Welcome to the tutorial about SAP Cost Elements. This tutorial is part of our free SAP CO training. SAP Cost Elements are important objects that help users to analyze or reconcile costs between Financial Account (FI) and Managerial Accounting (CO) modules of SAP ERP. There are two types of cost elements that are generally used in an organization:

- Primary cost element

- Secondary cost element

We will discuss each of these types in more details below.

During creation of SAP cost elements, they should be assigned to a category which is known as cost element category. So, the primary cost elements category technically determines which transactions can be used for a particular cost element.

For example, primary SAP cost elements or revenue cost elements use the following categories:

- 1 Primary costs/cost-reducing revenues

- 3 Accrual/deferral per surcharge

- 4 Accrual/deferral per debit = actual

- 11 Revenues

Whereas secondary SAP cost elements use the following categories:

- 21 Internal settlement

- 31 Order/project results analysis

Above are just few examples of the cost element categories. Different categories can be used as per the business requirement of companies.

SAP Cost Elements

Cost elements are defined in the controlling module of SAP and are assigned to various objects such as cost centers, internal orders, etc. Basically, their function is to classify and analyze the cost for internal reporting purposes. The integration between the expense accounts in financial accounting and cost elements in management accounting is essential for reconciliation purposes. Therefore, posting to a primary cost element is done through a posting to a G/L account. All the primary cost elements have a corresponding P&L G/L account in FI.

Primary Cost or Revenue Elements

The primary elements should be assigned to a corresponding object in CO such a cost centers, an internal order, etc. This is necessary for the identification of the origination of the cost. The revenue element is also a primary cost element but unlike primary cost elements it has a corresponding revenue G/L account in the chart of accounts under the P&L. The prerequisite for creation of these elements is to have a corresponding G/L account(s). Without them the SAP system will not allow to create primary cost or revenue elements.

Let’s look at some examples. Material costs, personnel costs, salary costs are different type of costs which are posted to P&L of G/L accounts which in turn are allocated to primary cost elements.

Secondary Cost Elements

These elements are only used in CO for the identification of internal costs for settlements or assessments. Unlike primary cost elements which have corresponding G/L accounts, secondary SAP cost elements do not have G/L accounts associated with them. They are used in overhead calculation, internal cost allocation, settlements, etc. If the SAP system finds that there is a corresponding GL Account during creation of a secondary cost element, it prohibits its creation.

Let’s look at some examples. Production cost, material overheads are allocated internally or settled internally through primary cost centers and internal orders for internal requirements of the business.

How to Create SAP Cost Elements

Primary Cost Elements

There are two ways to create primary cost elements: manual and automatic.

