Welcome to the tutorial about SAP Direct Activity Allocation. This tutorial is part of our free SAP CO training. We will study what is the direct activity allocation in SAP ERP, consider a couple of examples, and show to how perform direct activity allocation in SAP system.

SAP direct activity allocation is used in the cost center accounting sub module of SAP CO which involves recording, measuring and allocation of the performed services. Now, to do so the user must maintain the cost drivers or the measurable tracing factors which are known as activity types in cost center accounting. In other words, posting and recording is performed based on the activity types. This method directly charges the cost center providing activity or process to the receiver. The posting contains all the information such as the sender cost center name, cost driver name, quantity used or consumed by the receiver cost center (or order) along with the receiver information.

Direct internal activity allocation in SAP is the process of documenting the activities of sender cost centers to the receiving cost centers based on the activity type. It is a transaction-based posting on a real-time basis within controlling module and it enables you to have an updated cost information in the cost centers at any given point of time.

Examples of SAP Direct Activity Allocation

Let’s consider the following example. The cost center “Electricians” (1220) performs 4 hours of the activity type “electrical repairs” for the admin cost center “ADMIN” (4550). The planned price for this activity type is $10/Hour. The valuation is as follows:

4 x $10 = $40

Later, we will perform SAP direct activity allocation to transfer the cost from the “Electricians” cost center to the “ADMIN” cost center. The cost center “ADMIN” will be debited and the cost center “Electricians” will be credited simultaneously.

Here is another example. The process “Purchasing dept.” consumed overall 2000 hours from cost center “Purchasing” (2205), the employee per hour cost is $15 and the result is:

2000 x $15 = $30000.

Later, we will perform SAP direct activity allocation to transfer the cost from the “Purchasing dept.” process to the “Purchasing” cost center. The cost center “Purchasing” will be debited and the process “Purchasing dept.” will be credited.

Details of SAP Direct Activity Allocation

The following are the cost accounting methods that are used by direct activity allocation:

- Activity based costing

- Standard costing (Flexible standard costing and static standard costing)

- Direct costing

If the receiving end of the activity allocation is not a cost object (e.g., business process, internal order or cost center) and the prices are not maintained manually, then the planned price is taken under consideration.

If the receiving end of the activity allocation is a cost object (e.g., business process, cost center or internal order), then the prices from the valuation variant are considered which is in turn linked to the cost center from the costing variant.

The following are possible receivers of SAP direct activity allocation:

- Cost centers

- Orders

- WBS element

- Business processes

- Real estate object

- Cost object

- Profitability segment

- Network/activity

- Production process

- Cost center/activity type

- Customer order

How to Post SAP Direct Activity Allocation?

Before posting direct activity allocation, some settings should be in place in SAP ERP:

- Relevant cost centers (sender and receiver)

- Activity type (cost driver)

- Activity prices

Step 1

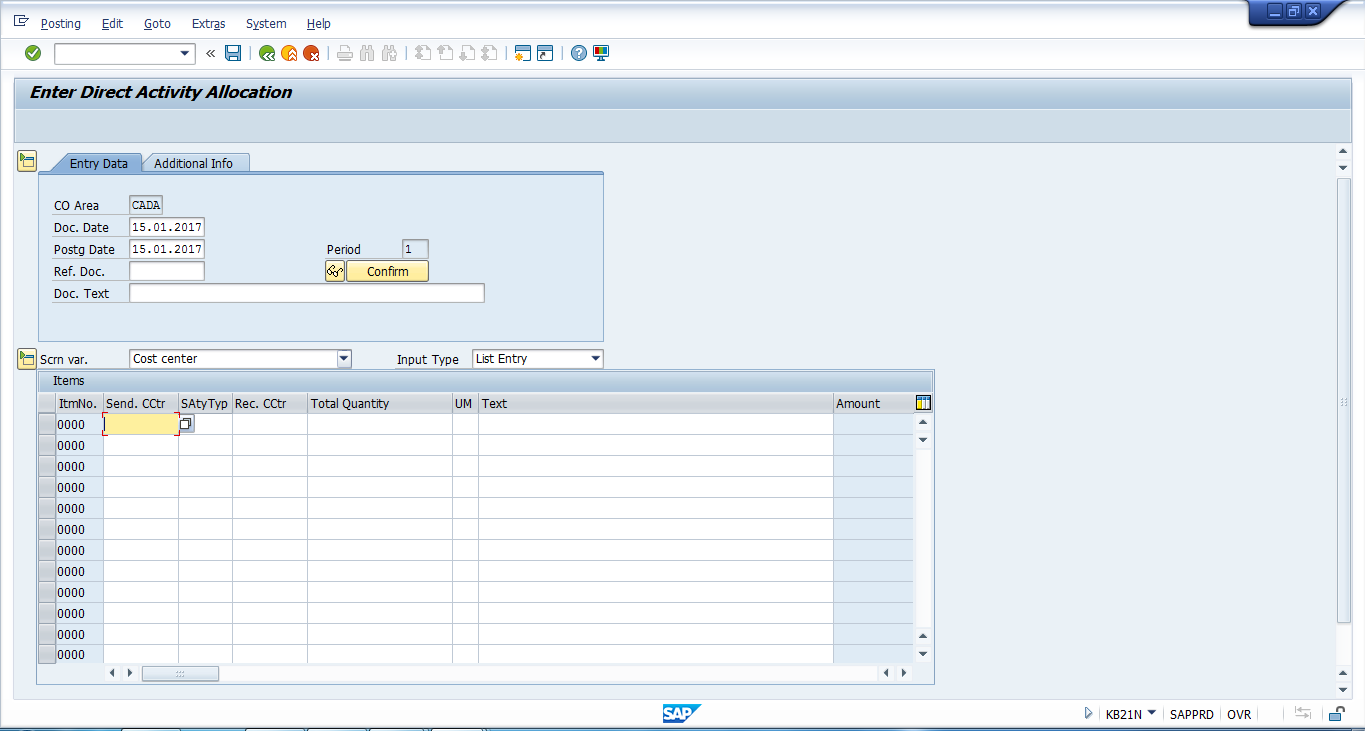

Start the transaction for activity allocation by navigating for the following menu path:

SAP Menu – Accounting – Controlling – Cost Element Accounting – Actual Postings – Activity Allocation – KB21N – Enter

Alternatively, you can directly start the transaction KB21N from the command field.

In this transaction, you should do the following:

- Enter the “Sender Cost Center” which provides the activity;

- Enter the “Activity Type” the cost driver;

- Enter the “Receiver Cost Center” which is consuming the cost;

- Enter the total quantity;

- Press Enter button on the keyboard to validate the postings;

- Click save

button.

button.

Step2

Confirm the postings of allocation in the receiver and sender cost centers using the line items report in the transaction KSB1.

Leave A Comment?

You must be logged in to post a comment.