This blog provides a process how to calculate Reverse Charge Tax in SAP S/4HANA Cloud.

Target Audience

Business Users, Key Users, Consultants

Target Industry

All

Reverse Charge Tax calculation

Reverse charge is a scenario in Taxation, where, the tax paying entity creates a tax liability on it self.

One of the examples of this is India GST, where reverse charge needs to be applicable under specific scenarios such are below

1. Purchase from Unregistered Vendors

2. Import of services

3. Purchase of specific Goods and Services.

To understand it better, let us take an example. An organization purchases goods from a supplier. That supplier is not eligible/registered to pay taxes to government. The rule in that particular tax regime tells that, in such case, the buyer needs to create a tax liability on itself and submit the tax amount to government. This concept is called reverse charge.

Let’s talk about it from an accounting point of view.

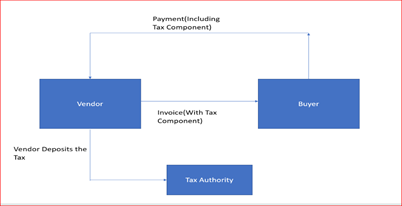

Purchase without Reverse Charge (Regular Purchase)

In case of a normal purchase, the accounting entry will be as it below.

Vendor Cr 1000

Expenses Dr 900

Input IGST Tax Dr 100

In this case, the buying organization pays the tax amount to the Vendor (in the payment against invoice), who in turn will submit it to the government.

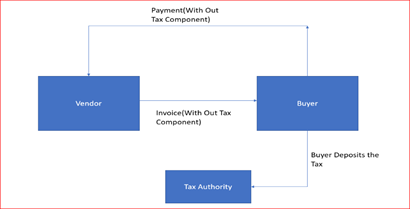

Purchase with Reverse Charge

In case of a reverse charge, the accounting entry will be as below.

Vendor Cr 1000

Expenses Dr 1000

Input RCM IGST Tax Dr 100

RCM Payable IGST Tax Cr 100

As part of S/4HANA Cloud SAP has provided below pre-defined RCM tax codes in India.

Standalone FI App

Standalone FI apps uses the country tax procedure ‘0TXIN’ – India Tax Procedure

– Tax Procedure consists of all the condition types (base amount and different tax components)

– Step Numbers are used to maintain the condition types in the procedure

– ‘From’ and ‘To’ determines, the tax calculation against the condition types

– Account Keys helps in posting the calculated condition values against the GL accounts or to inventory based on the type of account key

– NVV – is the non-deductible account key, which loads the condition value to the inventory

– 363 routine is used to calculate taxes for import cases, which includes accessible value

– Condition types against which the 363 routine is assigned, is applicable only for the import of goods and not the services (assessible value not applicable for services)

Note:

– Access sequence with multiple combination of fields will not work for Standalone FI apps to determine the tax rates automatically

– User must choose the right tax codes manually for posting Standalone FI apps

Customer Invoice creation App: Vendor Invoice creation App:

0TXIN – India Tax Procedure (For your reference only)

Reverse Charge Condition Types for deductible and non-deductible scenarios:

| Condition Type |

| Description |

| JICR |

| IN: RCM CGST |

| JISR |

| IN: RCM SGST |

| JIIR |

| IN: RCM IGST |

| JIUR |

| IN: RCM UTGST |

| JCIR |

| IN: RCM Comp. Cess |

| JCRN |

| IN: RCM CGST Inv |

| JSRN |

| IN: RCM SGST Inv |

| JIRN |

| IN: RCM IGST Inv |

| JURN |

| IN: RCM UTGST Inv |

| JRCN |

| IN: RCM Cess Inv |

GL accounts for reference:

