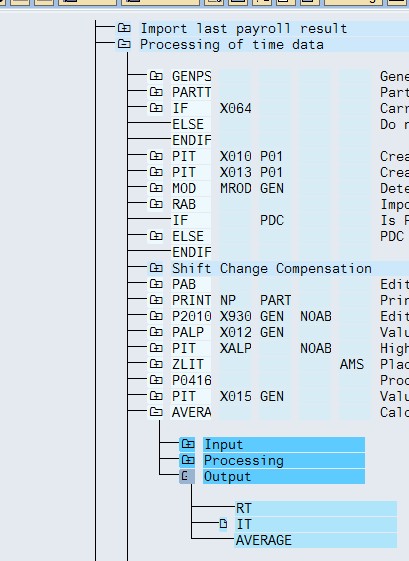

Valuation of absence using average value involves the following steps:

1. No assignment of valuation basis to the wage type carrying absence data (wage type 4002) in V_512W_B

2. Creating bases for calculating average values as follows: In this step, you specify which primary wage types and which partial period parameters should be included in which average calculation basis. The secondary wage types /201 to /232 are available as average calculation bases. Specify which primary wage type should be included in which average basis. Specify which wage type field (RTE, NUM, or AMT) should be used with which percentage.

SPRO–IMG–Payroll–Intl Payroll—Time wage type valuation—New Averages—Create bases for calculating average values

Here, over time remuneration is taken into account in /201 secondary wage type

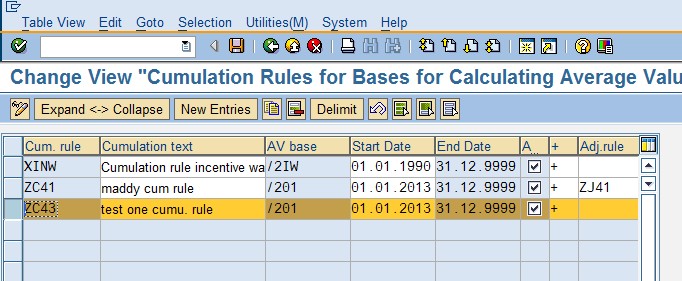

3. Create calculation rules for Averages: SPRO–IMG—Payroll—Intl Payroll–time wage type valuation–new averages–create calculation rules for averages–click on a. cumulation rules for bases for calculating average values

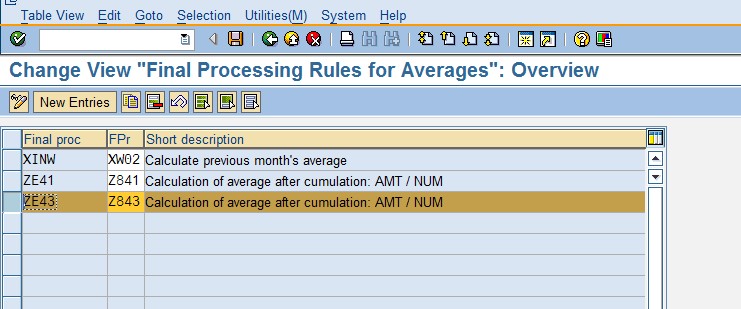

b. Modify the average formula in X018 PCR as per custom requirment. For example, the average value is based on the overtime remuneration of the last 3 months calculated on per day basis…therefore, X018 is modified as follows into Z843

c. Final processing rules for Averages: SPRO–IMG–Payroll–Intl Payroll—Time wage type valuation—New Averages–Create Calculation rules for Averages–click on Final Processing rules….Create a final processing rule ZE43 and assign custom PCR Z843 to ZE43…

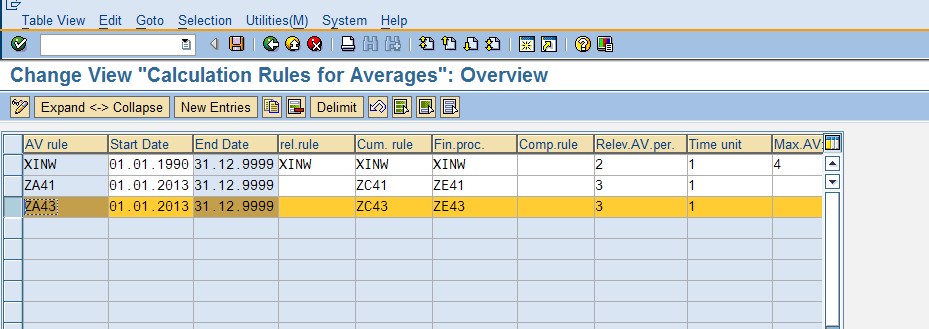

d. Create Calculation rule for averages : Create Average calculation rule ZA43 as shown in the screen shot by assigning all the above rules as follows:

