarly, create other account keys in the SAP S/4HANA system.

Tax Account Key AR2 – Input State GST

Tax Account key AR3 – Input Integrated GST

Tax Account Key AP1 – Output Central GST

Tax Account Key AP2 – Output State GST

Tax Account Key AP3 – Output Integrated GST

6. Define G/L Accounts for Tax Account Determination

When you are posting GST tax documents, the GST tax amount will be posted to the particular G/L accounts. To full fill this requirement, we need to do account determination by linking the G/L accounts to the tax account keys.

Based on the requirements, we need to create the following G/L accounts for Input GST and Output GST.

Input Tax G/L Accounts

| G/L Account | Description | G/L Account Type |

| 180010 | Input Central GST | B/S Account |

| 180011 | Input State GST | B/S Account |

| 180012 | Input Integrated GST | B/S Account |

Output Tax G/L Accounts

| G/L Account | Description | G/L Account Type |

| 130010 | Output Central GST | B/S Account |

| 130011 | Output State GST | B/S Account |

| 130012 | Output Integrated GST | B/S Account |

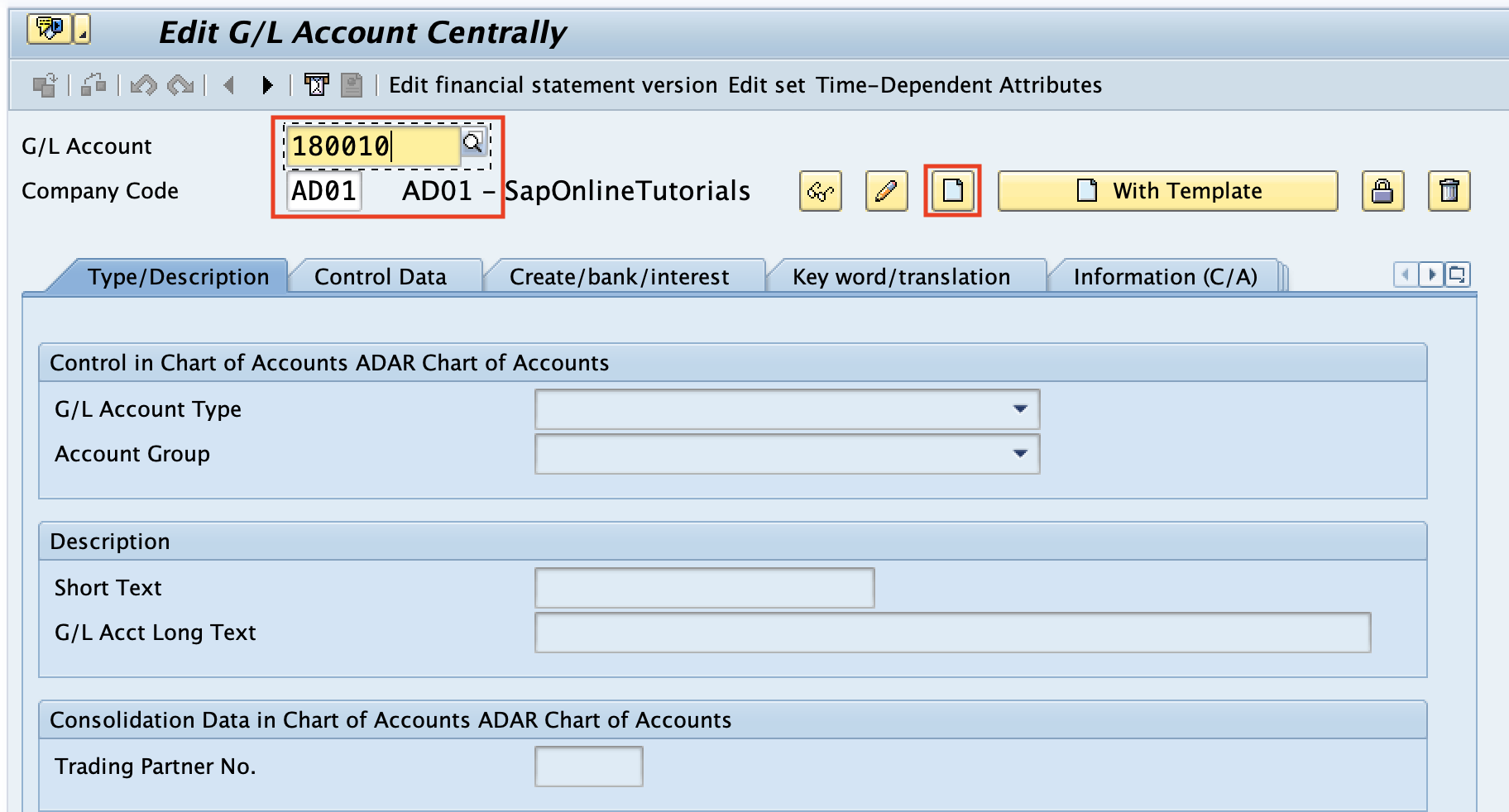

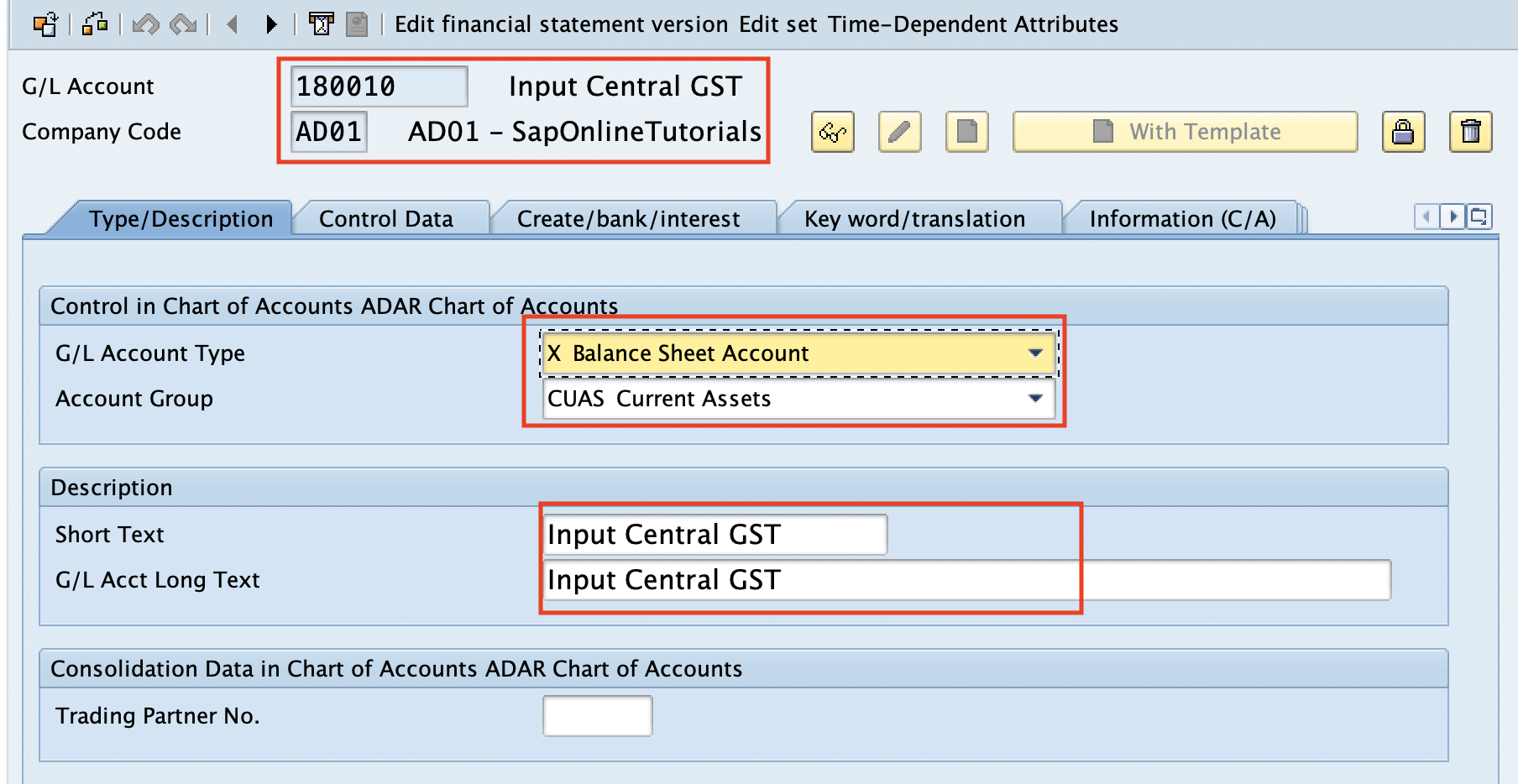

We can create G/L accounts in the SAP S4 Hana system using the transaction code “FS00”

On the G/L account centrally screen, give the G/L accounts number, Company Code and then click on the “Create” button

On type/Description, update the G/L account type, Account group, short text & long text.