MANUAL

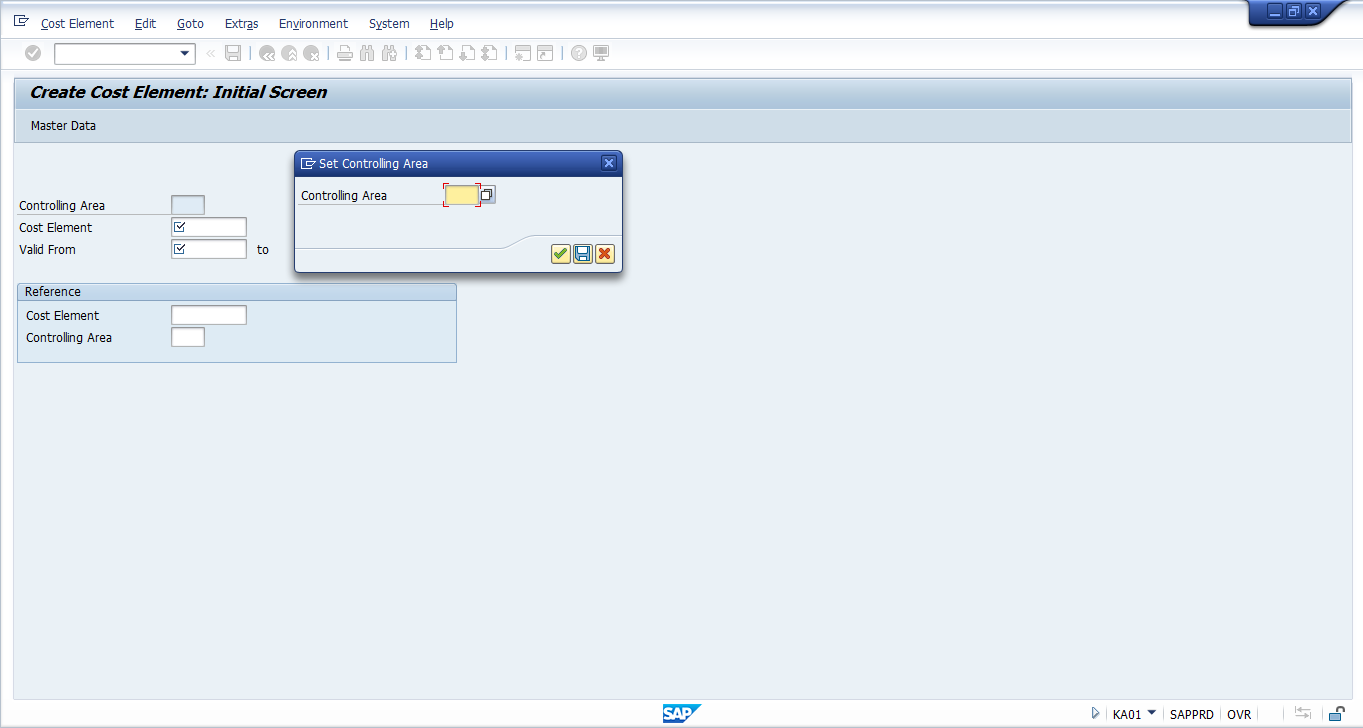

Launch the transaction KA01 or navigate to the following path in SAP Easy Access Menu:

Accounting – Controlling – Cost Element Accounting – Master Data – Cost Element – Individual processing – KA01

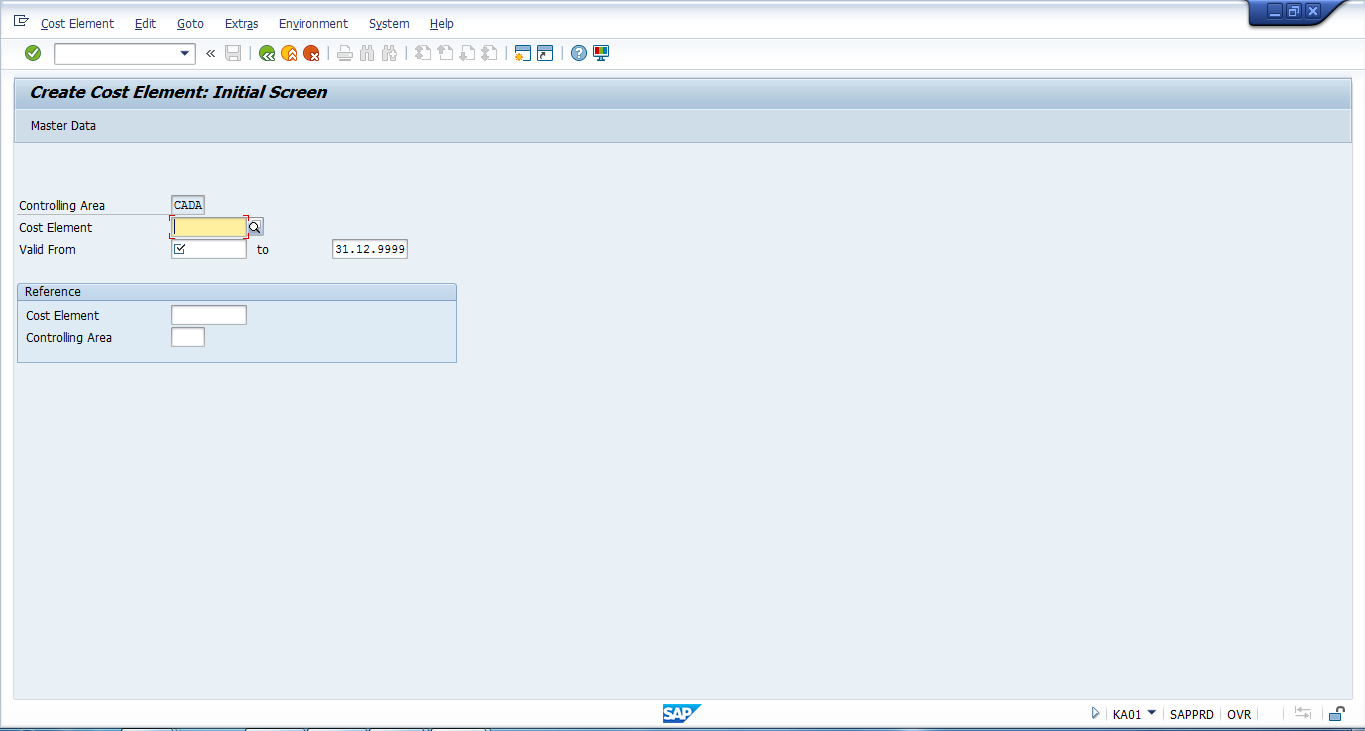

On the initial screen enter the controlling area in which you want to create a cost element. Next, enter number of the cost element that has to be created with validity dates and click on Master Data button.