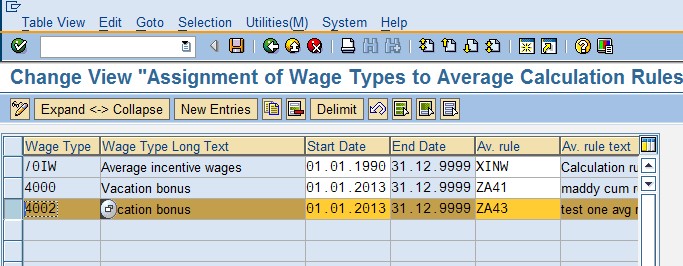

4. Assign the valuation of averages to primary wage type (4002 here) in V_T51AV_P: SPRO–IMG–Payroll—Intnl Payroll—time wage type valuation—New Averages—Assign the valuation of averages to primary wage type as follows

5. Besides, absence valuation rule must also be configured and primary wage type (4002) to be assigned with as discussed in Absence valuation using constant or fixed amount ( skip the entry in T510 J)

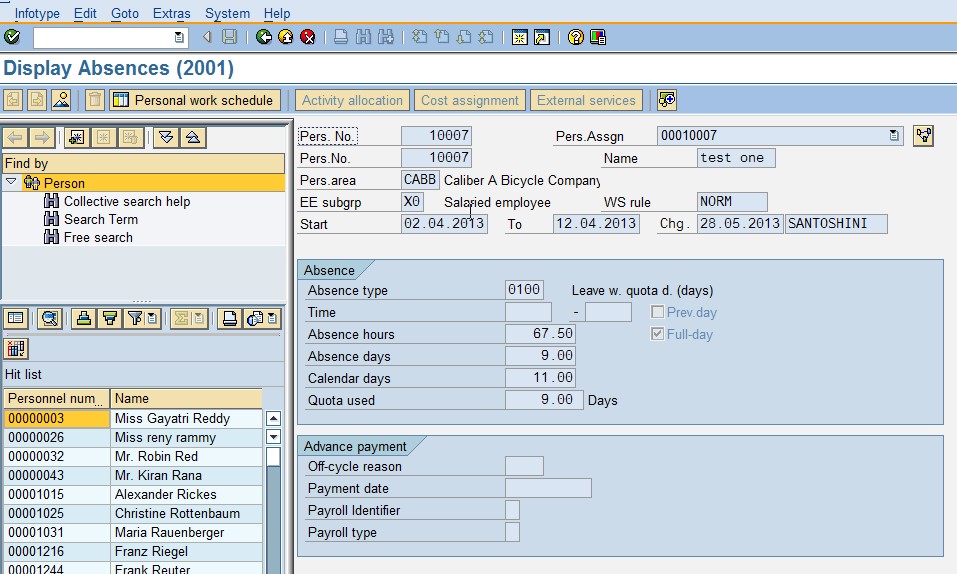

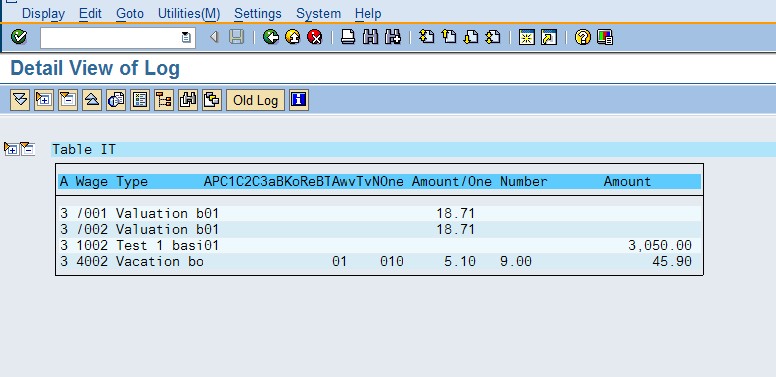

6. Maintain absences via PA30 for the relevant employee and run payroll to see absence valuation with average value as follows:

Leave A Comment?

You must be logged in to post a comment.