This tutorial is part of the SAP FI course and it talks about SAP outgoing payment and how to perform it manually. Learn how to use transactions F-53 and F-48.

Payment processes in modern companies are being standardized and periodic payments runs are scheduled on specific days in order to pay vendor invoices.

The automatic payment program (transaction F110) pays most of the vendor invoices, but in practice, manual payments are also need in many cases. For example:

- Bank accounts for which the payment program is not configured;

- Based on business requirement payment is needed before next scheduled payment run;

- Vendor down payments.

In such cases, payment for vendor will be done manually and the bank documents will be posted using transaction F-53 and F-48 (for down payments). The documents posted with these manual transactions will appear in the system with KZ document type.

The manual payment can be performed in two variants that will be explained further in this lesson:

- Partial payment: it is used in cases when a partial payment for a certain open item is needed. The system will keep outstanding both documents: the original open item (invoice) and the partial payment until full outstanding amount will be settled.

- Residual payment: it is related to partial payments also, but the original open item (invoice) is cleared with the residual payment and the system will create a new outstanding document.

SAP Outgoing Payment (Transaction F-53)

To post SAP outgoing payment, navigate to the following path in SAP menu:

Accounting -> Financial Accounting -> Accounts Payable->Document entry-> Outgoing payment-> Post

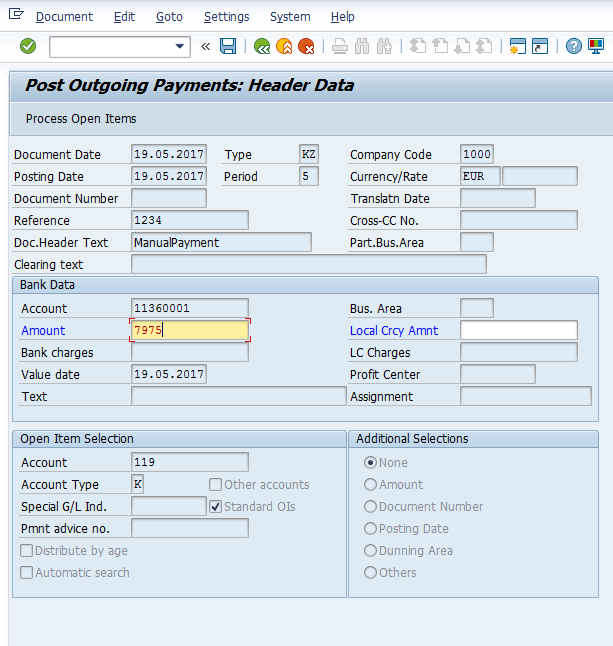

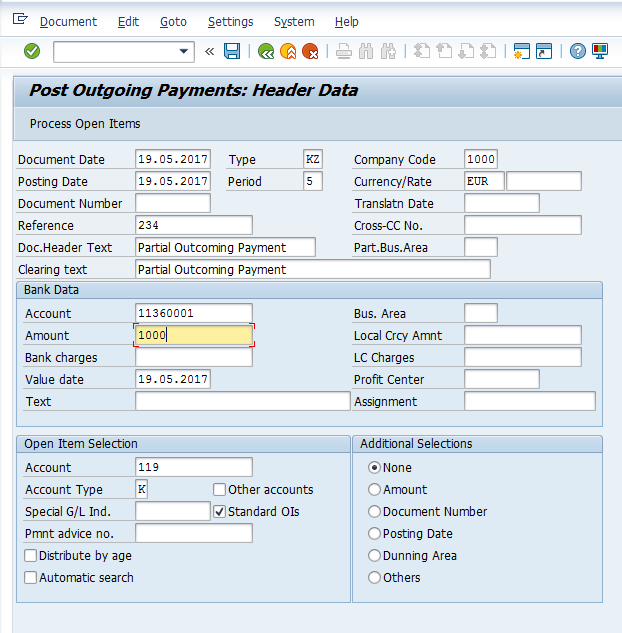

Or directly type in the command field the transaction code F-53. Next, input this information in the following fields:

- Document Date: input the date when the transaction occurs;

- Company Code: the code for your company code;

- Posting Date: date when the transaction is booked in the system;

- Currency: currency code used for this specific transaction;

- Reference: the invoice number from the vendor invoice;

- Bank Account: code identifying the G/L account;

- Amount: the value to be paid;

- Vendor Account: the account where open items to be paid are booked.

