Configuration-Canteen Deduction (0014)-Indian Payroll

This document illustrates the processing one deduction wage type pertaining the Canteen Charges incurred for an employee.

Requirement: The employer provides the lunch for the employees. The 50% the charges bared by the employer and 50% of the amount has to be deducted from the employee salary at the end of the payroll period.

Condition: The amount has to be deducted only on days when employee attended his duties. Relatively the Public Holidays, Weekly Offs, Paid Absences, Un-Paid Absences should be excluded from the monthly payroldays.

Solution at Glance: A) One deduction Wage Type in 0014 wage type group.

B) This scenario can be met by a PCR for the Wage Type.

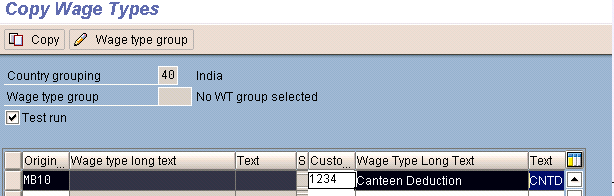

Step1: Copy the Wage Type by using T. Code PU30 or OH11 from model wage type’MB10’

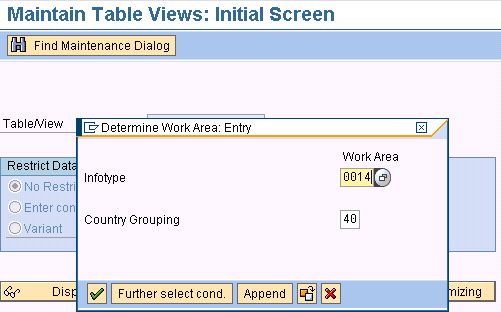

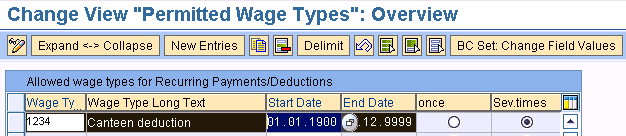

Step2: Maintain the Wage Type in ‘V_T512Z in ‘0014’Group.Enter the Wage Type give the Start Date and End Date. Mention the deductions several times.

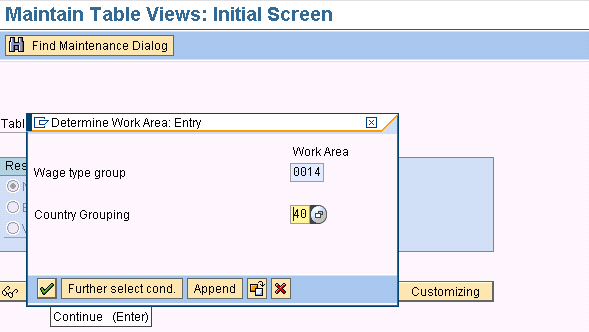

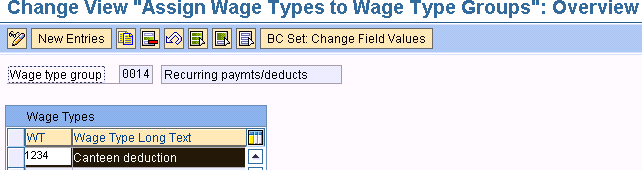

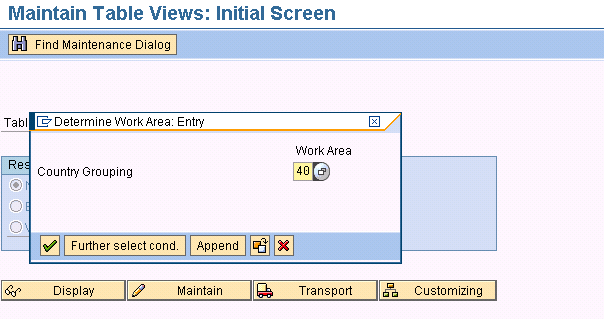

Step3: Maintain the Wage Type ‘VV_52D7_B_0014_AL0’. Enter the Wage Type Group ‘0014’.Then enter the wage type code.

