Valuation of wage types is done in two ways either using constant remuneration (wage type dependent constant or pay scale dependent constant) or using person related remuneration. In other words, valuation of time wage types in payroll i.e., processing of overtime for different working hours in payroll.

The wage types initially contain the number of hours of overtime that the employee has worked. This figure is specified in the number field (NUM) to be multiplied by a payable amount.

Valuation of wage types using wage type dependent constant and standard modifier: This involves three steps viz.,

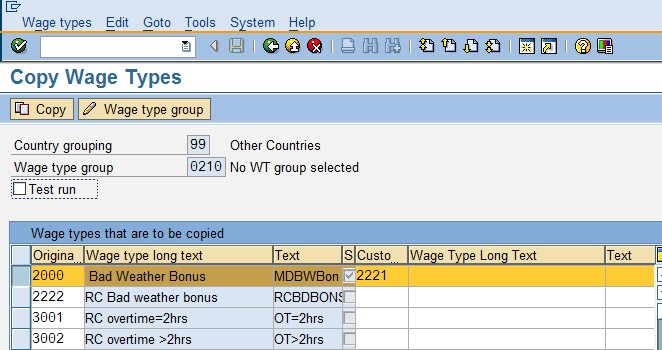

1. Creation of time wage type that carries the no. of hours in the number field (NUM) maintained via Info type Employee Remuneration Information (2010). For example creation of wage type 2221 Bad Weather Bonus using country grouping 99 (International) by copying wage type 2000

i. Go to Tcode OH11 or SPRO–IMG–PM–PA–Payroll data—Employee Remuneration Information—Wage types— Click on Create Wage type catalog as follows

Uncheck test run and click on Copy.

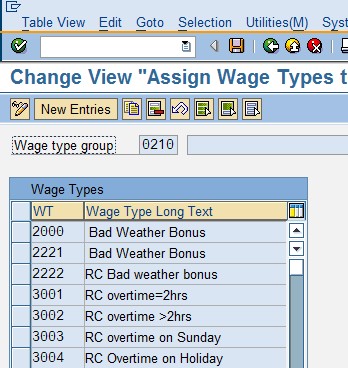

ii. Go to next node Check wage type group Employee Remuneration Information to check if the wage type 2221 is present i.e., in table V_T52D7.

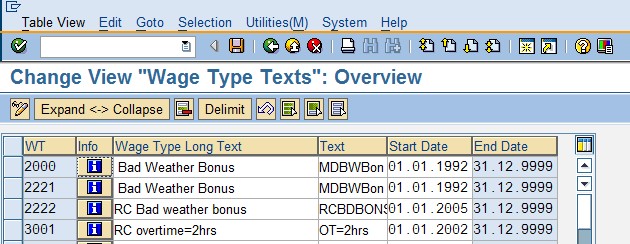

iii. Check wage type Catalog:

a. Check wage type text (V_512W_T)

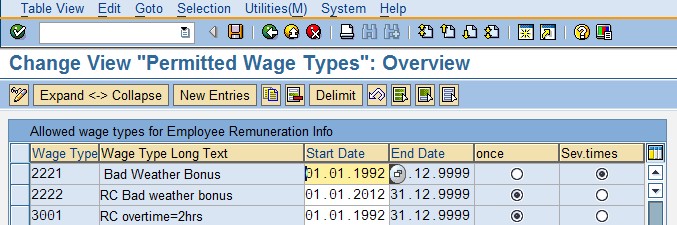

b. Check entry permissibility per infotype (V_T512Z)

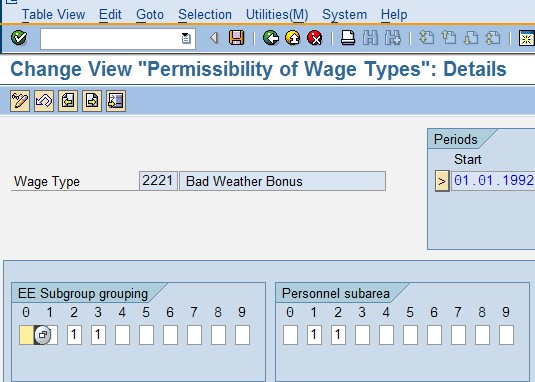

c. Determine wage type permissibility for each PS and ESG (V_511_B). Then accordingly group either Employee Sub groups or Personnel Sub area groupings.