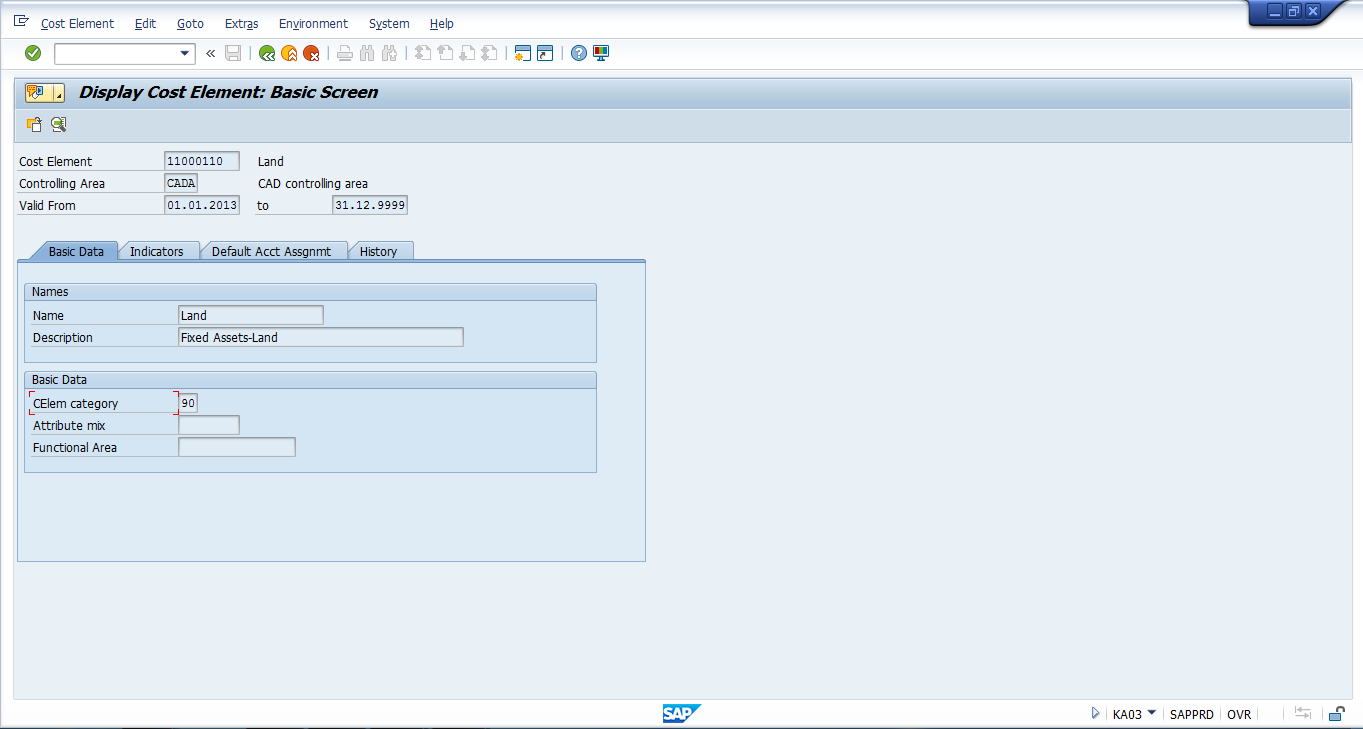

The system will take you to the next screen. Here, you should give the name and description of the cost element and choose cost element category number on the Basic Data tab. Next, you should click Save button.

After saving, the cost element will be created.

AUTOMATIC

The system creates cost elements automatically as you create G/L accounts. The numbers of cost elements are the same as numbers of G/L accounts.