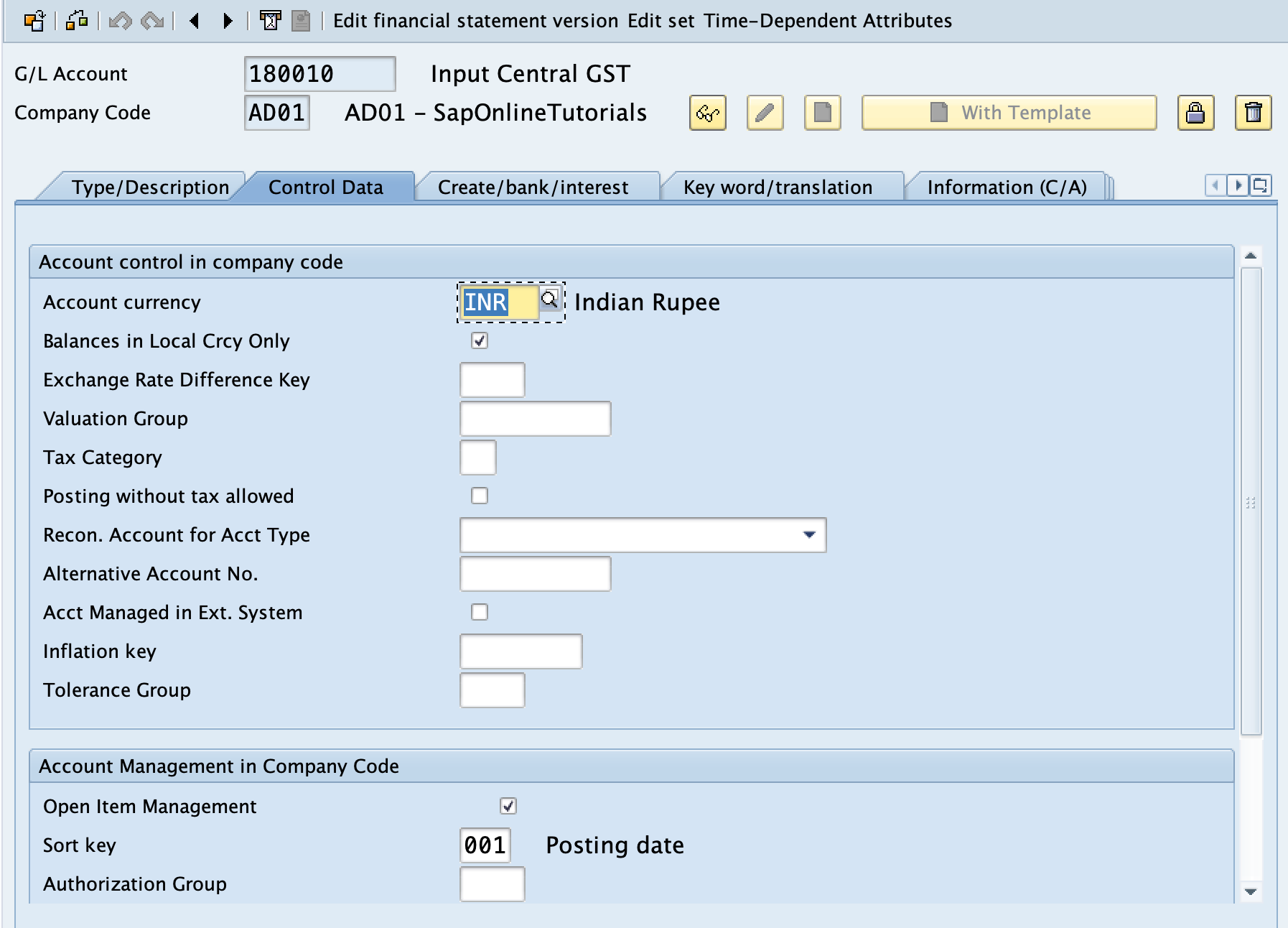

On the Control data tab, update the required details of account control and account management in the company code.

On Create/Bank/interest tab, update the field status group and click on the save button and save the created G/L account.

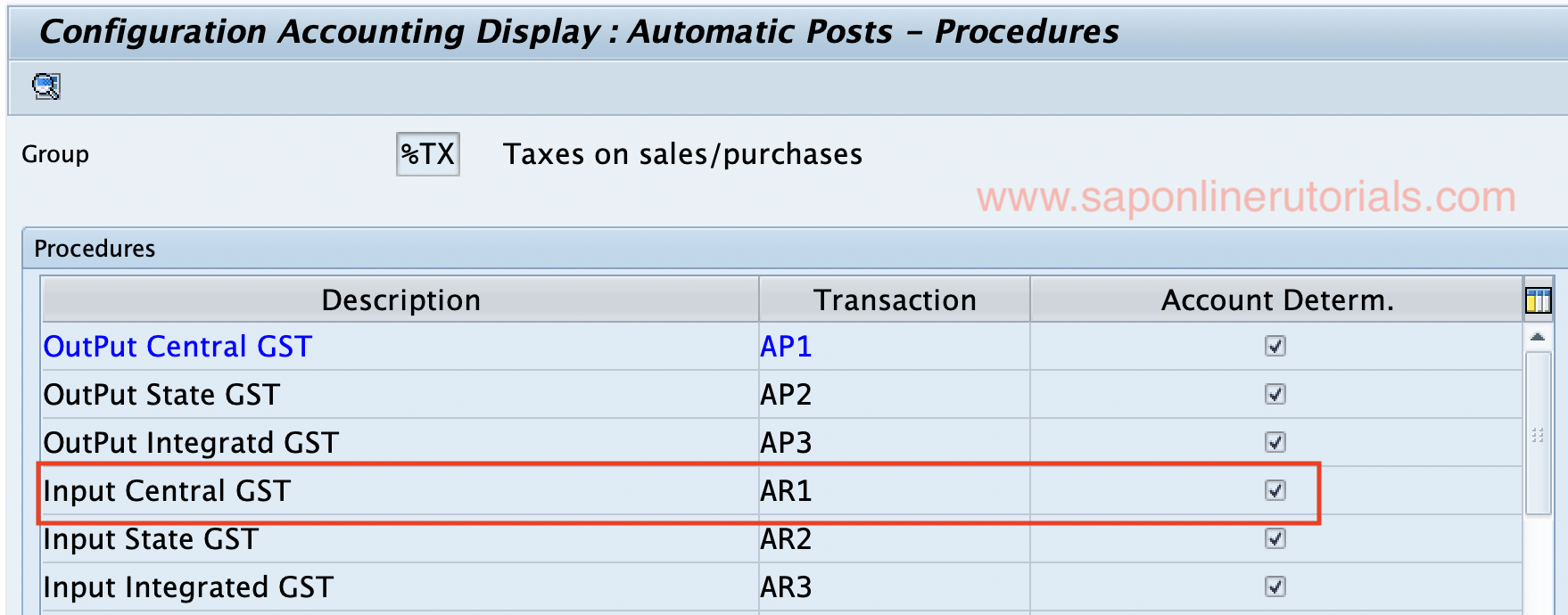

7. SAP GST Account Determination

After the creation of account keys and G/L accounts, we need to map the G/L account to the Tax account keys. Through this account determination, the S4HANA system allows posting the GST amount automatically to the G/L accounts.

We can assign the G/L accounts to the account keys by using the following configuration steps

- SPRO > SAP Reference IMG > Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Postings > Define Tax Accounts

- Transaction Code: OB40.

