Scenario:

- You have run the payroll in live mode for a given payroll period (e.g. 01.2019) generating pay results containing tables RTI and RTINI

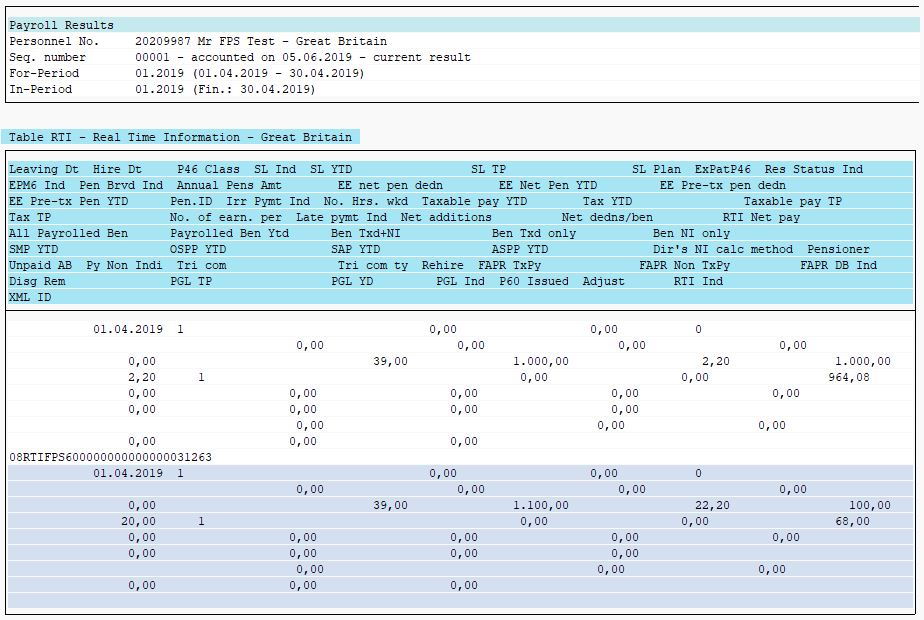

- You have submitted the FPS in live mode generating a global ID stamp in the above tables in the payroll cluster

- You have run the payroll for the same period without exiting that payroll period generating additional entries in RTI and RTINI in the payroll cluster having no global ID stamp:

You may need to do this if for example:

- You have adjustments to the payroll and have already processed the FPS in live

- and now would like to re-process the payroll for the same payroll period in order to make these adjustments (without having exited that payroll period)

Re-processing the payroll in this scenario will create a new entry in tables RTI and RTINI respectively.

You will then be able to process the FPS report for the same period again. The report will pick up the corrected YTD values and the delta of the This Period values from the new entries.

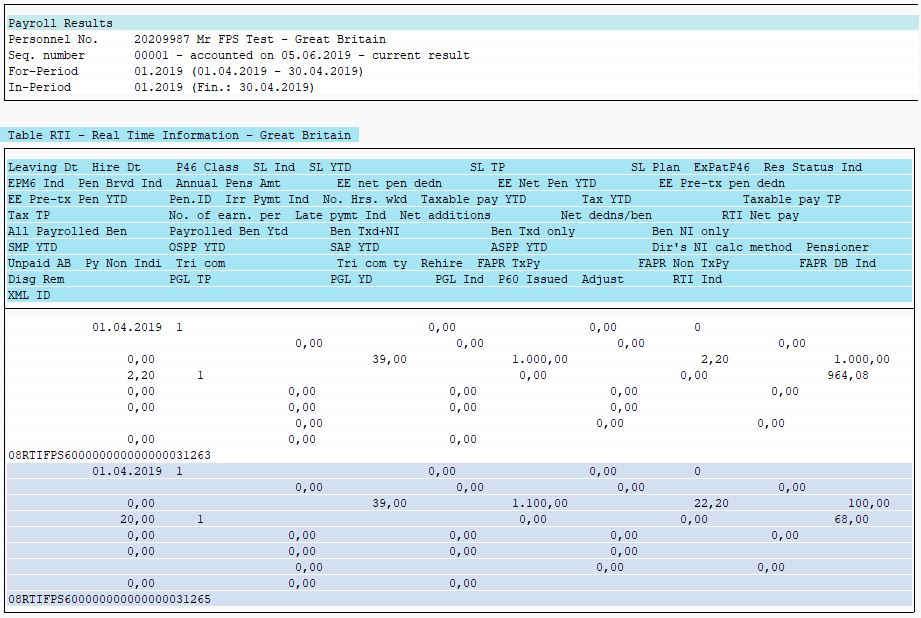

After processing the FPS report in live mode, a new global ID stamp will be generated onto the new RTI/RTINI entries in the payroll cluster:

If the pay date remains the same, you will not need to enter the payment date on the FPS selection screen, if it is later than the normal pay date then you will need to enter the new payment date.

N.B.: The FPS report should be processed as a “new” file and should only select the employees without the global ID already set.

If the FPS is sent to HMRC on or before the payment date on the file then you do not have to fill the Late Reporting Reason field.

Leave A Comment?

You must be logged in to post a comment.