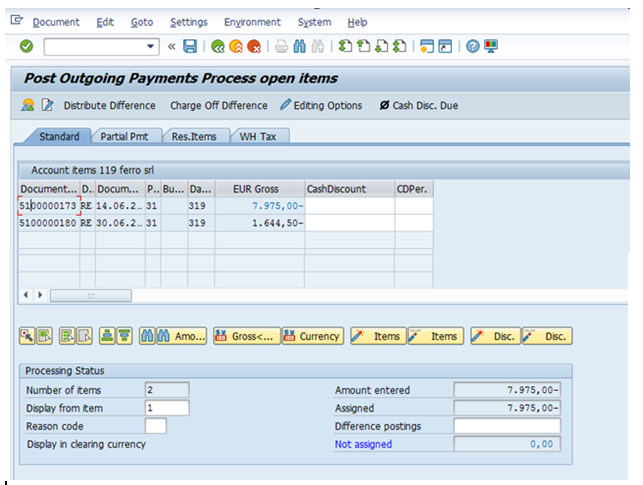

After filling in the fields on the initial screen, press Process Open Items button to display the list of open items. Assign the payment amount to the appropriate invoice to balance the payment with the invoice amount as shown below.

If the balance of the open items assigned is showing nil in the field “Not assigned”, then post the transaction using  button from the standard toolbar.

button from the standard toolbar.

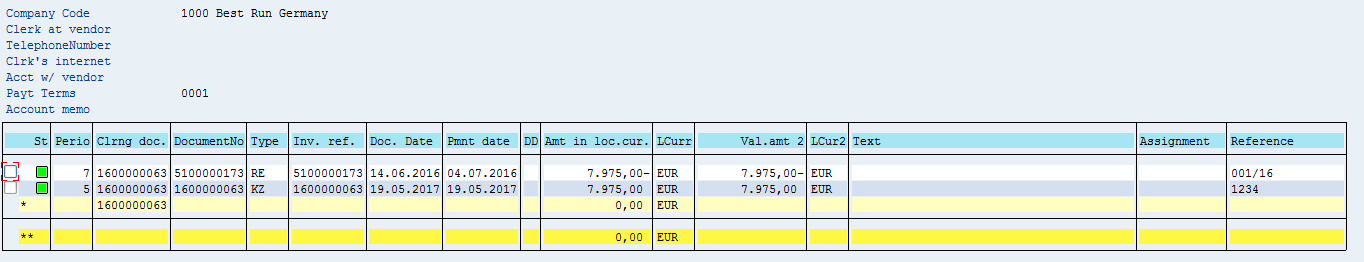

Now, let’s see the result of our posting by comparing the open items report before our manual payment and after the manual payment. This report is displayed in FBL1N transaction.

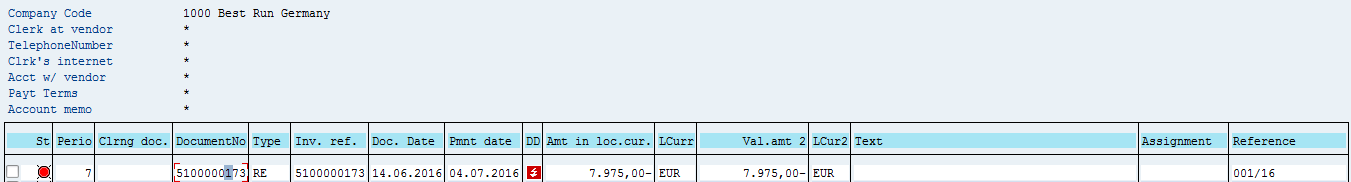

Here is the open items report before our manual payment (there is not clearing document):

Here is the open items report after the manual payment (both invoice and payment have the same clearing document):

Partial SAP Outgoing Payment

In SAP, it is possible to post a partial payment for a specific open item. The partial payment will be posted as a separate open outstanding item. No clearing document is created between open invoice and payment document.