Now we are going to link the account keys to the following G/L accounts

| Account key | Description | G/L Account |

| AR1 | Input Central GST | 180010 |

| AR2 | Input State GST | 180011 |

| AR3 | Input Integrated GST | 180012 |

| AP1 | Output Central GST | 130010 |

| AP2 | Output State GST | 130011 |

| AP3 | Output Integrated GST | 130012 |

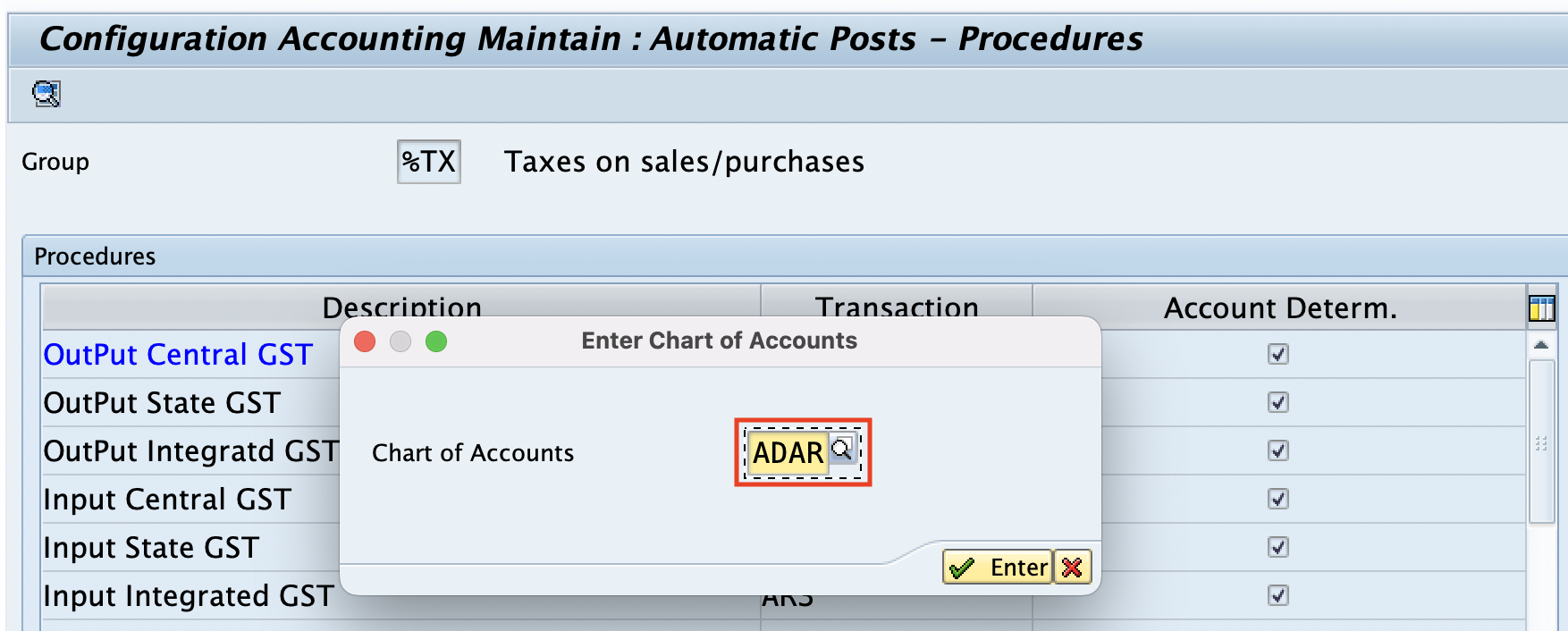

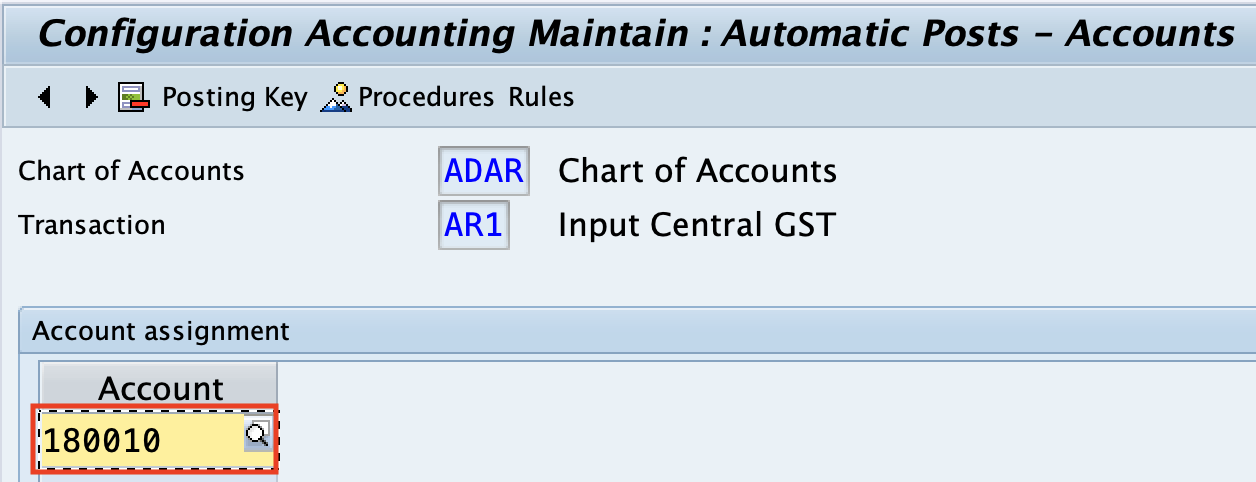

On Configuration Account Display: Automatic Postings screen, double click on the transaction key

Enter the chart of accounts key and click on enter to continue.