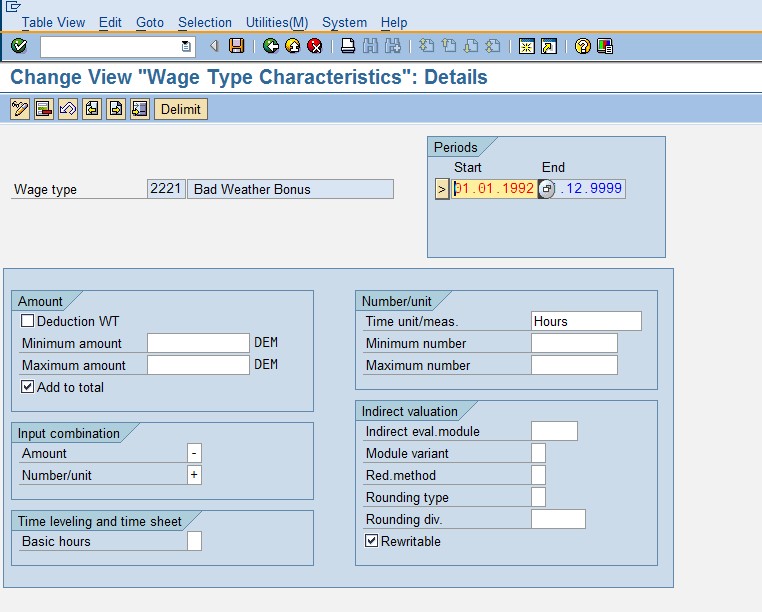

d. wage type characteristics (V_T511): Check the wage type characteristics as follows:

This done, now the next step is to create valuation bases.

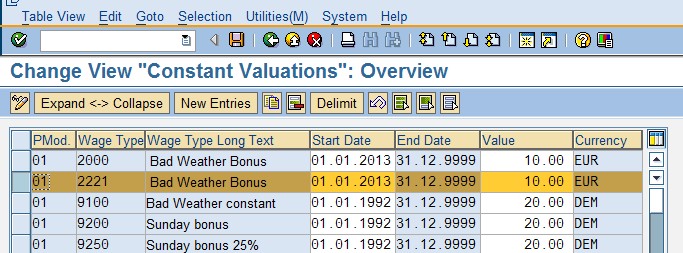

2. Using the standard modifier 01 in table V_T510J (Constant Valuations) to give amount (Say 10 Euros) with which the No. of hours contained in wage type 2000 will be multiplied.

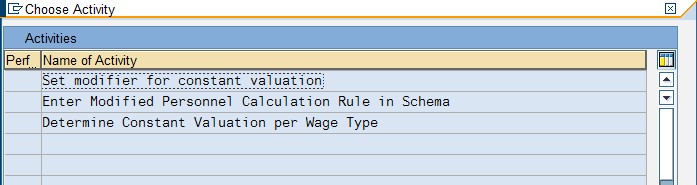

SPRO—IMG—Payroll—International—Time wage type valuation—Valuation bases—Constant Valuation Bases—Click on Wage type Dependent Constants..

and choose Determine Constant Valuation per wage type from the Activity box…and click on new entries and maintain as follows

