In cases where it is relevant to quickly identify all accumulations to a specific wage type – such as validating the accumulations of Social Security after RG 2388, RG 5858 and Decree 1990, which require all the accumulations to be equivalent so that the report generates correctly – the report RPDLGA20 can be used to quickly identify the accumulations and compare them as needed.

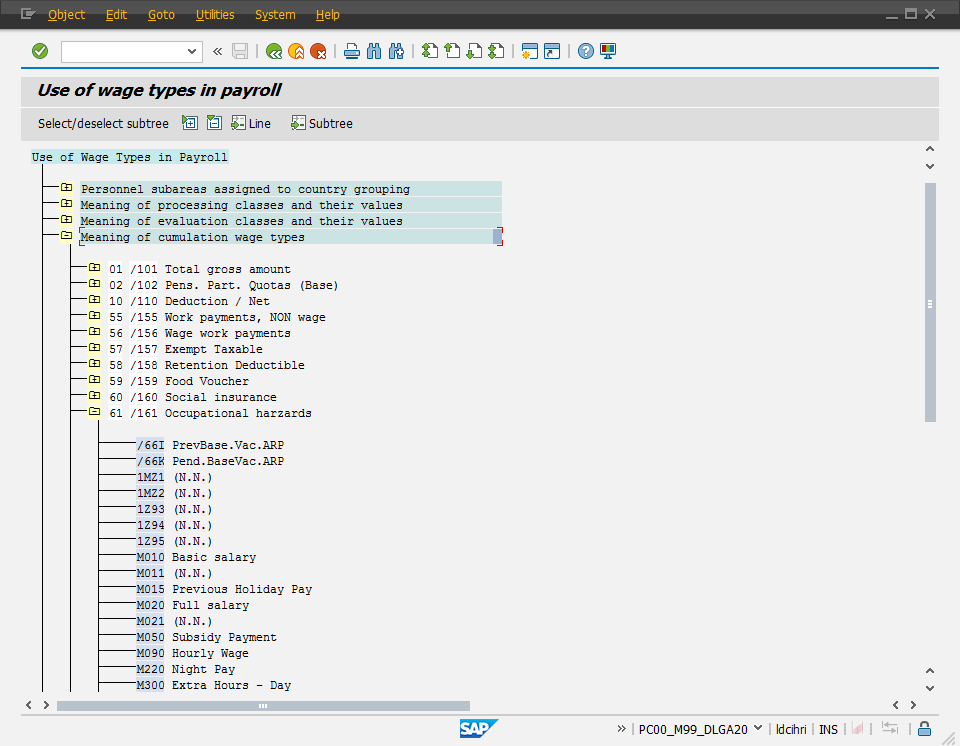

Using as an example the Social Security accumulation wage types, for the accumulation /161 (Accumulation for Risks – ARP), the report can be used to easily verify if there are no incorrect wage types accumulating into /161 – such as absences, which should not accumulate into Risks IBC.

1. Go to transaction PC00_M99_DLGA20. Alternatively, you can execute the report directly from SE38, typing RPDLGA20.

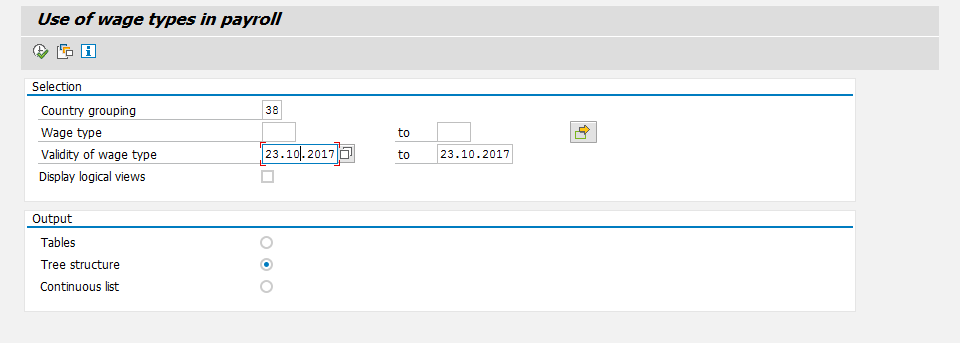

2. From the selection screen, input Molga 38 for Colombia and under the “Output” options, select “Tree structure”.

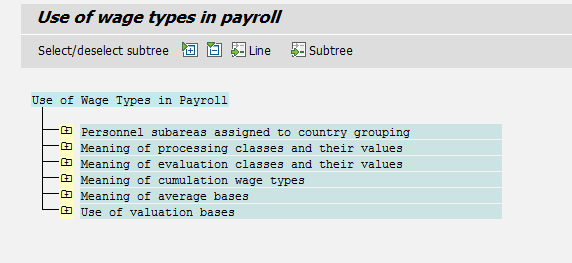

3. The report will provide an overview of wage type characteristics, as they were defined in different customizing tables (such as T512 tables). For this article we will be referring only to the “Meaning of cumulation wage types” section.

4. By selecting the option “Tree structure” in the output section, it enables you to expand each section as desired. Under the “Meaning of cumulation wage types” option, the report will display all /1** wage types and allows you to expand them to see which wage types are set to accumulate into them through the customizing of table V_512W_D.

Leave A Comment?

You must be logged in to post a comment.