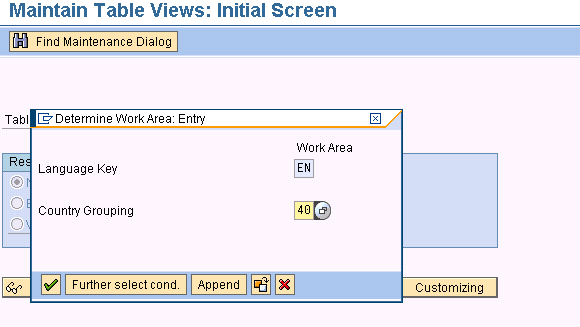

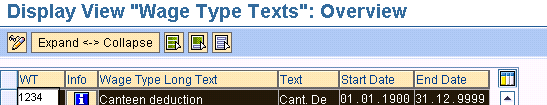

Step4: Maintain the Wage Type in V_T512T

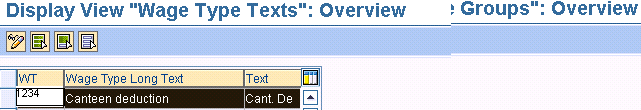

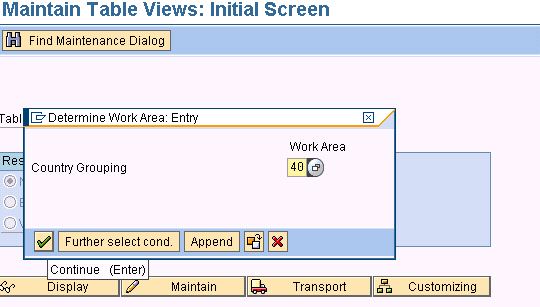

Step5: Check the Wage Type in V_512W_T

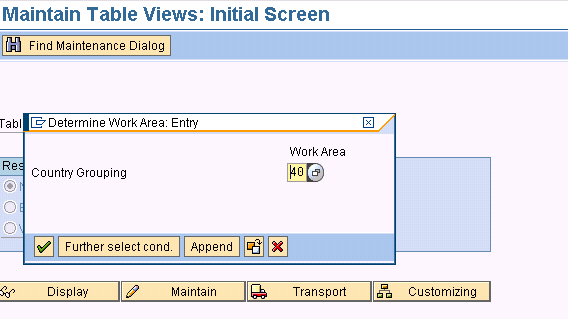

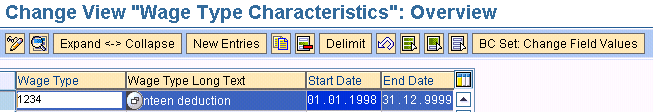

Step5: Maintain the Wage Type Characteristics.

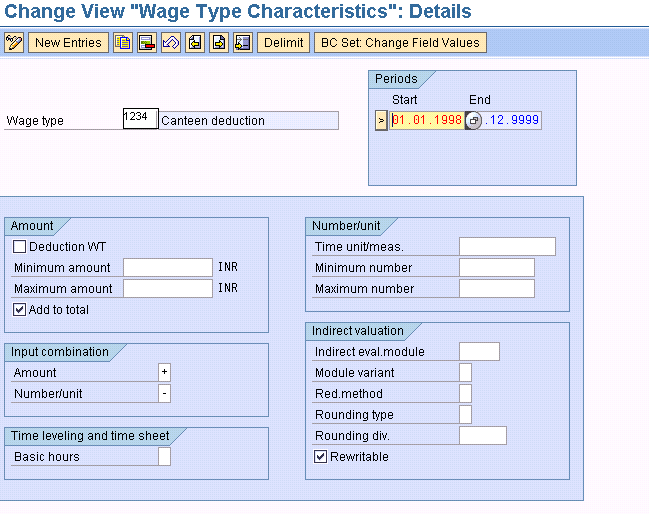

Double Click on the Wage Type: Will take to the maintenance screen

Maintain the below specification,

Amount: Tick the Wage Type to Add to Total

Input Combination: Amount: +

Number Unit: –

Start Date: 01.01.1900 End Date: 31.12.9999

Number: Unit: Nil

Indirect Valuation: Nil

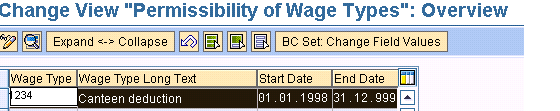

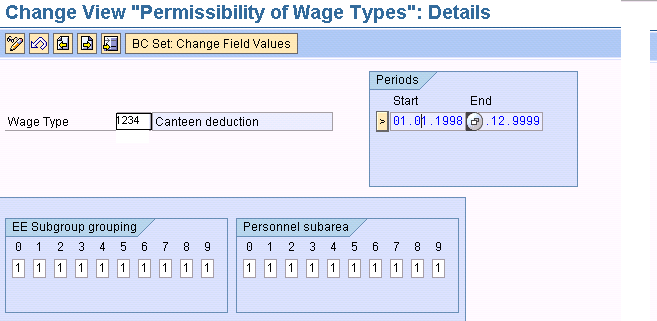

Step6: Maintain the Permissibility of Wage Types

Step 7: Maintain the permissibility of Wage Types according to your requirement

Table: V_511_B

Step8: Processing Classes and Cumulation Classes

V_512W_D

Processing Classes:

3 Cumulation and storage of time 0 Pass on unchanged

6 Enter wage type from old payroll 0 Wagetpe will not be transferred

10 Mark wage types for monthly fac 0 No reduction

20 Cumulation and storage at end o 3 RT storage and cumulation

30 Cumulation updates T Cumulation performed according

31 Allocate monthly lump sums to c 0 WT does not lead to cost center

72 Nominal cumulations 4 Prorate, ***. into ESI/PTX basis

CN Cumulation Wage Type

1 Total gross amount

10 Net payments/deductions

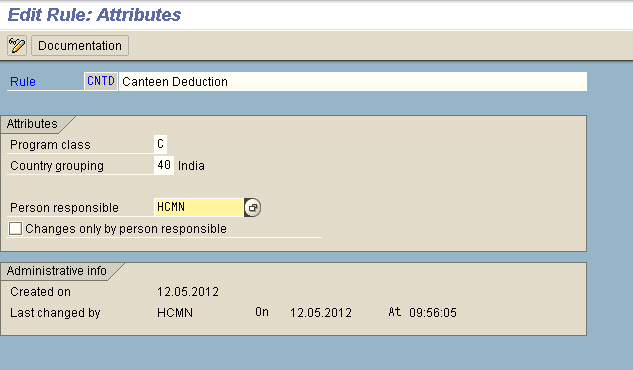

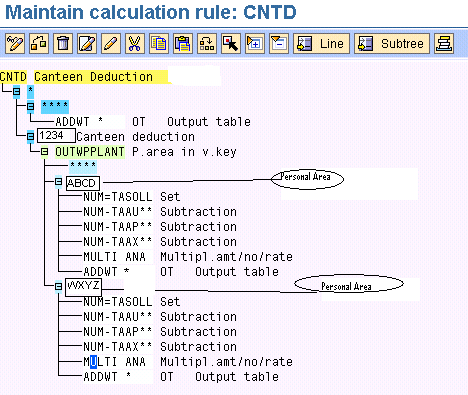

Step 9: PCR for Canteen Deduction:

Enter the ‘PE02’ in command field to write the PCR. Enter the name of the PCR.Mention the Programming Class ‘C’ (If it is a Payroll PCR or T if it is a Time Management PCR).Give the name of the PCR as “Canteen Deduction” and save it.

Step10: PCR Description:

Choose the Condition OUTWPPLANT or OUTWPPERSB or OUTWPPERSB depending upon your requirement.

Here ‘ABCD4000’ and ‘WXYZ’ are the personal areas.

Operations:Total No of Working Days:30

Substract:No of Weekly Offs:4(Sundays)

Sustract No Of Paid Absence:2(Sick Leave)

Sustract No Of UnPaid Absence:2(LOP)

Total Number Of Days Employee Attended*Per day Amount

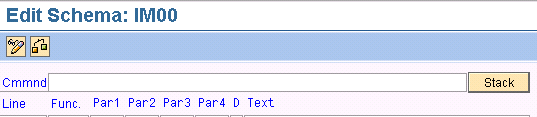

Step11Schema Modification:

- 1) Copied IN00 schema to IM00

- 2) Copied INAL to ZML

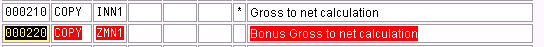

Step12: Inserting the PCR in to ZMAL:

- 1) Insert the PCR above ‘X023’ PCR. The PCR is called with function ‘PIT’.AS the PCR is called independent of ESG Grouping hence NOAB is placed Parameter ‘3’.

Step13:Maintain the Paid and Unpaid-absnces in 2001 infotype.

Total No of Working Days:30

Substract:No of Weekly Offs:4(Sundays)

Sustract No Of Paid Absence:2(Sick Leave)

Sustract No Of UnPaid Absence:2(LOP)

Step14:Go to PA30 maitain the Perday Cost of Canteen in 0014(Reccuring Payments & Deductions)

The rate is maitained as ‘Rs.30’

Step16: Go PE51 T.Code Enter the Wage Type in Windows, Single Fields and Cumulation ID’s

Step-17: Process the Payroll using T.Code”PC00_M40_CALC “ amount wil be calculated as “Rs.660”

Regards

Govardhan Reddy

SAP HCM Consultant

Leave A Comment?

You must be logged in to post a comment.