To post a partial incoming payment, start the same transaction F-53 as explained above.

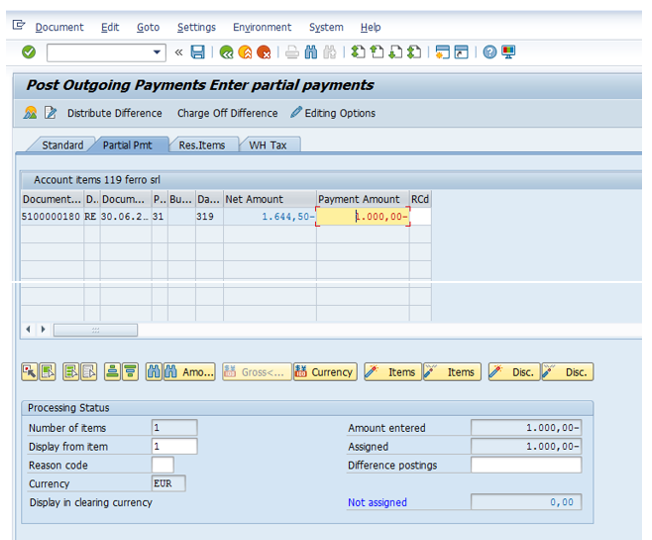

After filling in the fields on the initial screen, press Process Open Items button to display the list of open items. In the next screen, go to tab  . Next, select and activate the invoice against which the partial payment has to be made. Also, enter the partial amount for payment.

. Next, select and activate the invoice against which the partial payment has to be made. Also, enter the partial amount for payment.

If the balance of the items assigned is nil, then press Save button to post the document.

Now, let’s see the result of our posting by comparing the open items report before our manual payment and after the manual payment. This report is displayed in FBL1N transaction.

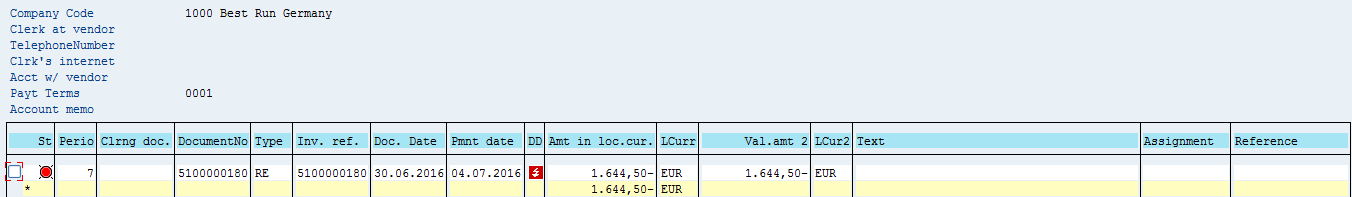

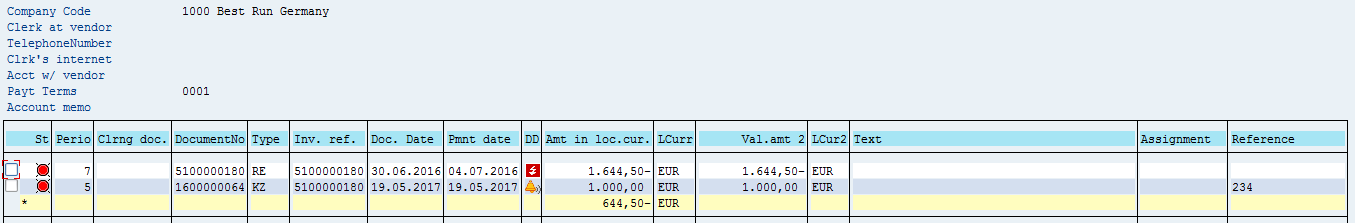

Here is the open items report before partial payment (there is not clearing document):

