Introduction

This blog post has been written to understand how we can generate India Localization reports such as GSTR 1/GSTR 3B/GSTR 6

Business Use Case

Statutory reporting has been localized for use by businesses with operations in the country/region and it comprises functions designed for laws and business practices relevant in the country/region. For India it is possible to generate reports for taxation and legal compliance in SAP S/4HANA Cloud. In todays blog post we will see how to generate GSTR1 Report.

For the Reports to be created you need to activate the scope item 1J2-Compliance Formats – Support Preparation.

Configuration Steps

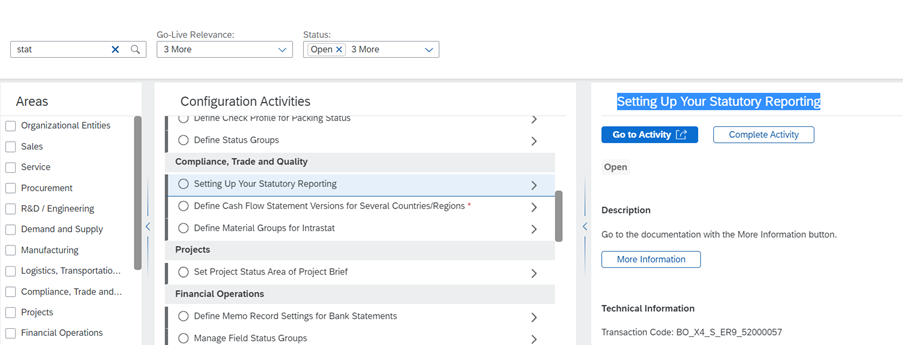

1. Setting Up Your Statutory Reporting

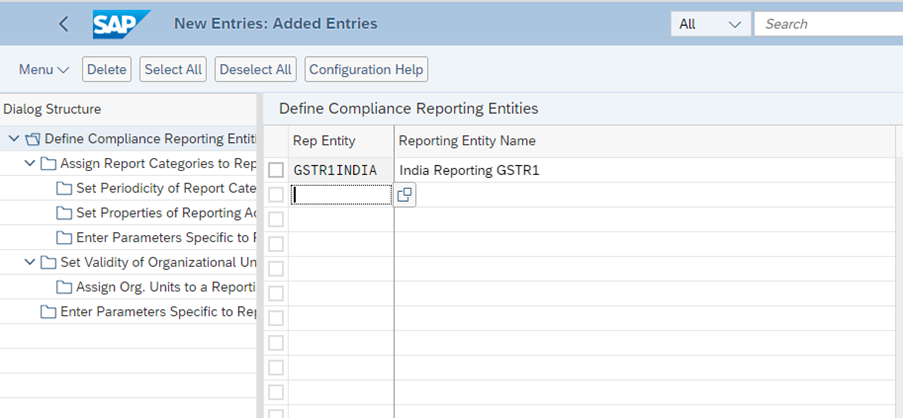

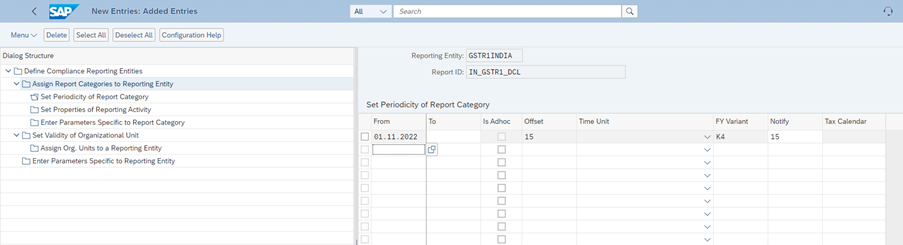

2. Define Compliance Reporting Entities

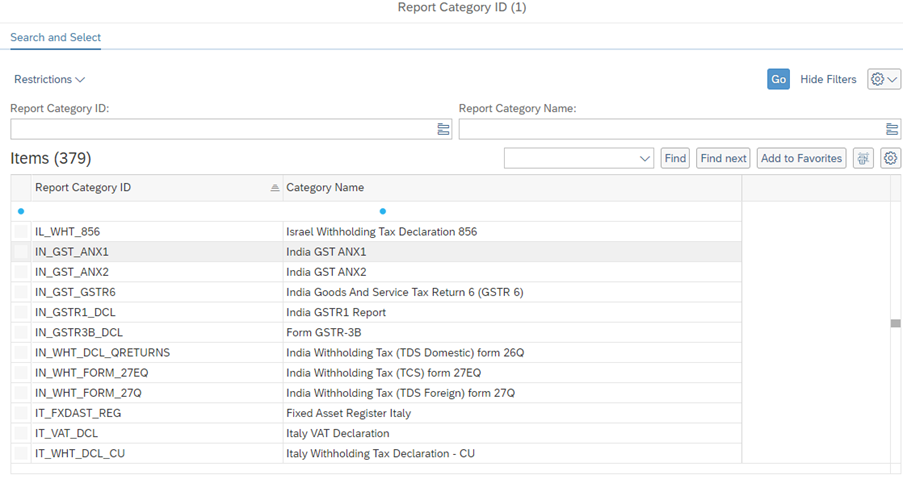

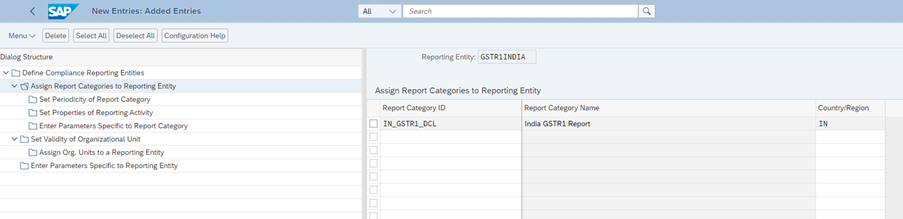

3. Assign Report Categories to Reporting Entity

4. Set Periodicity of Report Category

Process Steps

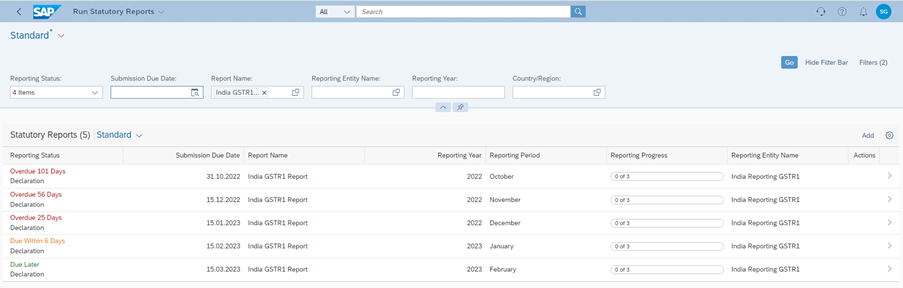

In App “Run Statutory Reports”

