Business Scenario:

Deducting one day salary from employees for various contributions like national calamities, PM’s Fund, etc. The contribution should be deducted after taking consent of the employee.

Detailed configuration steps with screen shots are given below for One day Salary deduction as per Business Requirement.

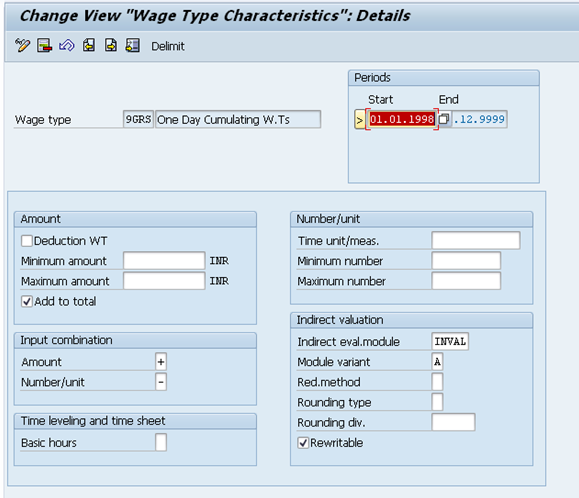

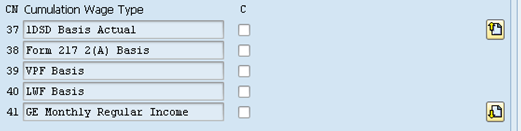

1. Create custom wage type for the base amount.

Create a Wage Type to generate the base amount for the one day salary deduction.

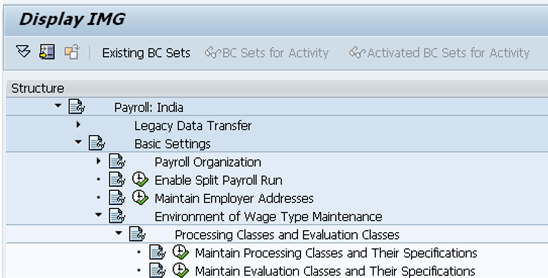

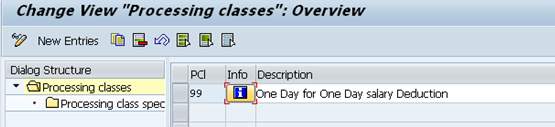

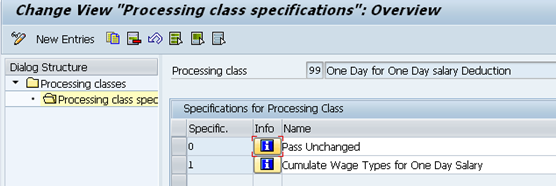

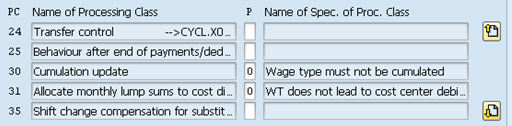

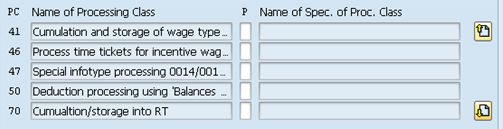

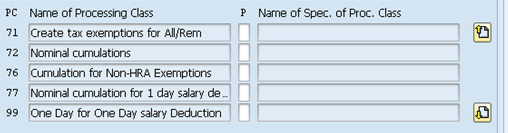

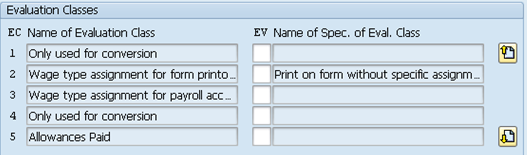

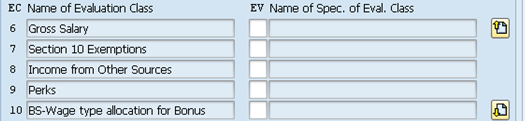

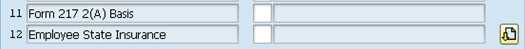

2. Create custom processing class 99.

SPRO → Payroll → Payroll India → Basic Settings → Environment of wage type maintenance → Processing classes & Evaluation classes → Maintain Processing classes & their specifications.