Here is the open items report with partially paid items (the system created a new document for the partial payment which is outstanding until the full payment will be executed- no clearing document):

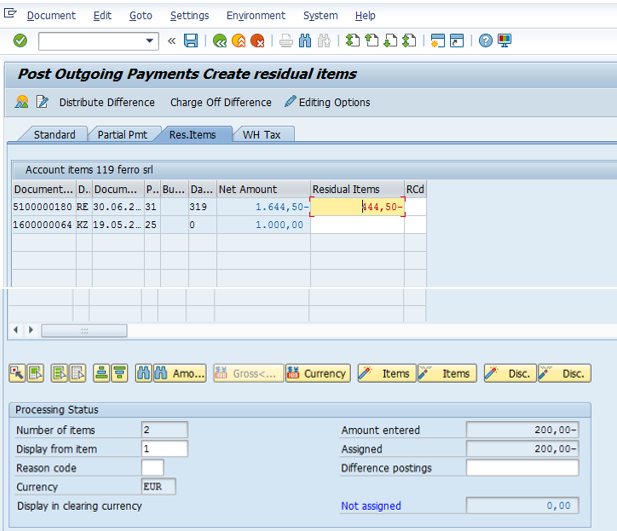

Residual SAP Outgoing Payment

The residual payment method in SAP clears the partially paid document and creates a new document with the residual amount as an open item.

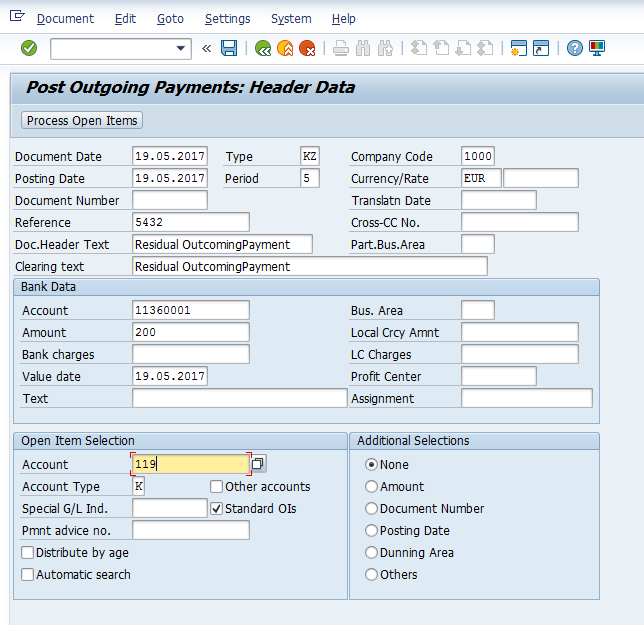

To post a residual incoming payment, start the same transaction F-53 as explained above.

After filling in the fields on the initial screen, press Process Open Items button to display the list of open items. In the next screen, go to the tab  . Here, you should select and activate the invoice against which the residual payment has to be made. Next, enter the residual amount for payment.

. Here, you should select and activate the invoice against which the residual payment has to be made. Next, enter the residual amount for payment.

If the balance of the items assigned is nil, then press Save button to post the document.