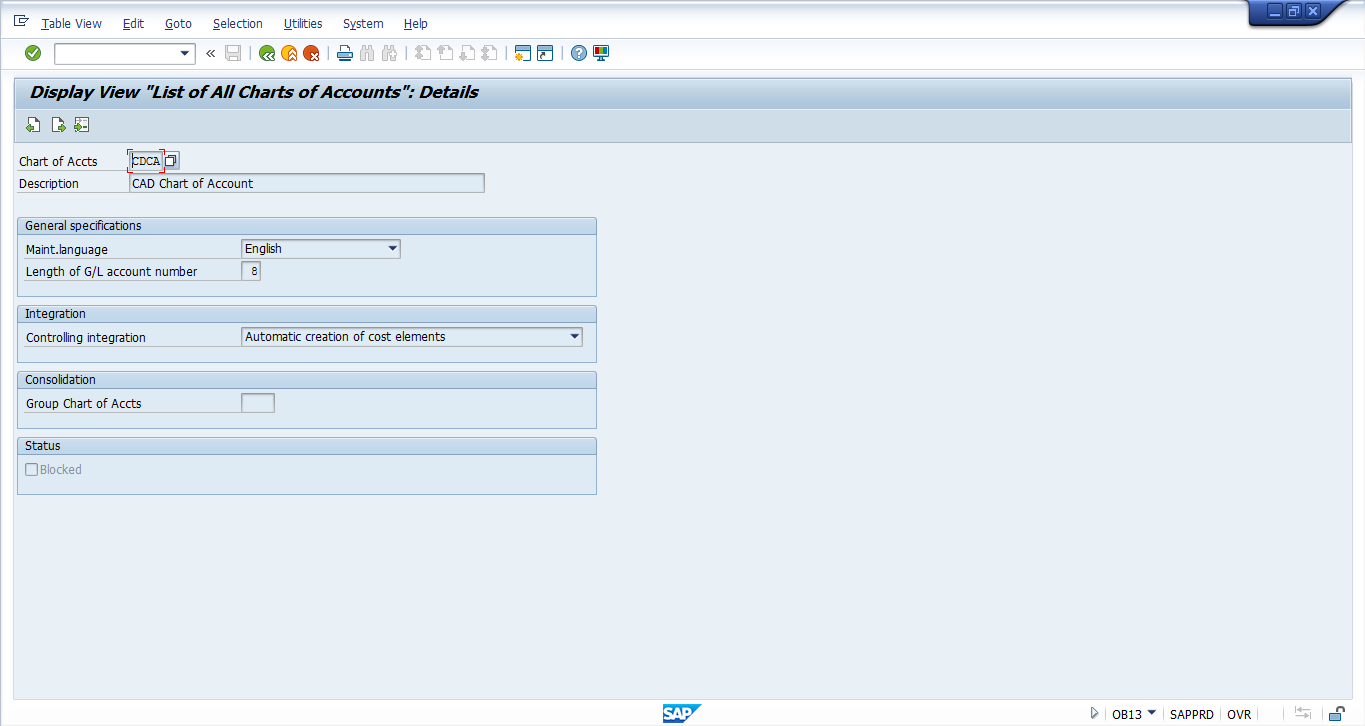

If you want to enable automatic creation of SAP cost elements, it is necessary to set up some settings in the chart of accounts customizing. Start the transaction OB13 or navigate to the following path in SPRO transaction:

Financial Accounting (new) – General Ledger Accounting (New) – Master Data – G/L Accounts – Preparations – Edit Chart of Accounts List

Select the chart of accounts of your company and click on ![]() button. On the next screen select “Automatic creation of cost elements” in the controlling integration field. Click save button

button. On the next screen select “Automatic creation of cost elements” in the controlling integration field. Click save button ![]() .

.

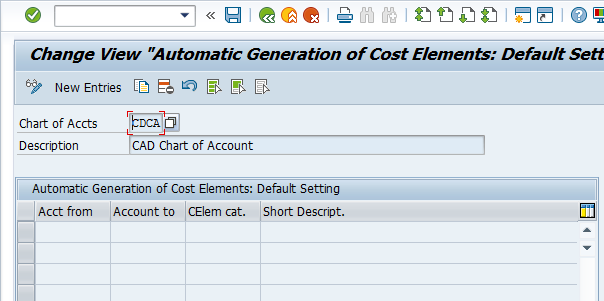

Now, we need to define cost element categories that the SAP system will use during automatic creation of cost elements. It is possible to define different cost element categories for various G/L accounts. To do it, start the transaction OKB2 or navigate to the following path in SPRO transaction:

Controlling – Cost Element Accounting – Master Data – Cost Elements – Automatic creation of Primary and Secondary Cost Elements – Make Default Settings

Enter the chart of accounts on the initial screen and press OK button. Next, you should enter account numbers in “Acct from” and “Account to” columns and corresponding cost element categories in “CElement cat.” column. When you enter numbers of G/L accounts in “Acct from” column, the SAP system will select one or several accounts according to the account number given in “Account to” column. Then, it is necessary to save these settings.