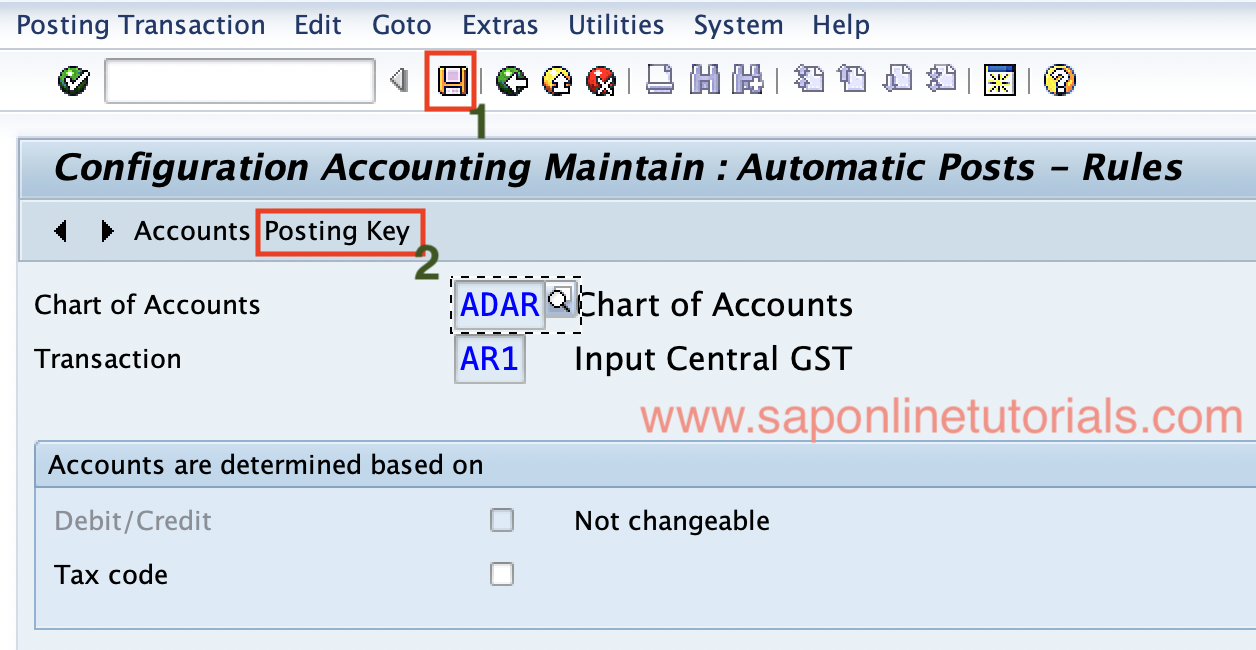

Click on the “Save” icon and save the details. Now click on “Posting Keys”

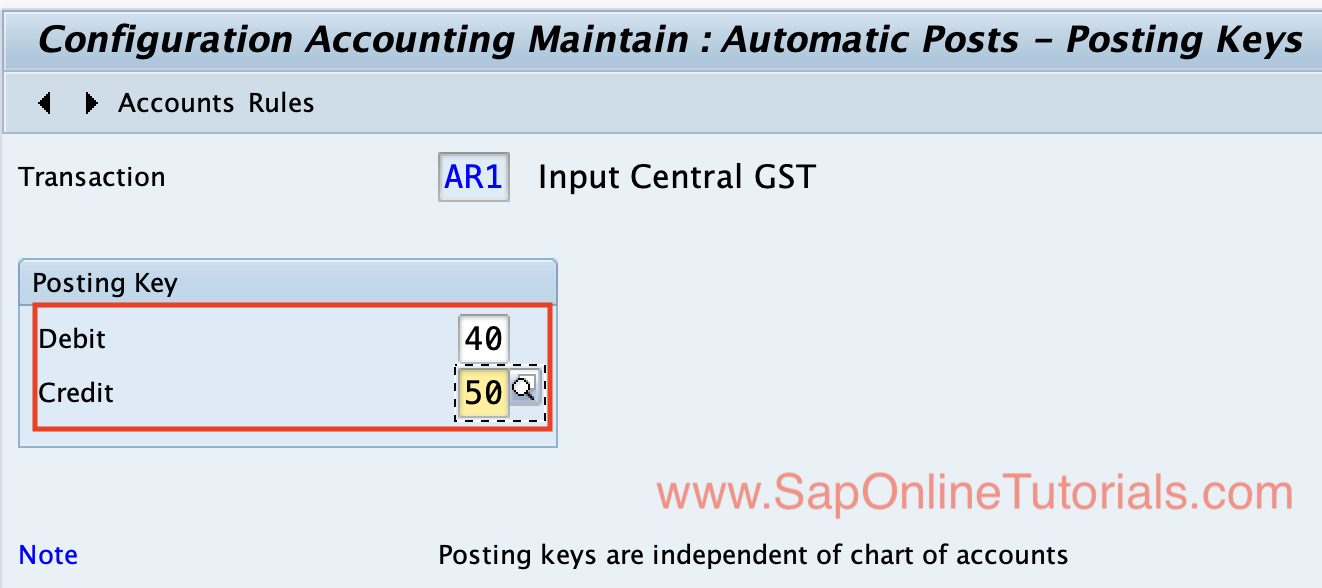

Update the posting keys Debit – 40 & Credit – 50 and click on the save button to save the details.