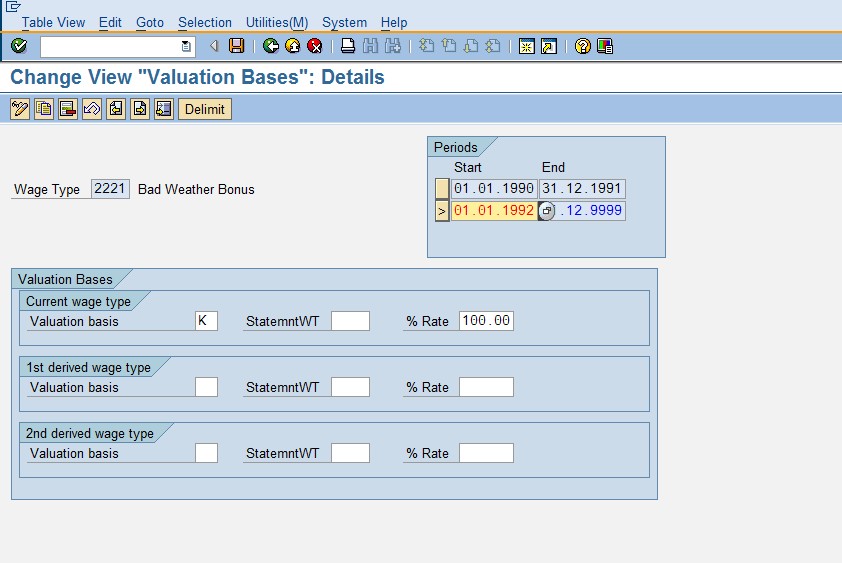

3. Assigning valuation bases in table V_512W_B (Valuation bases) as K for the same wage type 2000 where K is an indicator for valuation with a constant amount from Constant Valuation table V_T510J.

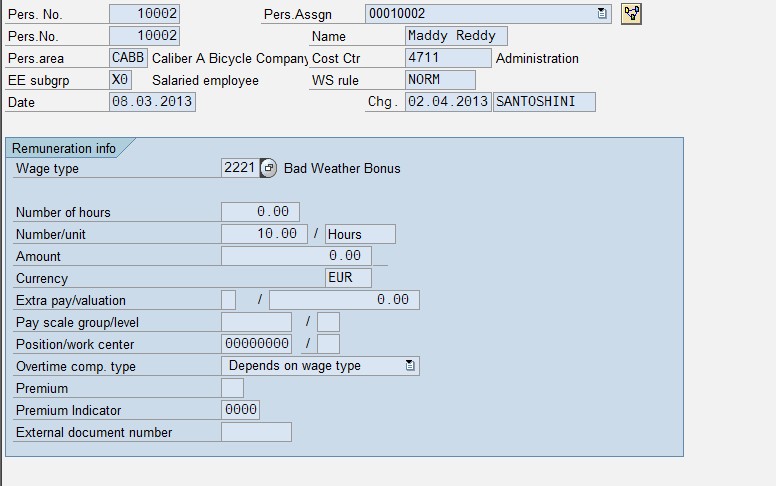

Now maintain the infotype 2010 ( Employee Remuneration Info) for wage type 2221 with 10 hrs as follows

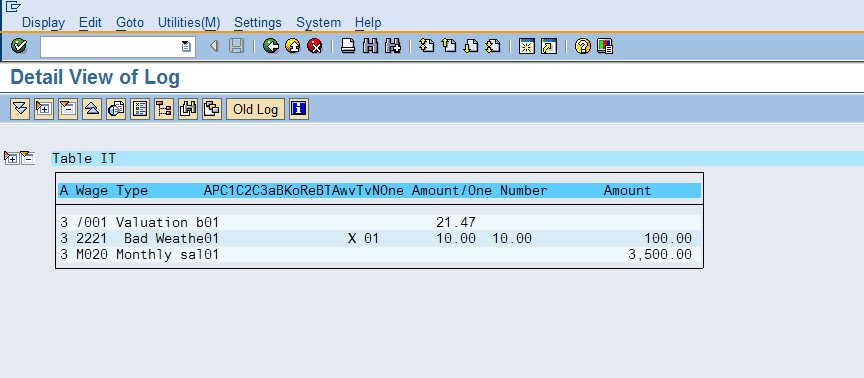

Now run Payroll for the relevant period and open the payroll log to see the valuation as follows:

Leave A Comment?

You must be logged in to post a comment.