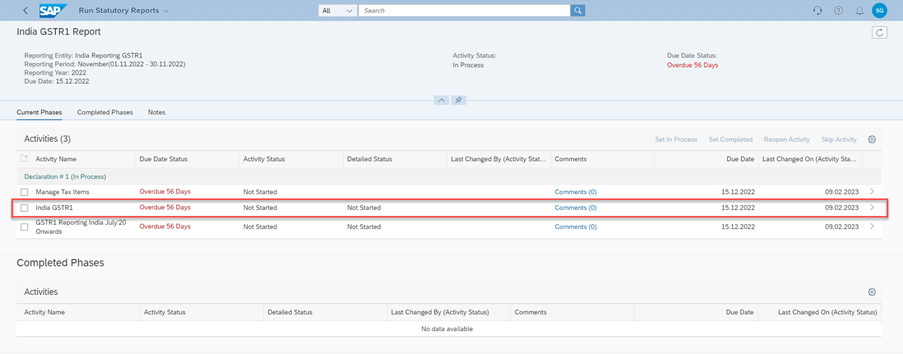

Let’s Run for November

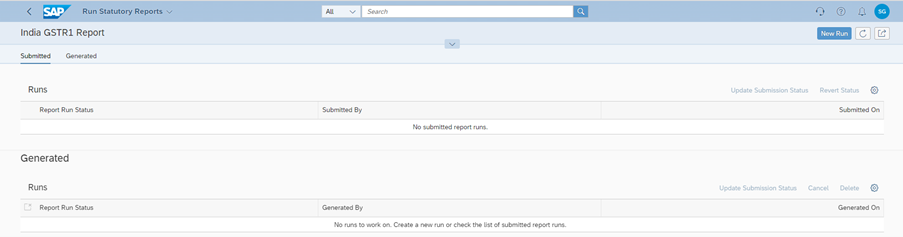

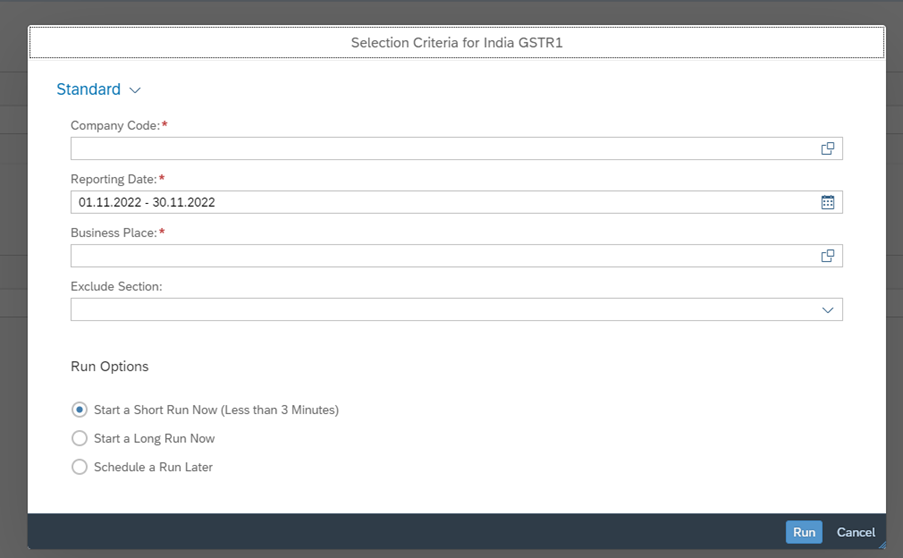

Go Inside the Activity India GSTR1 and click on New Run

Please choose Company code and Business Place

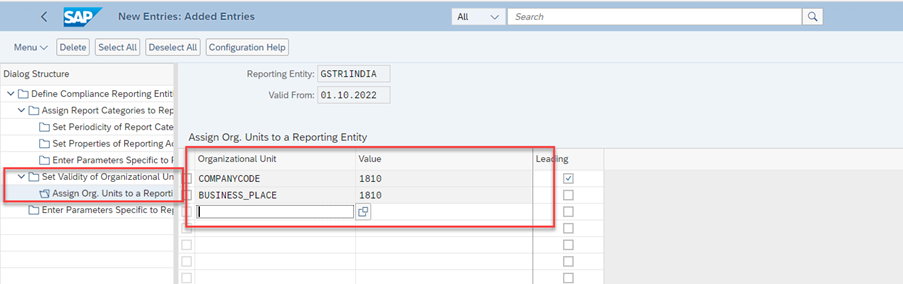

If you want to auto fill the Company code and Business Place, then you can add the entry in below structure.