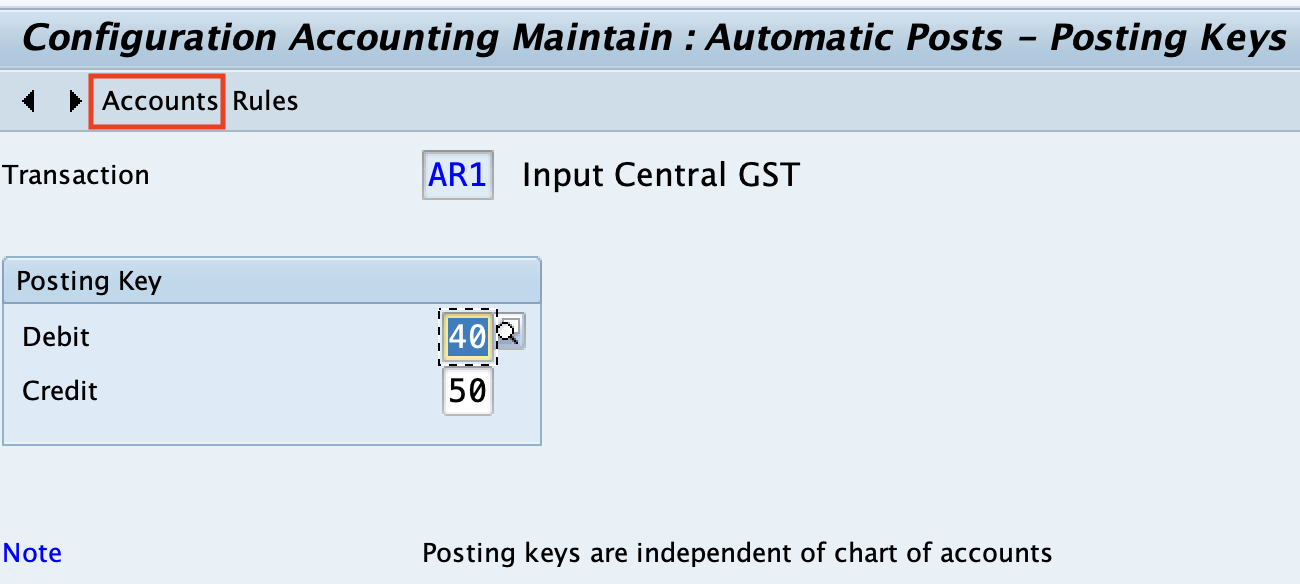

Click on the “Accounts” option to link the G/L account for this transaction account key AR1.

Now update the G/L account# 180010 under the account assignment filed and click on the save button to save the details.

Similarly, assign the G/L accounts and posting keys to the remaining account keys AR2, AR3, AP1, AP2, and AP3.