3. Create a PCR to cumulate the base amount to the custom Wage type

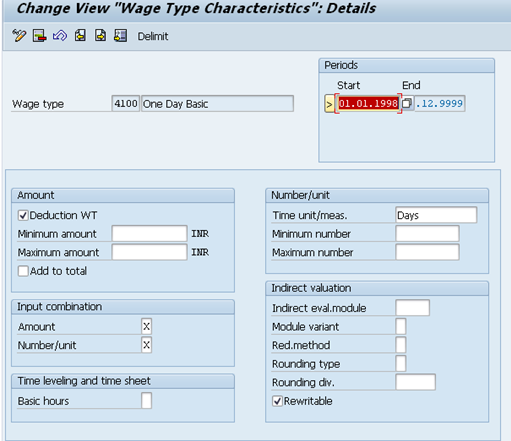

4. Create a deduction wage type to make the deduction.

5. Maintain the table V_512w_d for the custom Wage type

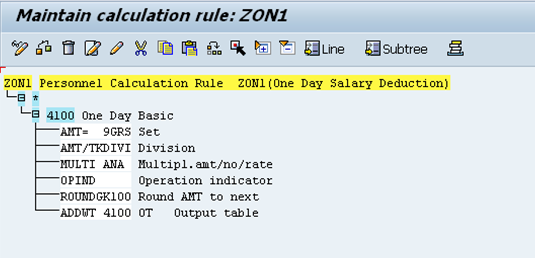

6. Create a PCR to generate the exact amount for One Day Salary.

TKDIVI→ Number of calendar days in the period.

OPIND→ Multiplies amount, number & rate (or) all by -1,If the wage type is a deduction wage type.

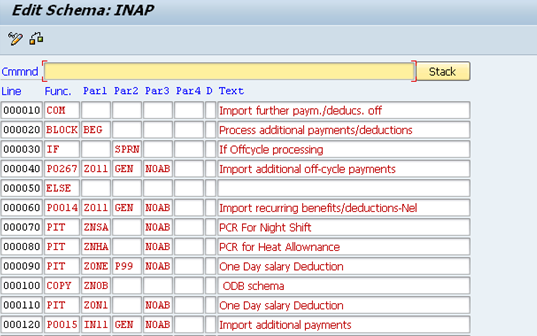

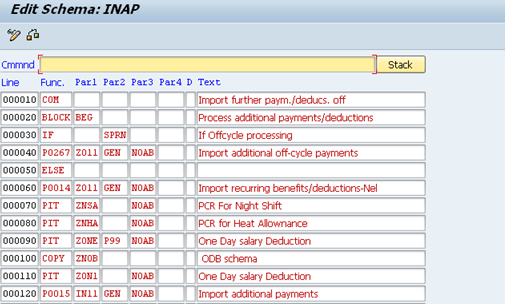

7. Create a schema and insert the PCR

Copy the standard sub schema INAP as ZNAP & deactivate INAP. We need to insert the PCR at the right place in the Schema. In the present scenario we are processing one day salary deduction through Infotype 14. So insert the PCR’s in ZNAP subschema.

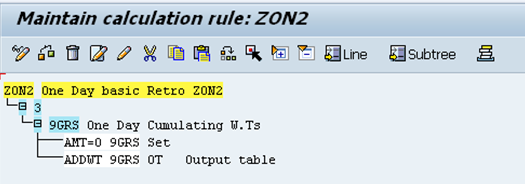

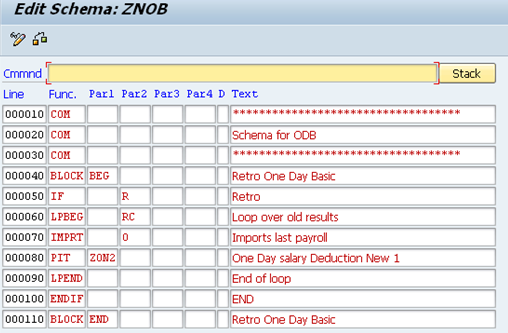

8. Restriction for Retro

As it is generated from the cumulation of Wage types, when there is a change in the base Wage types which is used to cumulate base amount also will change. So, it is need to restrict from retro. To do that create a New PCR and insert in a new Sub-schema, and insert after the PCR to generate the Base amount.