| GL Account Description |

| GL Account |

| Purpose |

| Reverse Charge Account IGST (IN) |

| 12605912 |

| Reverse Charge Tax Account Specific to GST Tax India |

| Reverse Charge Account SGST (IN) |

| 12605913 |

| Reverse Charge Tax Account Specific to GST Tax India |

| Reverse Charge Account CGST (IN) |

| 12605914 |

| Reverse Charge Tax Account Specific to GST Tax India |

| Reverse Charge Account UTGST (IN) |

| 12605915 |

| Reverse Charge Tax Account Specific to GST Tax India |

| Reverse Charge Account Compensation Cess (IN) |

| 12605916 |

| Reverse Charge Tax Account Specific to GST Tax India |

| Reverse Charge Account Import IGST (IN) |

| 12605917 |

| Reverse Charge Tax Account Specific to GST Tax India |

| Reverse Charge Account Import Comp. Cess (IN) |

| 12605918 |

| Reverse Charge Tax Account Specific to GST Tax India |

| Reverse Charge Account IGST Inv (IN) |

| 12605919 |

| Reverse Charge Tax Account for inventorized case Specific to GST Tax India |

| Reverse Charge Account SGST Inv (IN) |

| 12605920 |

| Reverse Charge Tax Account for inventorized case Specific to GST Tax India |

| Reverse Charge Account CGST Inv (IN) |

| 12605921 |

| Reverse Charge Tax Account for inventorized case Specific to GST Tax India |

| Reverse Charge Account UTGST Inv (IN) |

| 12605922 |

| Reverse Charge Tax Account for inventorized case Specific to GST Tax India |

| Reverse Charge Account Compensation Cess Inv (IN) |

| 12605923 |

| Reverse Charge Tax Account for inventorized case Specific to GST Tax India |

| Reverse Charge Account Import IGST Inv (IN) |

| 12605924 |

| Reverse Charge Tax Account for inventorized case Specific to GST Tax India |

| Reverse Charge Account Import Comp. Cess Inv (IN) |

| 12605925 |

| Reverse Charge Tax Account for inventorized case Specific to GST Tax India |

Input Tax Codes for reference:

| Tax Procedure |

| Tax code |

| Description |

| 0TXIN |

| J1 |

| IGST 18% – Domestic input GST – RCM |

| 0TXIN |

| J2 |

| CGST 9% + SGST 9% – Domestic input GST – RCM |

| 0TXIN |

| J3 |

| CGST 9% + UTGST 9% – Domestic input GST – RCM |

| 0TXIN |

| J4 |

| IGST 18% + Comp cess 18% – Domestic input GST – RCM |

| 0TXIN |

| J5 |

| CGST 9% + SGST 9% + Comp Cess 18% – Domestic input GST – RCM |

| 0TXIN |

| J6 |

| CGST 9% + UTGST 9% + Comp Cess 18% – Domestic input GST – RCM |

| 0TXIN |

| J7 |

| IGST 18% + Comp cess 18% – Demestic input GST – RCM – ND |

| 0TXIN |

| J8 |

| CGST 9% + SGST 9% + Comp Cess 18% – Domestic input GST – RCM – ND |

| 0TXIN |

| J9 |

| CGST 9% + UTGST 9% + Comp Cess 18% – Domestic input GST – RCM – ND |

Account Keys for reference:

| Transaction Key |

| Description |

| JRC |

| IN: RCM CGST |

| JRS |

| IN: RCM SGST |

| JRI |

| IN: RCM IGST |

| JRU |

| IN: RCM UTGST |

| JCR |

| IN: RCM Comp Cess |

| JCN |

| IN: RCM CGST ND |

| JSN |

| IN: RCM SGST ND |

| JIN |

| IN: RCM IGST ND |

| JUN |

| IN: RCM UTGST ND |

| JRN |

| IN: RCM Comp Cess ND |

Deductible and Non-Deductible Taxes in SAP S/4HANA Cloud

Deductible Tax – A Tax already paid to a Vendor that can be balanced against Output Tax.

While Purchase of materials, the Tax paid on the Purchase of items can be availed back from the government, this is called a Deductible Tax. Here, the Tax is not loaded to Material Inventory, It is posted to a separate G/L account as per the configuration and later stage it will be cleared-off by Financials.

In case base Price – 100 INR with IGST 18% then below accounting entry will be posted in the system

Good Receipt

Material/Exp Account Dr 100

GR/IR Account Cr 100

Invoice Receipt

GR/IR Account Dr 100

IGST Input tax A/C Dr 18

Vendor Account Cr 118

Non-Deductible Tax – A Tax already paid to a Vendor that cannot be balanced against Output Tax.

In case of a Non-Deductible tax, the Tax amount will be loaded to Material Inventory. Here, the Company cannot claim this Tax amount back from the government.

Taxable persons pay Input Tax to Vendors and Output Tax to the Tax Authority.

One part of the Input Tax, the Deductible Input Tax, can be balanced against the Output Tax, that is, a business pays tax on Sales and Purchases only on its own added value.

The other part, the Non-Deductible Input Tax, is excluded from this arrangement and depends on the applicable tax law of the appropriate country.

In case base Price – 100 INR with IGST 18% then below accounting entry will be posted in the system

Good Receipt

Material/Exp Account Dr 118

GR/IR Account Cr 118

Invoice Receipt

GR/IR Account Dr 118

Leave A Comment?

You must be logged in to post a comment.