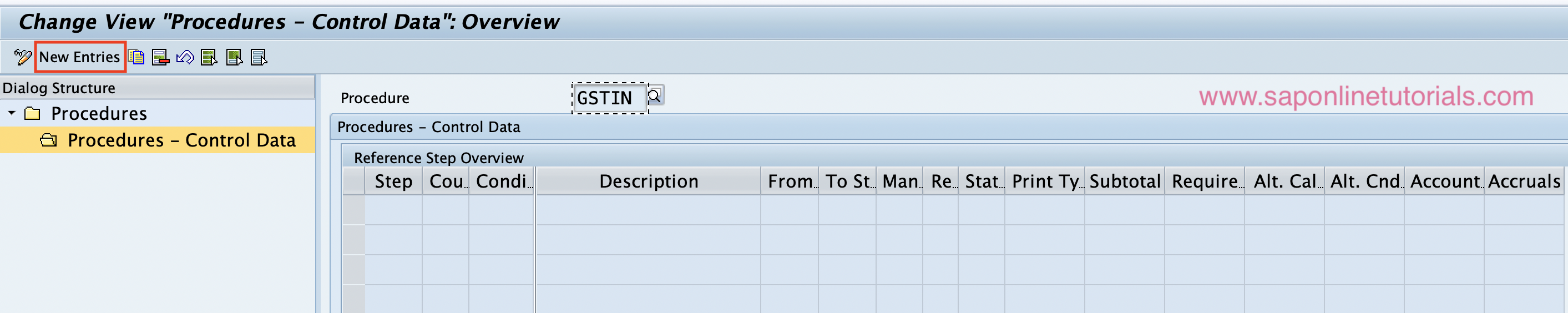

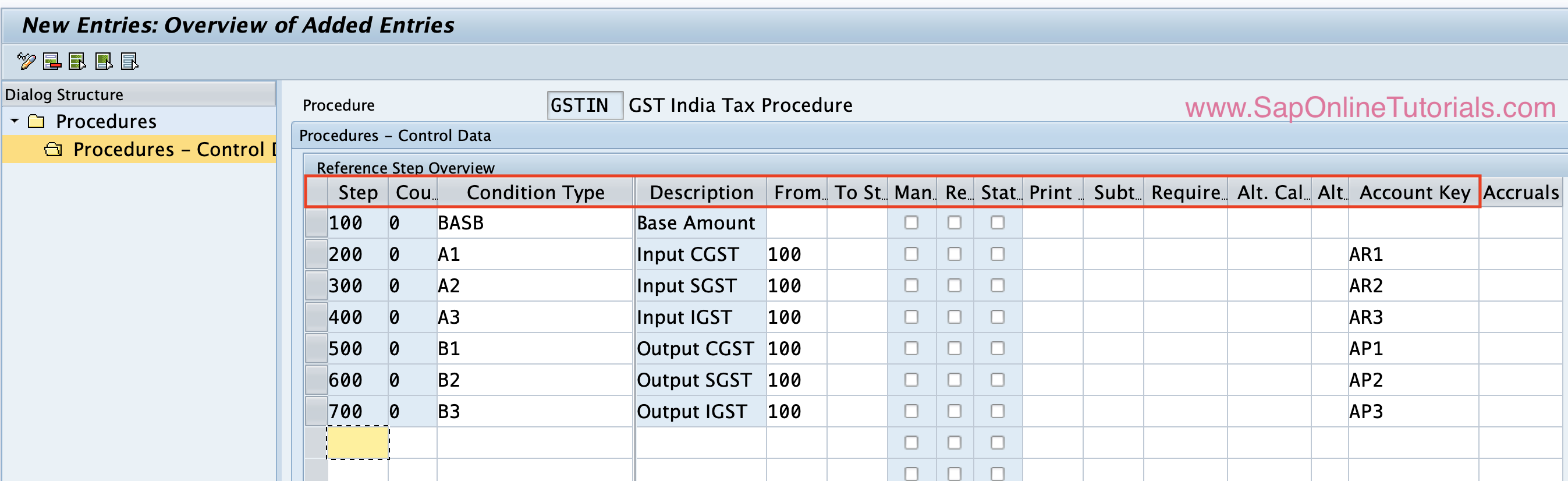

8. Define Tax Calculation Procedure

Tax procedure is defined for each country with the calculation procedures. In this configuration step, we define the procedure by assigning the condition types, account keys, and how the amount to be calculated.

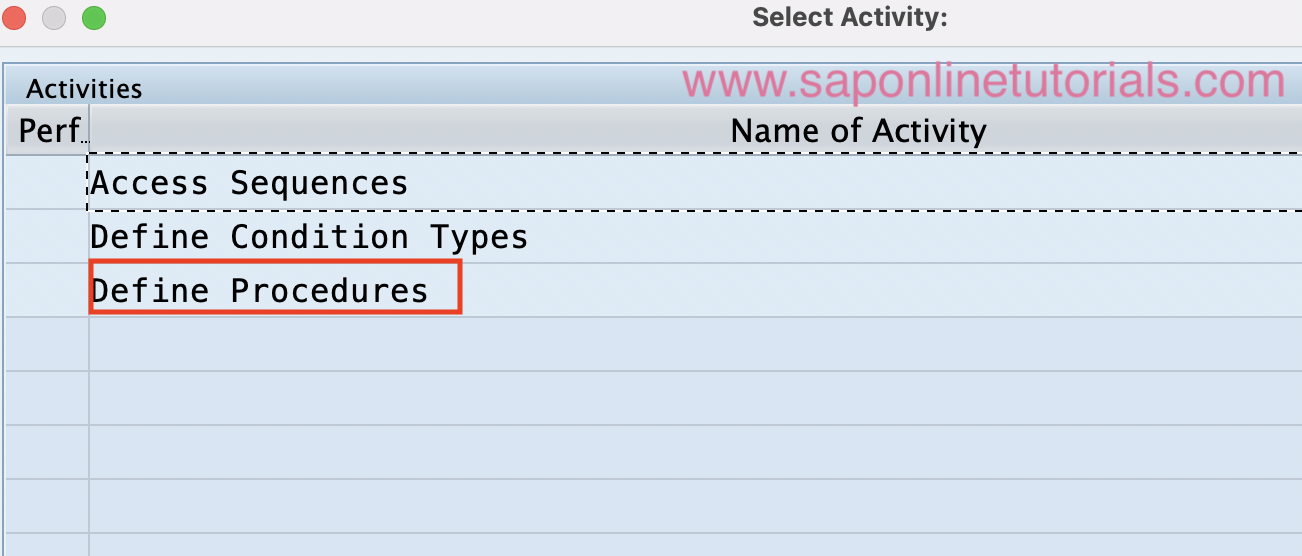

