SAP has reported its second-quarter financial results, with strong cloud revenue reported and no change in the tech giant’s full-year outlook.

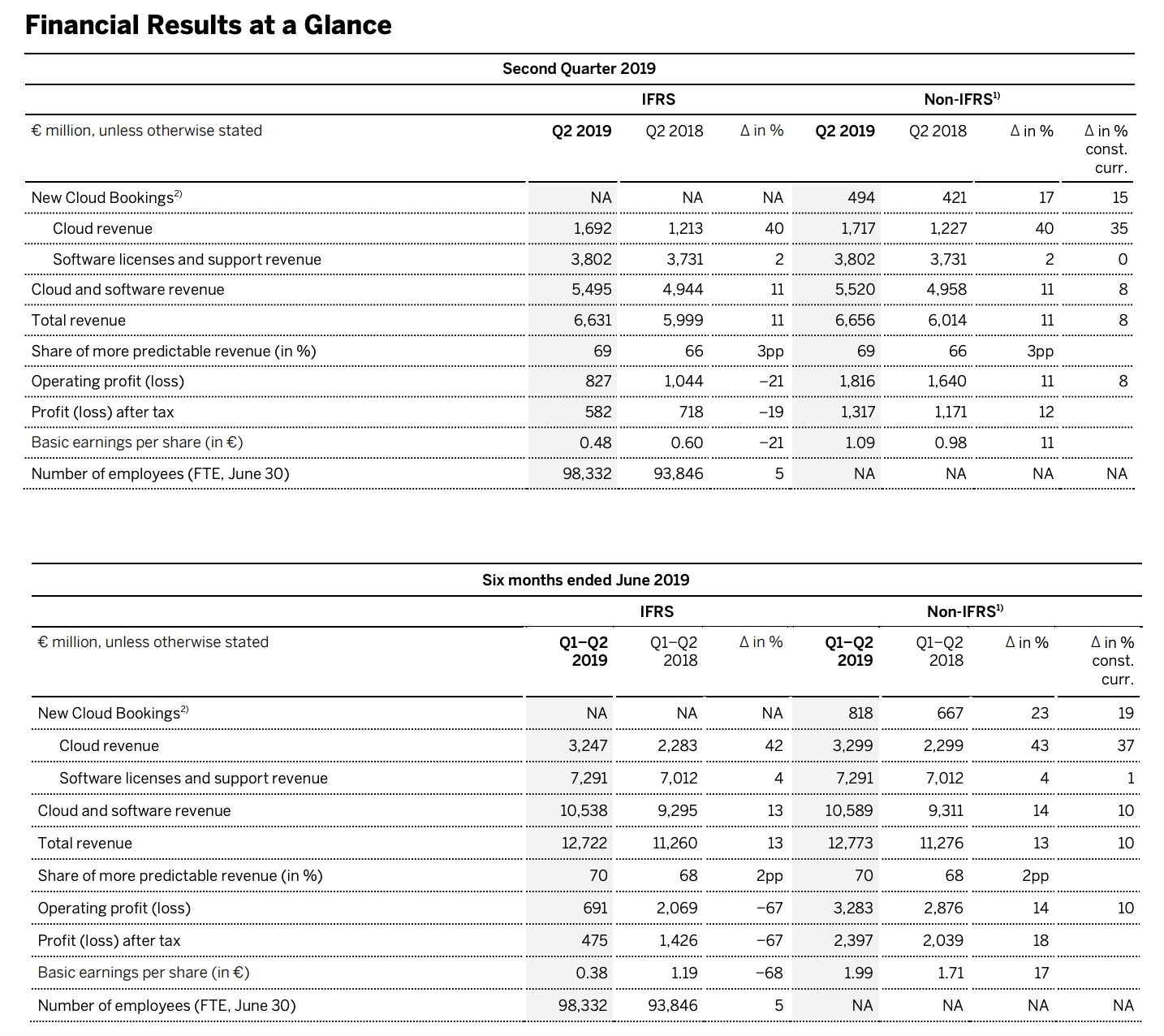

SAP’s Q2 2019 earnings (statement) reveal revenues of €6.63 billion IFRS or €5.99 billion non-IFRS, up 11 percent year-over-year with basic earnings per share of €0.48 (€1.09 non-IFRS), an increase from Q1 2019’s -€0.10 earnings per share.

SAP reported an operating profit of €0.83 million IFRS, which has declined by 21 percent year-over-year due to a hefty bill associated with restructuring costs.

Non-IFRS operating profit was up 11 percent or 8 percent at constant currencies.

At the end of Q2 2019, net liquidity was -€8.55 billion.

New cloud bookings were up 17 percent or 15 percent at constant currencies. Cloud revenue grew 40 percent year-over-year to €1.69 billion IFRS, or up 35 percent non-IFRS at constant currencies, an improvement based on the first quarter’s €1.56 billion IFRS.

Software license revenue reduced by 5 percent to €948 million IFRS or 6 percent non-IFRS at constant currencies. SAP says the reduction is due to recent business uncertainties, especially in Asia, where the trade war between the United States and China continues to boil.

Cloud and software revenue grew by 11 percent year-over-year to €5.49 billion IFRS and up 8 percent non-IFRS at constant currencies.

The three main business segments SAP reports on, “Applications, Technology & Services,” “Customer Experience” and “Intelligent Spend Group” performed adequately over the second quarter of 2019.

Applications, Technology & Services revenue increased by 6 percent to €5.38 billion year-over-year.

SAP S/4HANA added an additional 600 customers in Q2 2019. SAP S/4HANA now accounts for over 11,500 customers, up 29 percent year-over-year.

TechRepublic: Take Your SAP HANA Migration to a Higher Level

SAP’s Intelligent Spend Group revenue was up 22 percent to €786 million year-over-year, or up 17 percent at constant currencies.

In the Customer Experience category, SAP reports revenue of €365 million, a boost of 81 percent year-over-year, or 74 percent at constant currencies.

“SAP delivered double-digit growth in total revenue, cloud revenue, and non-IFRS operating income,” said Bill McDermott, CEO of SAP in a prepared statement. “Qualtrics is growing fast as the global standard in the Experience Management category. As shown by our rising cloud gross margins, we are progressing nicely on our ambition to be the Best-Run SAP. With XM driving the CEO digital transformation agenda, we resolutely reaffirm our full-year guidance.”

See also: SAP Q1 2019: First quarter operating profit slammed by restructuring hit

In April, SAP reported Q1 2019 revenues of €6.09 billion IFRS or €6.11 billion non-IFRS, up 16 percent year-over-year with basic earnings per share of -€0.10 (€0.90 non-IFRS), a decline from 2018’s €0.59 earnings per share.

Leave A Comment?

You must be logged in to post a comment.