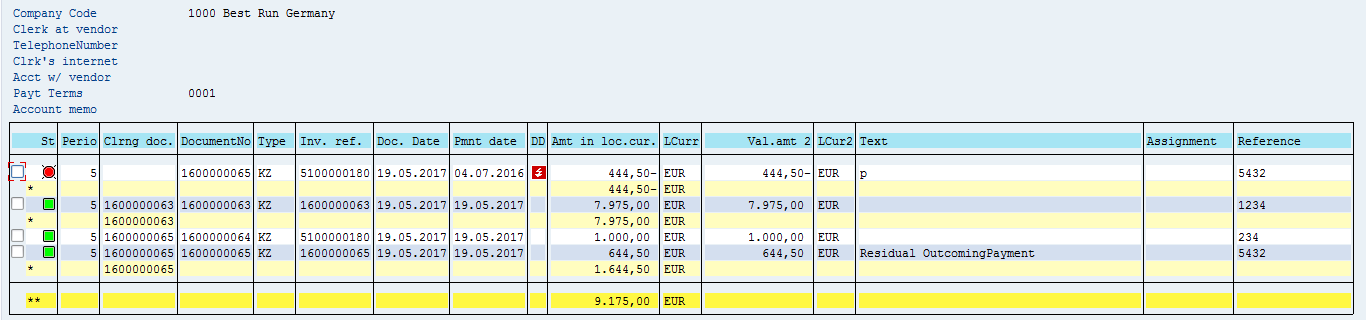

Now, let’s see the result of our posting by comparing the open items report before our residual payment and after the residual payment. This report is displayed in FBL1N transaction.

Here is the open items report before residual payment (there is not clearing document):

Here is the open items report with open items partially paid by residual method (the system clears the initial open item and creates a new outstanding document with residual value):

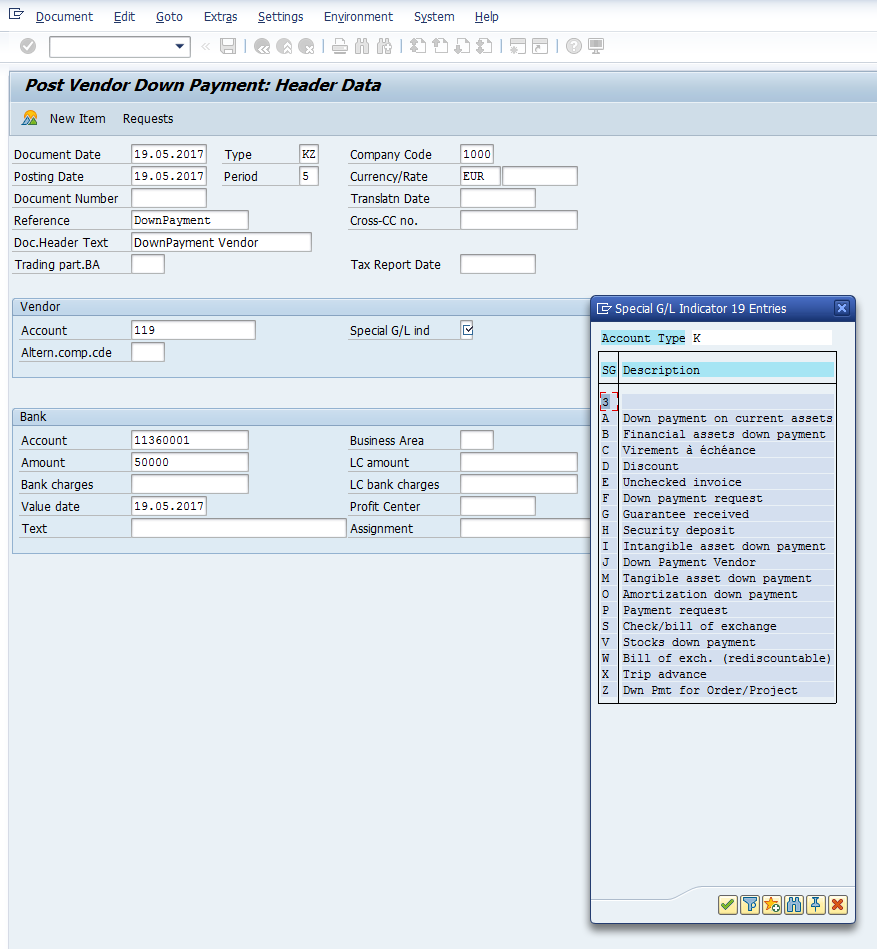

Down Payment for Vendors

To post a vendor down payment (DP), navigate to the following path in SAP Easy Access menu:

Accounting -> Financial Accounting -> Accounts Payable -> Document entry -> Down payment

Or directly type in the command field transaction code F-48. Next, input information in the following fields on the initial screen of the transaction:

- Document Date: input the date when the transaction occurs;

- Company Code: the code for your company code;

- Posting date: date when the transaction is booked in the system;

- Currency: currency code used for the specific transaction;

- Reference: the invoice number from the invoice;

- Bank Account: code identifying the G/L account;

- Amount: the value to be paid;

- Vendor Account: the vendor to be paid.