- IMG Menu Path: IMG > Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Check Calculation Procedure > Define Procedure

- Transaction Code: OBQ3.

Execute the transaction code OBQ3” or follow the IMG menu path and execute “Define Procedure”

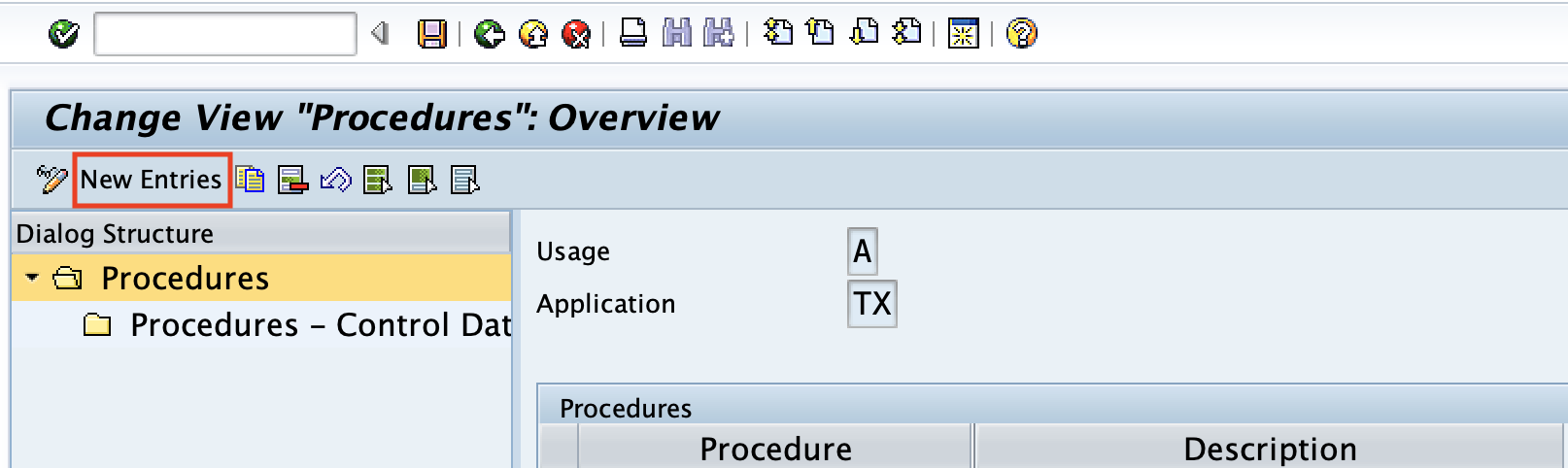

Click on the “New Entries” button to create the new GST tax procedure as per the requirements

