The first GST was implemented in India on 1st July 2017. It is a single Taxation system applicable across India. The different types of GST that are applicable in India are

- CGST (Central Goods and Service Tax)

- SGST (State Goods and Service Tax)

- IGST (Integrated Goods and Service Tax)

- UTGST (Union Territory Goods and Service Tax)

As per cbic-gst.gov.in, it was given different types of GST rates. So as per the Organization’s business, we need to implement GST taxation in SAP S4HANA and create the tax codes as per the GST rates.

In this scenario, we are going to create the following GST tax codes with the GST rates

| Description of Goods | CGST Rate | SGST Rate | IGST Rate |

| All goods [other than fresh or chilled] pre-packaged and labeled. | 2.5% | 2.5% | 5% |

Configuration Steps

- IMG Path: Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Calculation > Define Tax Codes for Sales and Purchase

- Transaction code: FTXP

Step 1: Execute the transaction code “FTXP” or follow the IMG path and execute the IMG activity.

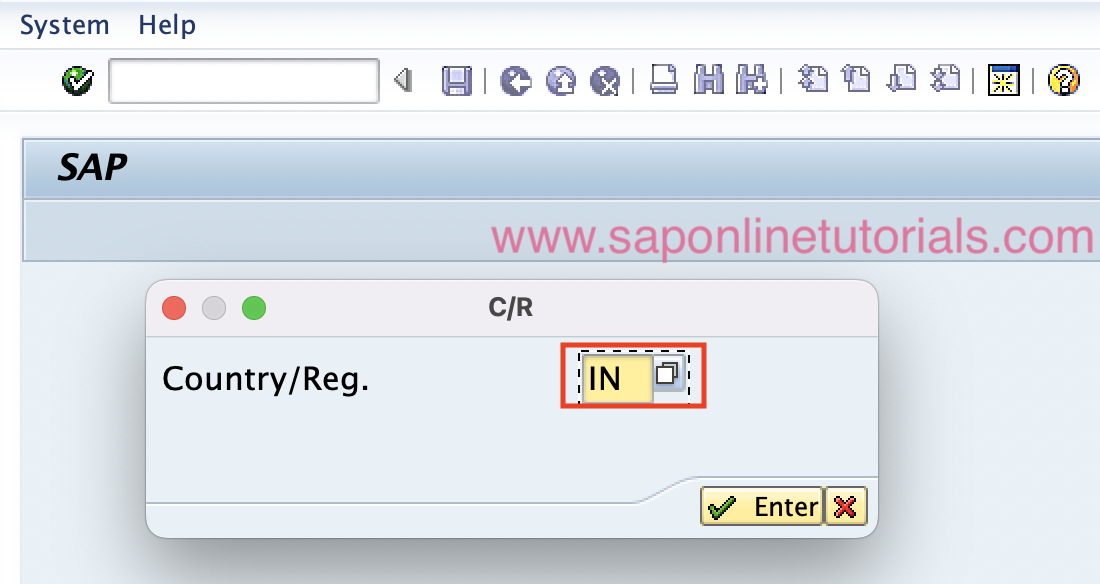

Step 2: Enter the country key “IN” and press enter to continue

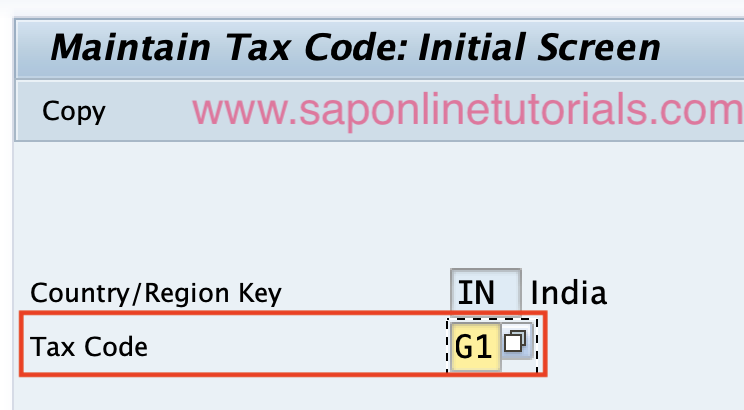

Step 3: On the Maintain Tax Code: Initial Screen, enter the new GST tax code that you want to create in SAP S/4HANA and press enter to continue.