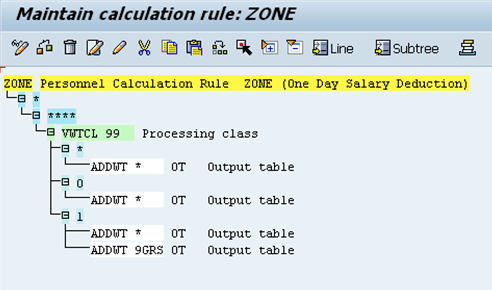

The PCR is

Below is the Sub-schema

Insert the sub-schema in INAP schema as shown below,

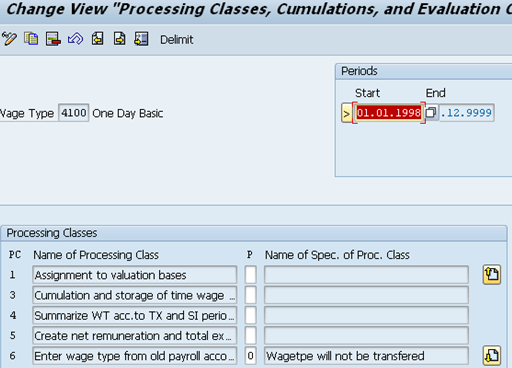

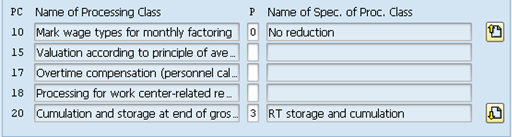

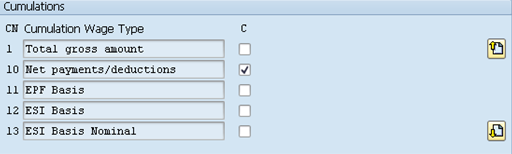

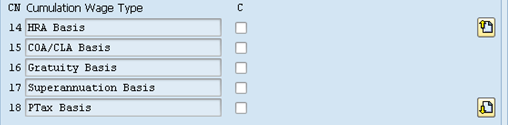

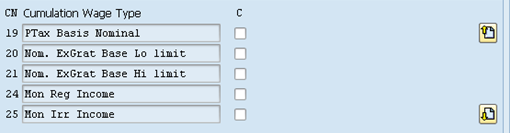

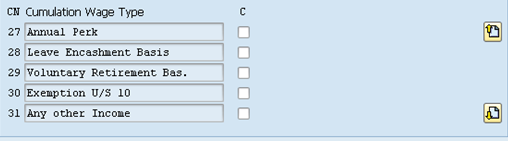

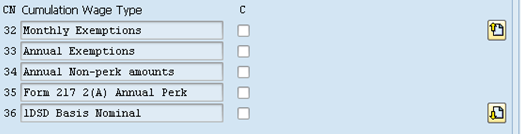

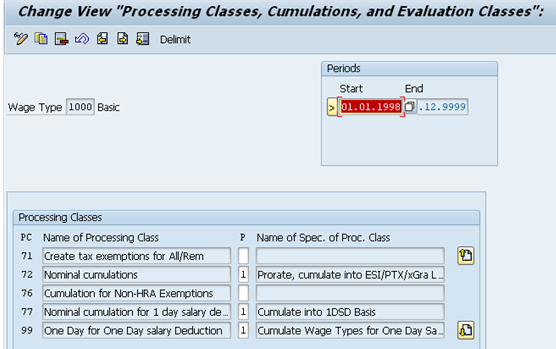

Select the Processing class 99 & specification class 1 for all the wage types which are to be cumulated for one day salary deduction in the table V_512W_D.

Leave A Comment?

You must be logged in to post a comment.