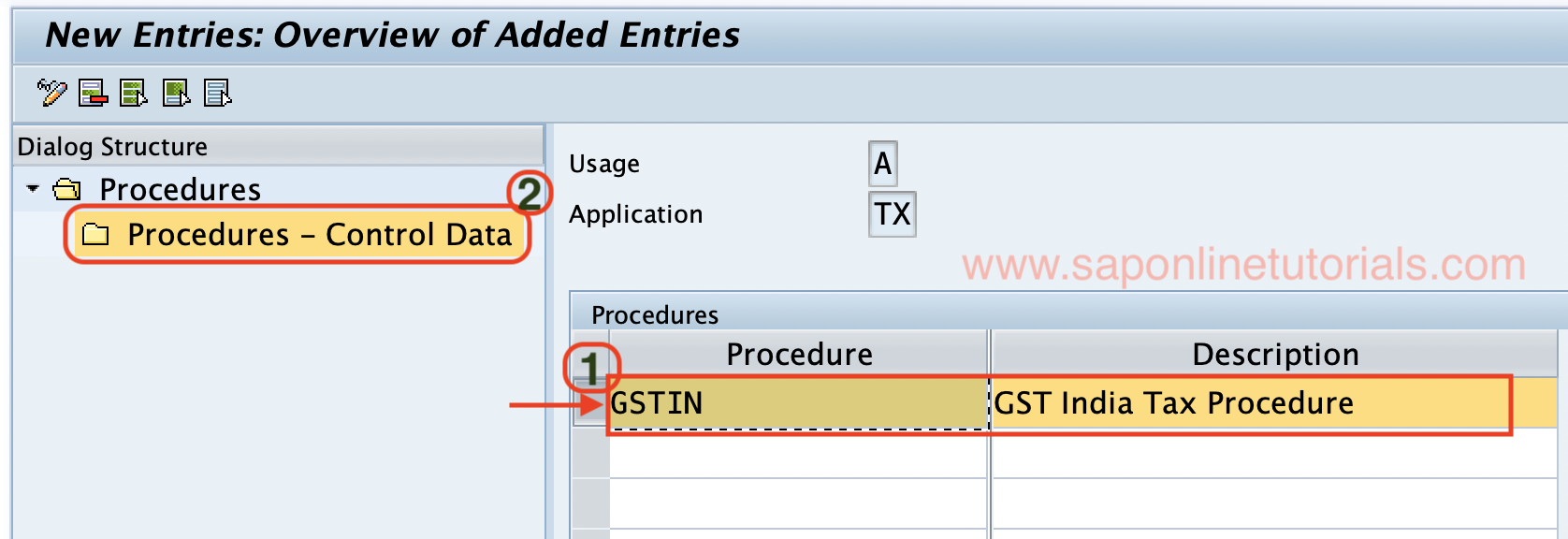

Now provide the new tax procedure key and description.

After updating the new tax procedure key, select the procedure and click on control data under the dialog structure.

Click on the “New Entries” button

Now update all the required details of

- Step

- Condition Type

- From

- Account Key

Click on the save icon and save the details.

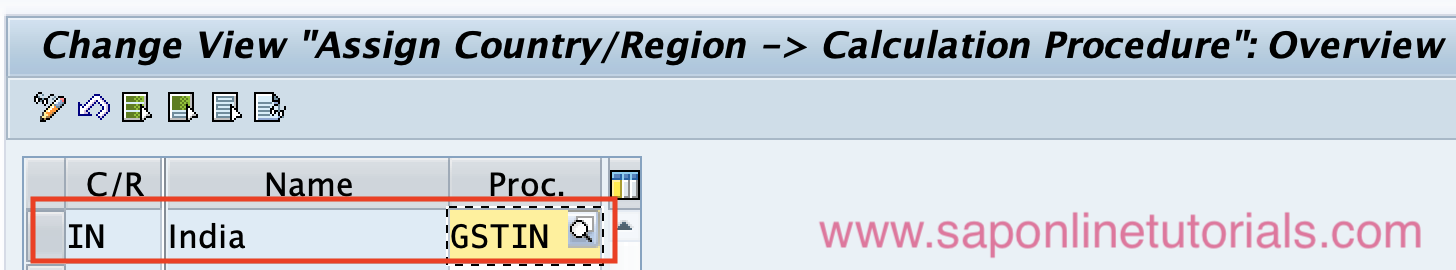

9. Assign Country/Region to the Calculation procedure

Finally, we need to assign the “GSTIN” tax calculation procedure to Country “IN”.

Configuration Steps:

- IMG Path: Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Assign Country / Region to Calculation Procedure

- Transaction Code: OBBG

On change view: Assign Country/Region to Calculation procedure, update the GST calculation procedure GSTIN

Now you can easily configure and implement GST in SAP S4 Hana system.

Leave A Comment?

You must be logged in to post a comment.