When one of my clients acquired another company in the middle of a fiscal year, it presented me a new challenge in not only helping them manage a new 401(K) cumulation and reporting process but also maintaining their current method. I want to share what I learned and the solution I implemented for the situation.

Business rules and employee master data were to stay in effect at least for the rest of the fiscal year. Incorporating these into the purchasing company’s HRIS required understanding how the new business rules would be integrated into the HRIS and what the impact would be on the current existing rules. Could the current configuration of HCM core assimilate these new changes or do these new changes require an entirely new set of configurations?

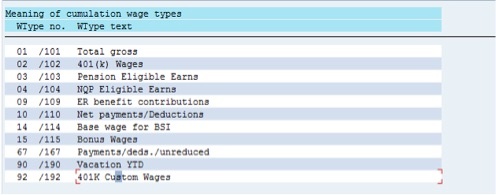

Many end users do not know that SAP infotypes /190 through /199 are custom cumulation wage types that can be available for any need and requirement. These custom wage types are easy to configure and apply to your SAP system.

One of the instances which warranted a change was the selection of shared wage types between the two companies that accumulated and served as base calculation for the 401(K) plan in the newly acquired company. The 401(K) plans were to be processed differently between the parent and new subsidiary. Certain wage types such as an overtime may be available to accumulate into one of the 401(K) plan but not the other.

The acquiring company also needed to report separately on the two plans, so the custom cumulation wage type was the perfect solution. It was a matter of creating a custom wage type for the new, separate 401(K) calculation.

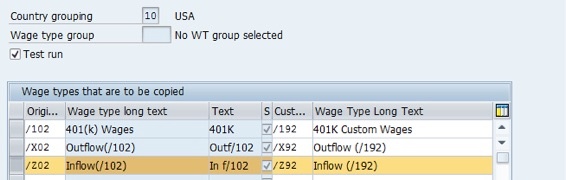

401(K) processing involves 3 wage types: cumulation, inflow, and outflow. We created substitute elements for each by adding /192, /Z92 and /X92 respectively type (Figure 1).

Figure 1. Creating the Customized Cumulation Wage Types for 401(K)

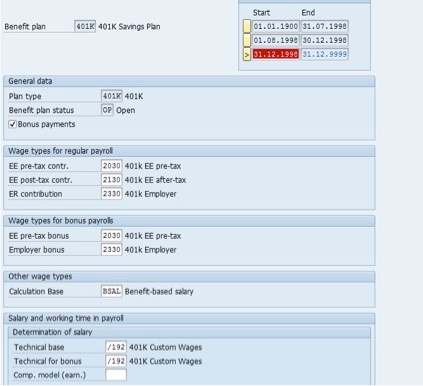

Once we created the 401(K) custom cumulated wage type, we needed to assign it in the corresponding 401K benefit plan (Figure 2).

Figure 2. Replacing the standard /102 configurations with the newly created custom cumulation wage type

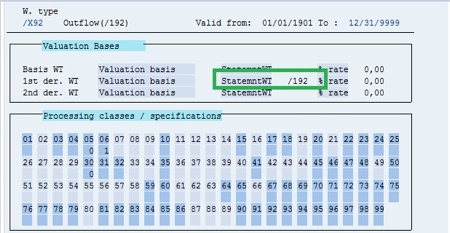

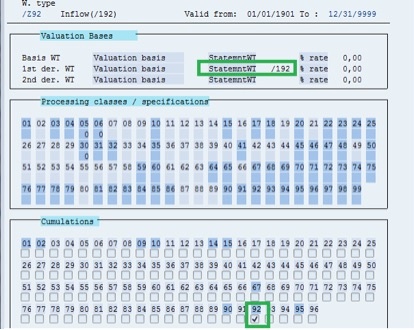

Third, we needed to ensure that the 3 newly created custom wage types related to 401(K) had the proper relationship with one another as in /102, /X02 and /Z02 by following the configuration steps in Figure 3 and Figure 4.

Figure 3. Replacing /102 with the custom wage type /192 for the outflow component to establish relationship with the newly created 401(K) custom cumulation wage type

Figure 4. Replacing /102 with the custom wage type /192 and switching the cumulation from 02 to 92 in the inflow wage type to establish a relationship with newly created 401(K) custom cumulation wage type.

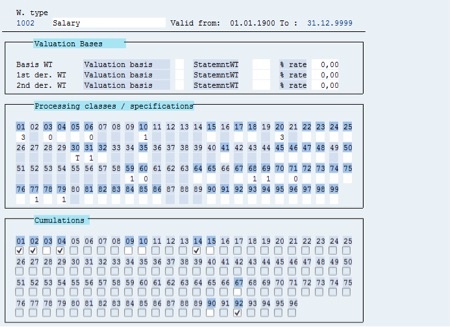

Next, we configured the earning base calculations for the new 401(K) plan processing. To do so, I simply added the wage types that contribute to the new earning base calculation by selecting the 92 cumulation checkbox shown (figure 5). It is also important to note that a wage type can cumulate into both the old /102 as well as the new /192. A perfect example of this is when a wage type accumulates to both 401(K) plans, it is not a problem for both the 02 and 92 cumulation checkbox to be selected.

Figure 5. Assigning a wage type to cumulate to the new 401(K) custom cumulate wage type- /192.

You can use the Wage Type Utilization Report to check your results. This report can help you ensure that all the wage types that are supposed to cumulate towards your newly created 401(K) cumulation wage type are configured in such a manner. (Figure 6).

Figure 6. Output results for Wage Type Utilization that shows all the wage types that currently cumulate towards a cumulation class.

Leave A Comment?

You must be logged in to post a comment.