Secondary Cost Elements

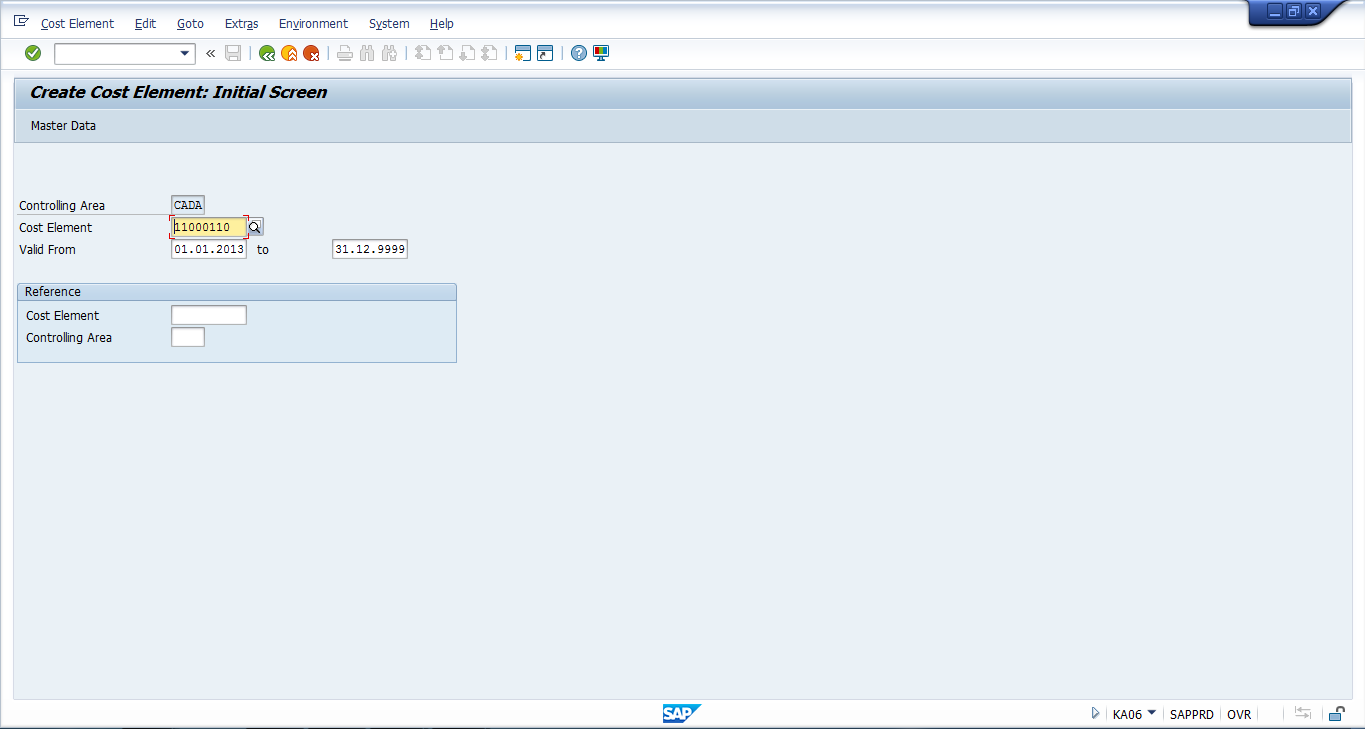

Now, let’s see how to create secondary cost elements. Start the transaction KA06 or navigate to the following path in SAP Easy Access Menu:

Controlling – Cost Element Accounting – Master Data – Cost Elements – Create Cost Elements – Create Secondary Cost Element

Overall, the procedure is similar to creation of primary cost elements. G/L Accounts are not needed for creation of secondary cost elements as these elements are used exclusively for internal cost analysis.

Posting to primary SAP cost elements is automatic and is done when you enter a document in financial accounting. For example, in transactions such as FB01 where users need to enter a cost center. Secondary cost elements cannot be directly posted like primary cost element. They are used for internal allocation between cost objects such as cost centers, internal orders, WBS elements, etc.

Leave A Comment?

You must be logged in to post a comment.