- Special G/L indicator: indicates the down payment type (current assets, trip advance, discounts, and guarantees). Needs to be selected from the drop-down menu.

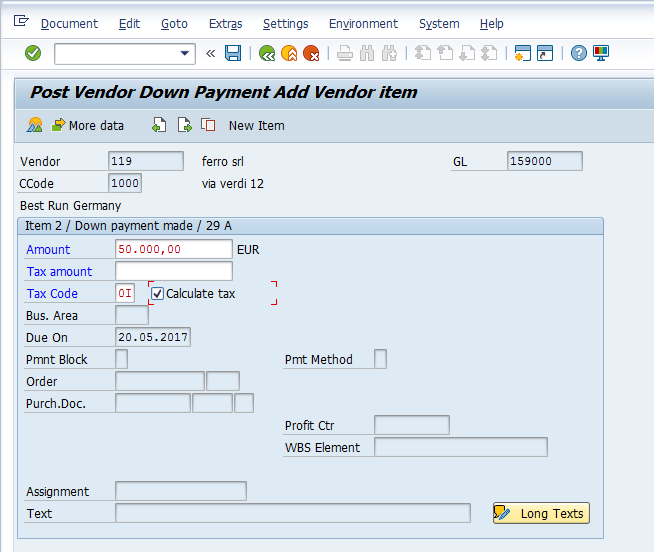

After entering the information on the initial screen, press Enter to go to the next screen where Due Date and Tax Code fields require your input.

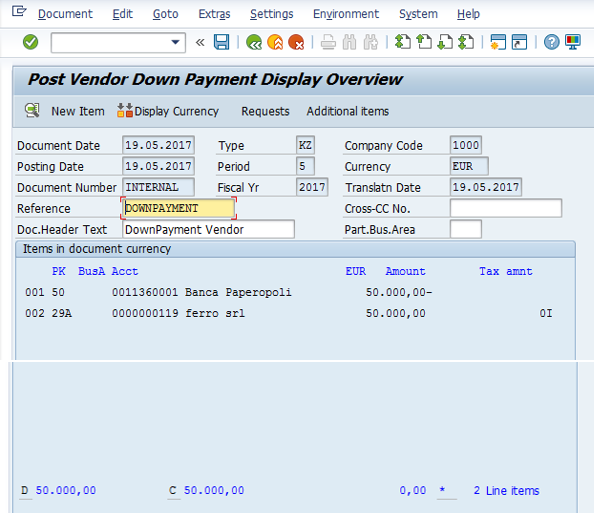

Simulate the transaction posting on G/L accounts and check the balance using button  .

.

If the posting simulation has the expected result, then press post button  .

.

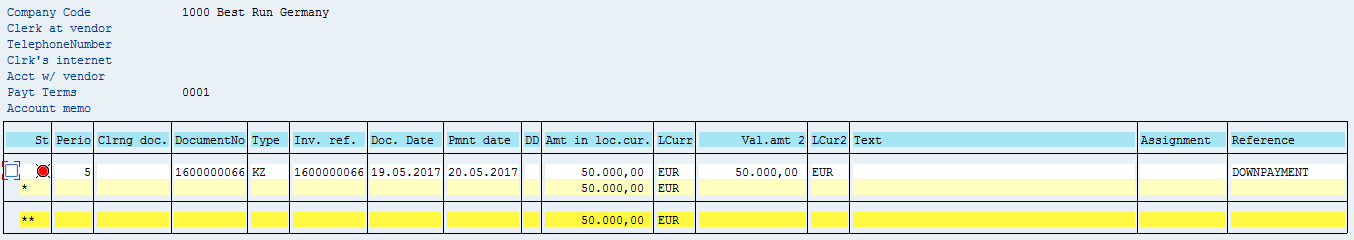

To check the effect of the posting, go to the transaction FBL1N. The DP remains outstanding until it will be cleared with the final invoice that will close the DP.

Leave A Comment?

You must be logged in to post a comment.