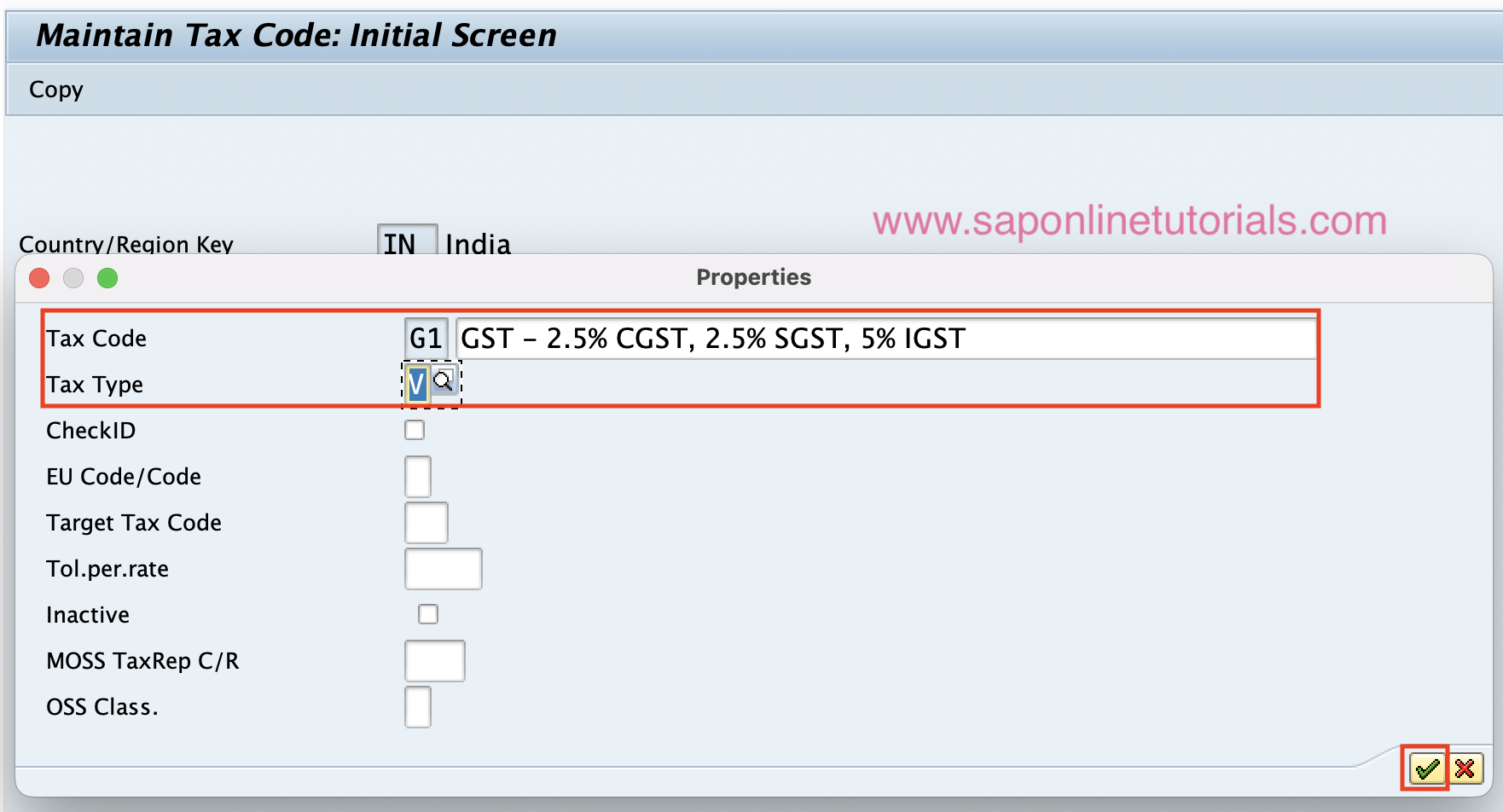

Step 4: Now update the following details

- GST tax code description

- Tax type (V – Input Tax or A – Output Tax).

Step 5: As per the GST rates, provide the tax percentage of CGST, SGST, and IGST to be calculated.

Click on the save button and save the GST tax code in the SAP Hana system.

Leave A Comment?

You must be logged in to post a comment.