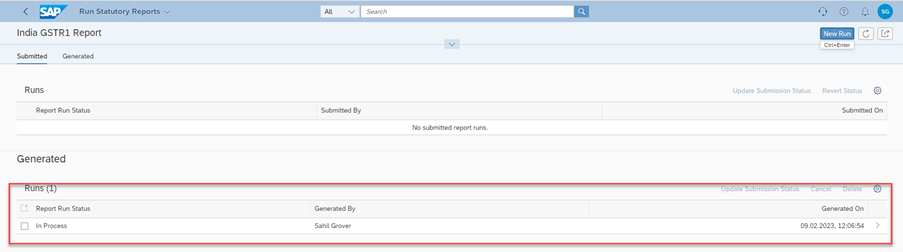

Run is done

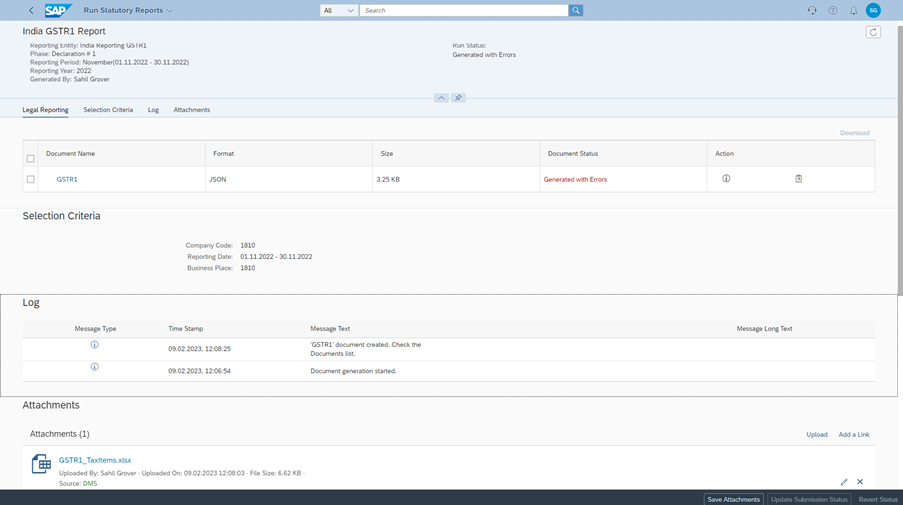

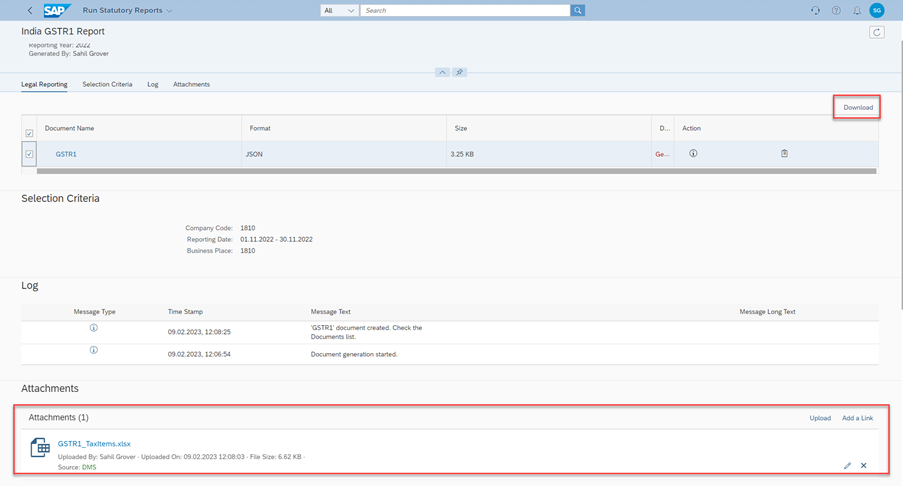

Once the report is generated, we can go Inside and see the details

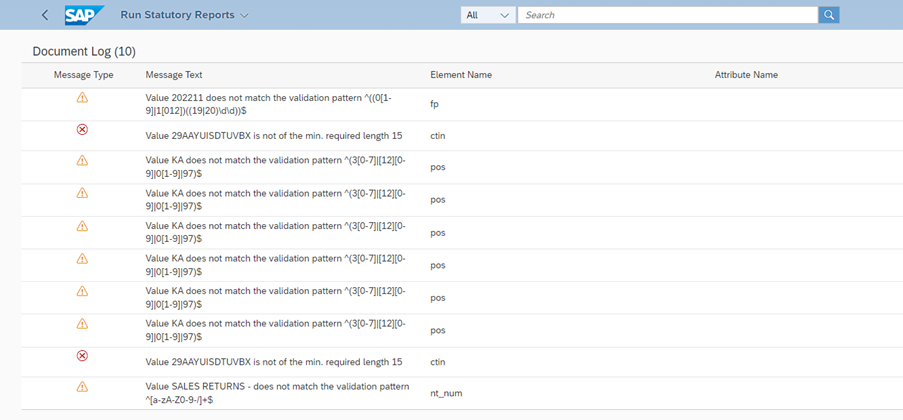

In case of any error(like above) click on Action and information message you can see the errors.

You can correct the errors and run the report again. You can even download the report with errors .

For JSON Download click on Download , Sign the JSON and upload to government. Also you can download the tax items.

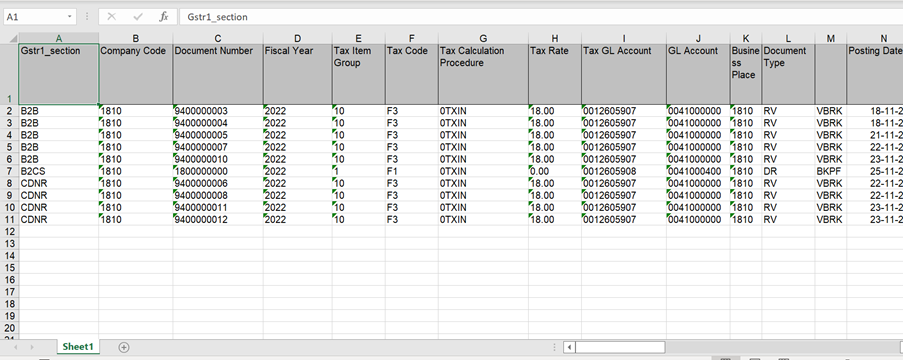

Sample Jason and Tax report.

After the file has been generated, submitted to the tax authorities, and the authorities approved it, change the status of the reporting run by choosing the row of the run and then click the Update Submission Status button. Change the status manually to Accepted by Government.

Conclusion

This blog post should help you to understand in detail how to generate India Compliance Reports.

Thanks for reading this blog post, hopefully the blog post was informative

References

For more Information

http://help.sap.com/docs/SAP_S4HANA_CLOUD/634261119fec4d58970471f2c4a9a740/9c6e816f7ad94a27a76b98f2…

Leave A Comment?

You must be logged in to post a comment.